IT service companies in recent months have committed to training more than 1 million consultants on generative AI, a campaign that aims to capture customer mindshare and solidify relationships with key technology providers.

The training effort began to heat up in 2023 when global systems integrators and consultancies outlined plans to ramp up for an expected wave of generative AI (GenAI) deployments. Accenture, Capgemini, Deloitte, PwC, Tech Mahindra and Wipro were among the companies launching GenAI training initiatives. That pattern has continued into 2024, with more IT service providers joining the race to get their professionals up to speed on the emerging technology.

Some companies expect to spend $1 billion or more on AI initiatives that include training.

Consider the following examples:

- Accenture is making a $3 billion AI investment that includes expanding its roster of AI specialists from 40,000 to 80,000 and cultivating new generative AI skills.

- Wipro’s $1 billion AI initiative includes training all 250,000 employees on GenAI fundamentals as well as providing more specialized training for employees in AI roles.

- The U.S. branch of global consultancy PwC plans to upskill 65,000 people on AI tools as part of its $1 billion program to work with clients on generative AI adoption.

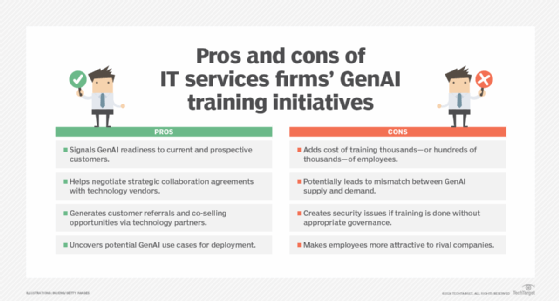

Such investments are a way of signaling GenAI readiness to potential customers, who place considerable weight on a service provider’s training commitment and technical certifications on the offerings of GenAI vendors. Providers need to showcase bigger pools of qualified personnel to win over buyers facing budget constraints, said Peter Bryant, an analyst at Singapore-based market research firm Canalys.

“The numbers are quite sizeable,” Bryant said, noting the thousands of consultants in the training pipeline. “When you look at what’s driving that, the scrutiny of the procurement process is up. The training element is a key part of that.”

Bryant cited Canalys’ 2023 survey of cloud customers to underscore the importance of trained and certified service providers: 87% of the 303 respondents ranked partner specializations as a top-three selection criteria. In addition, 74% said they recheck certification status at least twice a year to make sure partners are keeping up to date on technology.

“It’s how customers are making these complex decisions,” Bryant said of the training-driven criteria.

Consultants and integrators have embarked on a massive employee training effort around generative AI.

Preparing for GenAI demand

Training and certification programs are especially important in generative AI, a field in which comprehensive university degree programs are still in the future.

“[ Partners] need these certifications — they’re the only qualification that exists,” Bryant said. “There are no generative AI degrees in the same way there are data science, computer science and IT management degrees.”

Integrators and consultancies provide varying levels of training on generative AI, using in-house employee development programs or online services such as Coursera and Udemy. Most employees receive training at the basic level, with fewer employees trained at higher tiers. Training in GenAI fundamentals typically covers general business and technology topics and introduces employees to large language models (LLMs). The more advanced levels of training dig more deeply into GenAI offerings from technology providers such as AWS, Google, Microsoft, Nvidia and OpenAI.

[Partners] need these certifications — they’re the only qualification that exists. There are no generative AI degrees in the same way there are data science, computer science and IT management degrees.

Peter BryantAnalyst, Canalys

The goal is to have a significant slice of the workforce ready for generative AI roles when demand picks up.

Wipro, an IT consulting firm based in Bengaluru, India, has trained more than 225,000 employees on generative AI fundamentals and more than 25,000 workers on more advanced aspects of the technology, CTO Subha Tatavarti noted. The company wants to make sure its employees are “ahead of the curve when opportunities arise,” she said.

Tata Consultancy Services (TCS), an IT service company based in Mumbai, India, takes a similar approach. TCS has trained about 300,000 employees, around half the company, on the essentials of generative AI, said Krishna Mohan, vice president and global head of its AWS Business Unit. That training spans technology from AWS, Google, Microsoft and Nvidia among others. He said about 10% of those 300,000 employees have also taken more advanced AI training.

NTT Data’s foundational training focuses on the role of GenAI in business and how it can transform customer experience, said Nitin Bajaj, vice president and head of digital offerings for the IT service company’s Plano, Texas-based U.S. operations. This tier also covers ethical and validity concerns related to the use of GenAI tools.

Technical training “starter tracks,” meanwhile, explore prompt engineering, neural networks and deep learning, generative adversarial networks and generative versus discriminative models, among other topics, Bajaj said. Product training encompasses OpenAI’s ChatGPT and DALL-E, Copilot for Microsoft 365 and NTT’s own Tsuzumi Japanese-language LLM. NTT Data also offers business training tracks that cover GenAI use cases and the technology’s impact on sales, marketing and HR.

The industry’s training push coincides with a critical phase in enterprise GenAI adoption. Potential customers are sorting through a multitude of use cases and proofs of concept to find those with the greatest potential. That’s one of the challenges businesses face when scaling generative AI beyond the experimentation stage.

“They have so many uses cases, but which are the ones that matter, that can deliver the value?” Mohan said. “That is where we are: use case to value case, pilot to production.”

