User acquisition campaigns for mobile apps have continuously evolved over the years, driven by technological advancements and privacy regulations. Even though all they’re about is still acquiring new users for mobile apps and games, much has changed recently.

Above all, profitability has become the ultimate goal of app developers and advertisers, who are now working to make a substantial return out of their spend on user acquisition. Be it competition or external forces like economic downturns, acquiring a huge number of news users is good as long as they become paying users.

Such a shift in advertisers’ goals has led to several changes in how app campaigns need to be optimized and which KPIs matter the most. Specifically, ROAS has replaced CPI as the most important metric advertisers look at when evaluating the performance of their user acquisition channels and partners. In this article, we’ll discuss about this change and show some early results of ROAS optimization in user acquisition campaigns.

Let’s take a step back: what is CPI ?

Cost per Install has been the basic pricing model for app campaigns in the last years. Install is the basic conversion in the mobile world and much of the mobile advertising industry has been created upon this metric.

We already know that the CPI model isn’t perfect: there are some major issue when dealing with app installs:

- Retention is usually very low. Many users install the app and stop using it a few minutes (or hours) after it. Most of the new installs don’t bring in any value to the advertiser.

- Monetization isn’t an easy game for mobile app developers. Specially for gaming apps, monetization events often occur some time after the install, so measurement based on the install isn’t easy (conversion from CPI to equivalent CPA).

- Attribution. In a multi-touch world, understanding of the attribution model is not easy, many channels contribute to the installs and many more contribute to actions after the install (such as retargeting or actions based on CRM). Again, CPI is not always the best metric.

Despite these issues, CPI is still the most used metric for mobile user acquisition.

But there is something new that we are using together with some of our best clients. (ok, probably this is not actually new, it just becomes common now) We are talking about ROAS, a marketing metric is really adaptable to the world of the mobile user acquisition.

ROAS is tailored to measure not only new users, but rather money earned with these new users. This makes ROAS a better metric to understand the economics of User Acquisition.

ROAS for mobile user acquisition

Let’s start with a simple definition of ROAS:

That takes into account the revenue generated from new users against the cost of getting these new users.

Many of our best clients stopped using CPI (or even CPA) and started measuring only ROAS.

Take a look at our complete guide to the most popular user acquisition KPIs monitored and optimized by advertisers and UA platforms.

ROAS prediction

Based on data from a mobile user acquisition campaign for a given app run for some time, there are statistical models able to predict ROAS, just a few hours after the install. These models are usually based on retention and some other events; for example one of the best games we are working with is measuring the number of users who reach level_5. Reaching that level in the game means the user has spent around 25-35 minutes playing with the app in the first day after the install. Around 25% of the users who reach level_5 will perform IAPs (in the next month or so).

So, just a few hours after the install we are able to predict the expected ROAS of new users. When this model is precise and reliable, the whole mobile user acquisition process might be based on expected ROAS.

Building a working model for ROI prediction isn’t easy at all, together with our clients we use analytics platforms that ingest a few weeks of data and help us build a model. This model must be refined over time, perhaps we’ll write a specific article about this later.

How to optimize UA campaigns towards ROAS

In the post-IDFA world, optimization is based on user segmentation, built upon behavioral and technological analysis. For example, we can segment users based on the app where they have seen our ads for the first time, or we can use their ISP to determine their average ROAS.

Using behavioral segmentation and technological segmentation, we can optimize every channel towards the desired ROAS.

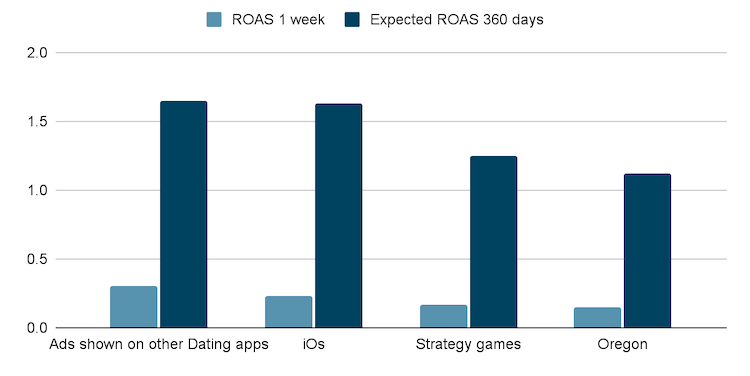

Here’s a simple example, taken from one of our customers, a dating app. For the purpose of this article, we’ve chosen a few segments that yield good results.

ROAS segmentation (actual ROAS 1 week + expected ROAS 360 days)

Source: Mapendo

What’s the difference between ROAS and CPA ?

Running mobile user acquisition campaigns on CPA is always a good idea, as it saves a lot of spending for the advertiser.

CPA, which stands for cost-per-action, lets advertisers pay only for users who generate a specific post-install event, usually tied to the app monetization strategy. Compared to CPI, CPA provides app developers with different benefits:

- Action-oriented measurement: it allows to evaluate the performance in terms of relevant in-app events like purchases, registration, deposits and so on;

- Less risky than CPI: advertisers don’t risk to spend money on new users who quit the app shortly after having installed it and don’t lead to any revenue;

- App optimization: CPA campaigns offer precious insights about the user funnel inside the app and all features which must be improved or optimized.

However, ROAS is even better, as this metric is not focused on saving spending, but rather on optimizing spending. This means ROAS is picking the best inventory in terms of monetization, instead of just saving money!

Eager to learn how it may work for your app ? Come visit our website to learn more about ROAS optimization and reach out to us.