Image Credit: DepositPhotos

Image Credit: DepositPhotos

Saving money today isn’t just about cutting a few expenses, it’s about finding smarter ways to make every dollar go further. While most people focus on common tactics like budgeting, there are hidden strategies that few consider, and these can add up fast.

Consumer prices rose 3.7% year-over-year in recent years, reflecting continued inflation. Many of these unique ideas, like bartering skills or using community swap events, can stretch your budget without sacrificing comfort.

In this article, you’ll get to know these lesser-known methods, and with it, you can enjoy a fulfilling lifestyle and still meet financial goals.

Have you tried any unusual ways to save? Drop a comment below or read on for even more tips!

Barter Services Instead of Paying

People often forget that bartering offers a simple way to exchange services without spending cash. If you have a valuable skill, such as web design or tutoring, find others who may want to trade their own skills or services.

For example, you could trade design work for haircuts or lawn care, creating savings that add up significantly over time. Even simple tasks like babysitting can be exchanged between families, saving both parties money on childcare costs.

To make the most of bartering, start by reaching out within your community or through social media groups. Bartering not only saves cash but also builds relationships and strengthens local connections.

Once you find reliable barter partners, these exchanges often become regular, leading to consistent savings each month.

Smart Budgeting Made Easy: Proven Strategies to Make Your Money Work for You

Shop at Local Libraries and Thrift Stores

Libraries and thrift stores provide a treasure trove of items people would otherwise buy at full price. Libraries go beyond books; they often offer DVDs, music, and even event passes for free or low-cost rentals.

Earn Free Gift Cards

Swagbucks: Coupons, Paid Online Surveys & Free Gift Cards

Do you want to make money online simply by searching, shopping, surveys, or playing games?

Pros:

- Account creation is free

- Big bonus on sign up

- Many ways to earn free money

- Mobile-friendly rewards site and apps

- Simple to complete tasks

- $10 to sign up

Cons:

- Not exactly passive income

- Redeeming SB points sometimes takes awhile

- It isn’t easy to qualify for all surveys

- Customer service isn’t the greatest (or fastest)

Borrowing these items instead of purchasing them offers easy savings and often leads to discovering items you may not find elsewhere. Similarly, thrift stores offer high-quality clothing, furniture, and household items at a fraction of retail prices.

Many of these items are in excellent condition and can be a valuable alternative to buying new. By incorporating thrift store shopping into your routine, you reduce costs, contribute to sustainability, and find unique items that reflect personal style without breaking the bank.

More Than Books: 28 Household Items Most Retirees Don’t Know They Can Get from the Library

Rent or Borrow High-Use Items

Instead of purchasing items you rarely use, consider renting or borrowing them. Items like power tools, party supplies, and outdoor gear can be rented for a small fraction of the buying cost.

This approach keeps your money where it belongs, safe in your wallet. Rental shops offer everything starting with specialized tools to camping equipment, helping you avoid storage issues and unnecessary expenses on items used only once or twice a year.

Borrowing can be just as effective as renting. Many people are happy to lend items to friends or neighbors in need, and community sharing groups make this even easier.

By sharing resources with those around you, everyone in the group saves. This also creates a network that helps you access what you need without constant spending.

Learn How To Earn: 24 Easy Ways to Make Money Renting Out Your Stuff

Automate Savings with “Invisible” Transfers

One way to save without much thought is through automated savings. Many banking apps offer a “round-up” feature that automatically transfers a few cents to your savings account each time you make a purchase.

This small change quickly adds up and grows your savings in a way that feels almost invisible. Setting up transfers with every paycheck also helps, putting a fixed amount aside before you even notice it.

This method works well for people who find manual savings a struggle. Since the process runs on autopilot, it minimizes the temptation to spend instead. By regularly contributing even small amounts, you end up with substantial savings by year’s end.

Inflation Hits Hard 21 Items Now Out of Reach for Many

Buy Groceries in Bulk to Cut Costs

Buying in bulk can save consumers up to 25-30% on groceries annually, depending on the item and store. Buying in bulk doesn’t only mean large warehouse stores; many regular stores also offer bulk options.

Items like rice, pasta, and cleaning supplies often come at a discount when bought in larger quantities. By focusing on non-perishable items, you ensure that bulk purchases won’t go to waste.

Some items, like spices or grains, also stay fresh for months, allowing for maximum value. An organized pantry can make bulk buying even more effective.

