Shares of C3.ai (NYSE: AI) were surging last month as investors cheered a new partnership with Microsoft, a sign that the AI software company may finally be turning the corner after years of wide losses. Additionally, the company benefited from a strong report from Palantir, the software company that has best proven the market for AI services thus far.

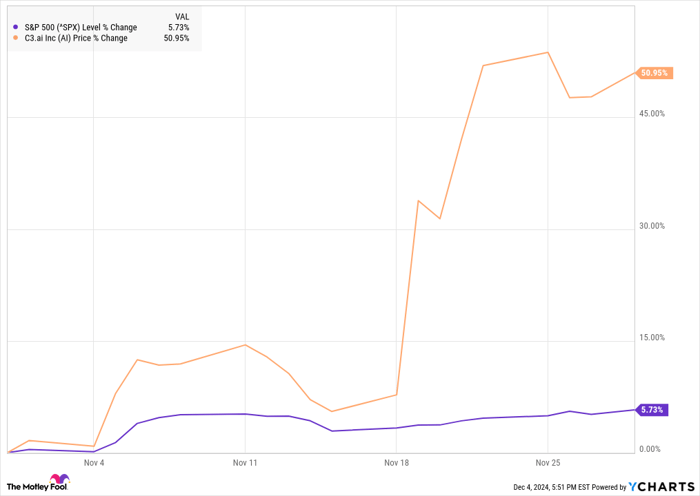

According to data from S&P Global Market Intelligence, the stock finished the month up 51%. As you can see from the chart below, the stock popped after the Microsoft news came out on Nov. 19.

^SPX Chart

^SPX data by YCharts

C3.ai is having a moment

C3.ai first scored gains on Nov. 5, tracking with Palantir, which posted strong results in its third quarter. C3.ai is much smaller than Palantir, but the two companies do have some things in common, including a focus on AI software and the fact that they derive a significant percentage of their business from the federal government.

C3.ai stock rose 7% on Nov. 5 and jumped another 5% on Nov. 6 in response to the U.S. election results.

However, the real surge in the stock came on Nov. 19 when the expanded Microsoft partnership was announced. The stock jumped 24.2% on the news and continued to gain from there. At the Microsoft Ignite conference, the two companies announced a strategic alliance to accelerate the adoption of C3.ai’s Enterprise AI platform on Microsoft’s Azure cloud infrastructure service.

The alliance includes technical integration that will make C3’s software like C3 Generative AI available on the Microsoft Commercial Cloud Portal, and include joint sales and marketing for C3’s Enterprise AI applications.

The two companies already had a partnership, but they called it a “significant milestone” in their relationship.

What’s next for C3.ai

The AI for the enterprise company is bringing a lot of momentum into its second-quarter earnings report, a sign that expectations are high after strong reports from Palantir and other software titans like Salesforce, and thanks to the expanded partnership with Microsoft.

C3.ai’s revenue growth has been improving, but the company is still significantly unprofitable. For its second-quarter report, which is due out on Monday, analysts expect revenue to increase 24.3% to $91 million and for its adjusted loss per share to widen from $0.13 to $0.16.

Given the recent surge, the stock is likely to have a big move one way or the other. Keep an eye out for commentary about the Microsoft partnership as well.

Should you invest $1,000 in C3.ai right now?

Before you buy stock in C3.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and C3.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $859,528!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of December 2, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft, Palantir Technologies, and Salesforce. The Motley Fool recommends C3.ai and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.