Solidifying strategic partnerships

Having plenty of GenAI-trained consultants isn’t all about preparing for customer demand. The pool of resources also helps service providers solidify relationships with technology providers.

“Investing in training has become table stakes in services vendors’ alliances with technology vendors,” said Boz Hristov, professional services principal analyst at Technology Business Research, a market research firm based in Hampton, N.H.

A large training investment indicates to vendors that a service provider is serious about GenAI and able to assist with buyers’ digital transformation projects, he noted.

Strategic collaboration agreements (SCAs) between technology companies and IT service partners are built on such investments, according to Bryant. Part of the negotiations sealing an SCA revolve around the number of employees certified on a vendor’s technology, he said.

SCAs provide several benefits for service providers: early access to technology, technical support, marketing funds and co-selling opportunities, among others. Customer referrals is another plus. A technology vendor might recommend an integrator to one of its clients, citing its partner’s pool of trained and certified consultants, Bryant said.

“It becomes another stat that makes the procurement easier,” he said.

IT service providers can benefit from generative AI training, but they must deal with potential risks.

Ricardo Madan, a senior vice president at TEKsystems, a technology and business solutions provider based in Hanover, Md., also noted the co-selling benefit, which contributes to a service provider’s deal pipeline. He also cited the advantage of tapping the go-to-market strengths of large tech providers.

“Those megatechs have been marketing geniuses, for the most part,” he said.

TEKsystems has strategic agreements with AWS, Google Cloud, Microsoft and other vendors. He confirmed that SCAs hinge on training.

“We have a firm commitment every year to upskill a certain portion of our workforce and put them through a certification program,” Madan said.

Similarly, the AWS-TCS partnership is measured partly on the number of AWS certifications and competencies TCS maintains, Mohan said. An AWS competency demonstrates a partner’s ability to provide services or develop software for particular industries, use cases or workloads. AWS launched a GenAI competency earlier this year.

TCS in April committed to upskilling 25,000 employees on AWS’ GenAI technology. The effort includes advanced training on AWS offerings such as Bedrock, CodeWhisperer and Amazon Q, Mohan said.

Such product-specific instruction unlocks business opportunities for IT service companies. Leidos, for example, collaborated with AWS on a U.S. Army use case, which involved deploying Amazon SageMaker and a secure, locally hosted LLM offering, according to the company. The use case embedded training, using a natural language Q&A capability, within a user manual for the Army Field Artillery Tactical Data System.

Leidos, a technology, engineering and science solutions and services provider based in Reston, Va., also partnered with AWS to demonstrate Bedrock and other AWS AI services used in the Army’s generative AI effort. Leidos has a strategic collaboration agreement with AWS. Its other GenAI partners include Dell and Sourcegraph, an AI coding assistant company.

Such technology providers see the value of training their partners, said Tifani O’Brien, vice president and director of the Artificial Intelligence and Machine Learning Accelerator at Leidos. “They know if you are devoting people’s time, you are increasing the knowledge of how to use their products.”

Influencing HR strategies

Partners’ current emphasis on generative AI training also marks a rebalancing of HR strategies, namely recruiting new employees versus developing existing personnel.

Hiring took precedence during the COVID-19 pandemic, when service providers expanded headcount to accommodate the accelerating pace of digital transformation. But many companies have since reduced staffing levels amid economic uncertainty and softening customer demand.

GenAI, however, has shifted HR strategies to training instead of large-scale hiring. Hristov said the emphasis on training over hiring lets service providers weather short-term macroeconomic headwinds while also preparing them for the long-term growth opportunity.

That trend could influence how consultants and integrators handle successive waves of emerging technologies.

“I believe hiring in bulk is now a thing of the past,” Hristov said.

Service providers’ recruitment strategies will become more measured, particularly as the broader technology labor market cools and employers regain bargaining power, he added.

Tech Mahindra, a consulting and digital transformation service provider headquartered in Pune, India, cited training and upskilling its workforce as an integral part of its strategy, given rapid technological change and economic uncertainty. But the company remains open to adding new talent, noted Kunal Purohit, its chief digital services officer.

While training reduces the risk of overhiring, the practice introduces other vulnerabilities. Of particular concern is a potential misalignment between generative AI supply and demand.

“There are real risks in just glutting the market with an oversupply of purported skills that don’t match the pragmatic use in the enterprise,” Madan said, referring to the industrywide GenAI training push.

And then there’s the risk of training developers on GenAI coding assistants — and turning them loose without adequate auditing or governance, he added.

“With no checks and balances, they will produce unsecure code,” Madan said.

But other industry executives viewed large-scale generative AI training as a necessity.

Greg Smith, head of global product and solution marketing at Certinia, a San Jose, Calif., company that provides automation software for IT service providers and professional services firms, acknowledged the need to manage risk exposure amid the GenAI hype cycle. On the other hand, service providers might fail to tap the technology’s full potential without widespread training, he said.

“Making this commitment to train these individuals, and really get them to ramp up on skill sets, will help them identify the use cases where AI can provide a better or faster answer,” Smith said. “If an organization doesn’t train the people to be fluent in this technology, it will have a hard time finding the use cases to deploy.”

John Moore is a writer for TechTarget Editorial covering the CIO role, economic trends and the IT service industry.