By knowing exactly what you have, you prevent duplicate purchases, and with a small initial investment, you see long-term savings on every trip to the store. This strategy stretches your dollar further and helps you reduce overall grocery spending.

The Art of Frugal Food Shopping: How To Save On Groceries

Embrace DIY Repairs and Maintenance

Learning basic repair skills can make a huge difference in saving money. Simple tasks like sewing a button, fixing a leaky faucet, or performing minor car maintenance keep you from spending on professional services.

With countless online tutorials, learning DIY maintenance has become easier than ever. For larger repair projects, local community workshops and online courses provide affordable ways to gain the necessary skills.

Not only does DIY save on labor costs, but it also boosts confidence, giving you the satisfaction of resolving issues yourself.

25 Home Maintenance Skills People Don’t Know How to Do Anymore

Optimize Energy Usage at Home

Switching to energy-efficient appliances can cut energy bills by 10-50% annually, depending on usage and appliance type. Simple habits like turning off lights, unplugging unused electronics, and adjusting the thermostat can have a significant impact on monthly costs.

Consider investing in energy-efficient appliances if you haven’t already, as they save on both energy and expenses in the long run. Another tactic is to use programmable thermostats, which automatically adjust temperatures during non-peak hours.

By scheduling energy use, you avoid unnecessary consumption and see steady savings every month. Small adjustments in energy habits can lead to big results on your energy bill.

15 Simple Hacks to Slash Your Electric Bill

Use Cashback Credit Cards Responsibly

If you already use credit cards, consider switching to a cashback card for routine purchases. Cashback credit cards offer a percentage back on groceries, gas, and dining, providing savings on everyday expenses.

With disciplined use and timely payments, these rewards add value to regular spending without adding extra costs. Always pay the balance each month to avoid interest charges that erase the benefits.

For those with strong financial discipline, cashback credit cards serve as a strategic tool, offering rewards that accumulate without extra effort.

Say Goodbye to Coupons and Hello to The Best Cashback Apps!

Grow a Small Home Garden

Gardening saves money on produce while also being a rewarding hobby. Even a small space, like a patio or balcony, can produce herbs and vegetables. Seeds and soil cost very little, and the produce from your garden often tastes better than store-bought.

For beginners, start with easy-to-grow plants like tomatoes, lettuce, or herbs, which quickly pay off in savings. A garden not only reduces grocery bills but also offers a relaxing activity. Gardening provides fresh produce and a sense of accomplishment with every harvest.

Need a Greener Garden? Here’s How to Start Sustainable Gardening Today!

Switch to Free Software and Apps

Instead of purchasing costly software, explore free alternatives that perform similarly. For example, Google Docs or LibreOffice offers features comparable to Microsoft Office without the price tag.

Many subscription apps also have free versions that serve casual users well, helping you cut down on digital expenses without sacrificing functionality. Switching to free software often goes unnoticed in daily routines but delivers solid savings.

With so many free resources available, it’s worth re-evaluating your subscriptions and apps to see what can be replaced at no cost.

🙋♀️If you like what you are reading, then click like and subscribe to my newsletter. We share tips to waste less time and money.

Choose Generic Brands Over Name Brands

Generic brands offer quality comparable to name brands, often at a fraction of the price. In groceries and personal care items, generic brands deliver the same benefits without the added cost of branding.

Once you identify items where quality differences are minimal, sticking to generics results in consistent savings on every shopping trip. Store brands today compete closely with major brands on quality.

By trying generic options, you often find little difference in taste, effectiveness, or durability. Making this small switch saves a surprising amount over time, especially for regularly used items.

30 Ways to Save on Prescription Medications

Host a Monthly “No-Spend” Weekend

A “no-spend” weekend challenges you to get creative without spending. Activities like board games, movie nights at home, and DIY projects offer fun without expense. This occasional break from spending reduces costs and helps refocus priorities.

Setting up no-spend weekends gives you a breather while helping you identify free or low-cost hobbies. Incorporate free activities like nature walks, baking, or art projects, which provide quality time and relaxation.

By doing this regularly, you realize that entertainment doesn’t need a price tag, creating a habit that reduces spending and increases savings over time.

Raising Kids Doesn’t Have to Be Expensive: 22 Ways to Save Money

Cut Unused Subscriptions and Memberships Regularly

According to a recent C&R research, an average American spends around $219 per month on subscription services they may not fully use. Figure out if you’re not getting the most out of your subscriptions, starting with streaming services to gym memberships.

Periodically review your subscriptions and cancel those that add little value. Cutting even a few services brings immediate savings and reduces recurring monthly costs. For lasting impact, set a reminder every few months to reassess subscriptions.

This practice helps you stay on top of expenses, ensuring you only pay for services you actively use. The simplicity of this strategy makes it a powerful way to keep spending low.

12 Top Tips to Save Money Buying on eBay (Some Are Sneaky)

Brew Your Own Coffee and Meals

Buying coffee daily adds up quickly, so try brewing at home for a cost-effective alternative. Invest in quality coffee beans and a simple brewing setup, and you’ll enjoy a great cup for a fraction of the cost. This switch can save hundreds each year without compromising on flavor.

Cooking meals at home also makes a huge difference in monthly expenses. Start with simple recipes that take minutes to prepare. These small shifts add up, helping you gain control over your spending with minimal effort.

18 Grocery Items You Can Easily Make at Home (And Save Big!)

Rent Out Unused Space

If you have extra space in your home, renting it out brings in extra income. Well, definitely provided that local regulations allow it and there is demand for rental space. Many people rent out garages, storage sheds, or rooms to those seeking storage or temporary housing.

This approach helps you make the most of your property and adds to your savings. To start, research local regulations and market rates to set a fair price. Once rented, the income helps offset bills or grows your savings account.

Renting unused space maximizes your assets, helping you save with minimal changes to daily life.

Side Hustle Guide For Beginners: How To Earn Money On The Side (With Video)

Try a Minimalist Approach to Personal Belongings

Adopting a minimalist lifestyle saves you money by reducing unnecessary purchases. Focus on buying only essential items, avoiding clutter and impulsive shopping. This approach not only saves cash but also improves mental clarity, as fewer possessions mean fewer distractions.

Minimalism extends beyond things to daily habits, encouraging you to spend less on non-essentials. Commit to evaluating each purchase carefully, only buying what truly adds value. Over time, this mindset helps build savings while creating a simplified, enjoyable lifestyle.

Create a Peaceful Space: Decluttering Hacks for Home Happiness

Use a Clothesline Instead of a Dryer

Air-drying clothes costs nothing and reduces electricity bills. Hang a clothesline in your yard or use a drying rack indoors. This method preserves clothes and reduces energy use, leading to noticeable savings each month.

Beyond saving on energy, air-drying extends the lifespan of your clothes. Fabrics fade less in the sun, keeping them fresh longer. With a simple switch, you save both energy and replacement costs, enjoying added savings without extra effort.

Best Hoist Clotheslines For Laundry

Buy Refurbished or Used Electronics

Refurbished electronics provide like-new quality at a fraction of the retail price. Items like phones, laptops, or tablets often come with warranties, giving you the same security as new products.

Purchasing refurbished or gently used items reduces upfront costs and keeps high-quality tech accessible. Look for certified refurbishers or reputable online marketplaces to find reliable options.

Many people buy used electronics only to realize they perform just as well as new ones. By choosing refurbished, you save money without sacrificing performance.

Why Pay Full Price? 27 Things to Buy Second-Hand (With Video)

Switch to a Prepaid Cell Phone Plan

Traditional cell phone plans can cost hundreds per month. Prepaid options let you control usage and avoid overages, giving you a set amount of data, talk, and text at a fixed price. This approach offers more budget flexibility, eliminating surprises on monthly bills.

Many prepaid plans offer competitive data rates and coverage. You may find that these plans meet your needs without compromise. The switch to prepaid provides consistent savings while giving you the flexibility to adjust as needed.

🙋♀️If you like what you are reading, then click like and subscribe to my newsletter. We share tips to waste less time and money.

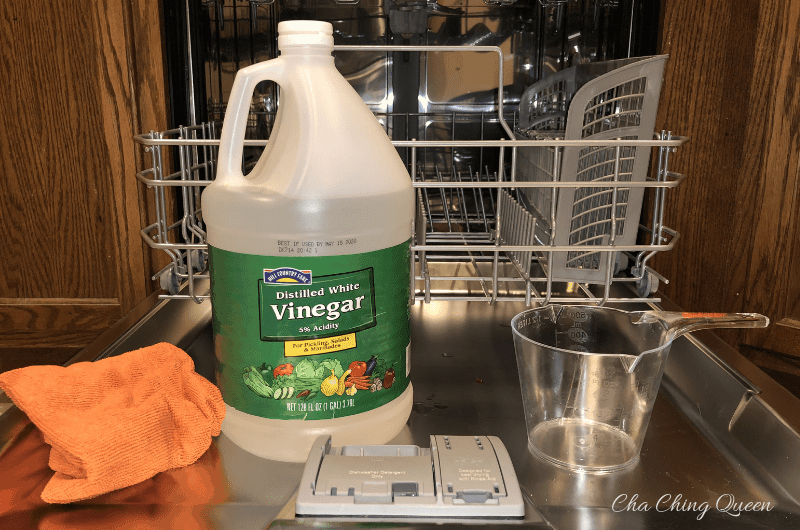

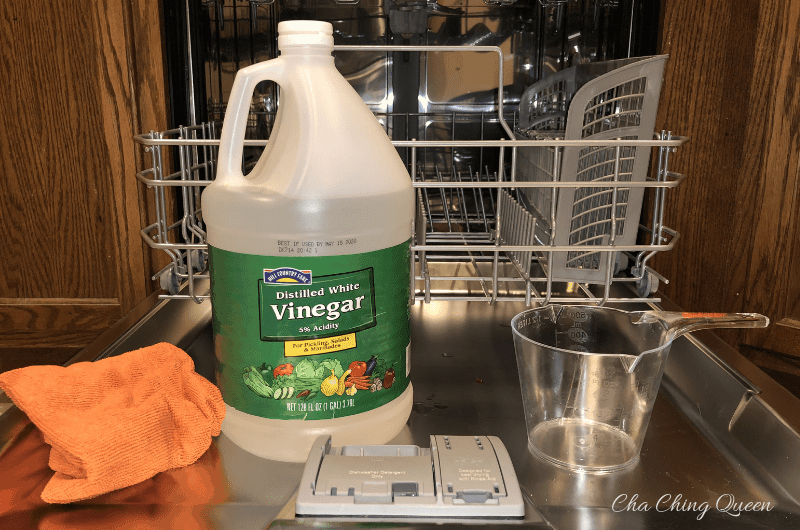

Make Your Own Cleaning Products

Store-bought cleaners often come with a high price and harsh chemicals. You can make effective cleaners at home using inexpensive ingredients like vinegar, baking soda, and essential oils.

These DIY cleaners work well on many surfaces, reducing the need for pricey cleaning products. Homemade cleaners also improve air quality and reduce chemical exposure in your home.

Mixing your own saves money, improves safety, and reduces environmental impact. With minimal effort, you replace store-bought cleaners and cut household costs.

🛑 Ditch These 10 Toxic Cleaners. Try These Safer Alternatives (That Actually Work) Instead 💪

Set Energy-Saving Reminders Around Your Home

Visual reminders help keep energy-saving actions top of mind, making them easy to follow. Simple notes by light switches or doors encourage turning off lights and unplugging devices. These small habits build over time, reducing utility costs significantly.

Consider setting reminders on your phone or computer to further reinforce these habits. By creating a routine around energy-saving practices, you see gradual savings on your monthly bills. Small reminders ensure you follow through, making energy conservation second nature.

Unplug These 15 Energy Vampires And Save Hundreds on Your Electric Bill

Use Coupons and Cash-Back Apps Wisely

Coupons and cash-back apps save money if used strategically. Instead of buying items just for discounts, focus on essentials you already need. This approach prevents overspending while maximizing savings.

Look for apps that give cashback on groceries, household items, and even online purchases. Many offer easy ways to redeem rewards with minimal effort. Using these tools wisely adds up, making routine purchases more affordable and helping you stretch each dollar.

My Secrets: How To Get Amazon Coupons, Discount Codes, Promo Codes, Free Stuff, and Deals

Making Your Every Dollar Count

Saving money doesn’t have to mean cutting out the things you love. With the strategies we’ve shared here, you can maintain or even enhance your lifestyle while watching your savings grow.

Be it growing your own herbs, switching to generic brands, or setting up no-spend weekends, every small choice adds up. By making these small adjustments, you build habits that keep more money in your pocket and make each dollar count.

Remember, the key to success is consistency. Embrace these ideas gradually, and see how they transform your spending habits and help you achieve your financial goals.

🙋♀️If you like what you just read, then subscribe to my newsletter and follow us on YouTube.👈

AI was used for light editing, formatting, and readability. But a human (me!) wrote and edited this.