Chipmaker ARM has reported revenue of $928 million, up 47 percent, with royalty revenue of $514 million (up 37 percent) and license revenue of $414 million (up 60 percent) in Q4 fiscal 2024.

Q4

The growth in royalty revenue was driven by the increasing penetration of Armv9- based chips which typically command a higher royalty rate. ARM does not share royalty rate.

The growth in license revenue was due to high-value license agreements as companies increase investment in Arm-based technology for AI across all end markets.

Fiscal 2024

ARM has reported revenues of $3,233 million, up 21 percent, with royalty of $1,802 million (up 8 percent) and license revenue of $1,431 million (up 43 percent).

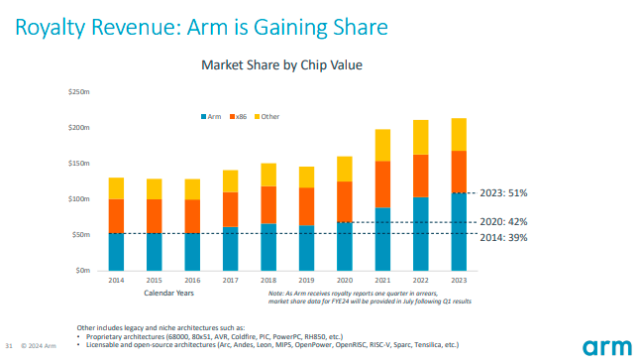

The growth in royalty revenue was driven by the semiconductor industry recovery in the second half of the fiscal year, especially related to smartphones, increasing penetration of Armv9-based chips, and share gains in automotive and at cloud hyperscalers.

The growth in license revenue was due to technology companies aligning their future roadmaps with Arm’s product portfolio, many signing long-term, high-value Arm Total Access agreements. This demand has been accelerated by the need for energy-efficient AI capability across a range of end-markets, from servers to smartphones to sensors, which only Arm’s technology can provide.

In cloud servers, ARM noticed early benefits from the adoption of Armv9-based chips and market share gains as more cloud companies start to deploy Arm-based server chips. Royalty revenue from smartphones grew strongly as AI-enabled Armv9 based handsets, which have a higher royalty rate, continued to gain share.

In the automotive market, more cars are deploying ADAS and digital cockpits creating more opportunity for Arm-based chips, leading to strong royalty revenue growth. Royalty revenue from the IoT/embedded market was down slightly due to semiconductor industry weakness, with industrial and general purpose microcontrollers being more impacted than consumer electronics.

During the quarter, Arm’s customers reported that they had shipped 7 billion Arm-based chips for the December quarter shipping period. This takes the cumulative number of Arm-based chips reported as shipped since inception to 287.4 billion.

Annualized contract value ACV at the end of Q4 FYE24 was $1,182 million, up 15 percent year-over-year and up 2 percent compared with Q3 FYE24. Sequential growth was primarily driven by the high-value Arm Total Access license agreements signed during the quarter.

Remaining performance obligations as of the end of Q4 FYE24 was $2,484 million, up 45 percent year-on-year and up slightly compared with Q3 FYE24, driven by multiple high-value license agreements. ARM expects to recognize approximately 28 percent of RPO as revenue over the next 12 months, 14 percent over the subsequent 13-to-24-month period, and the remainder thereafter.

During the quarter, Arm signed four additional Arm Total Access agreements, taking the total number of extant licenses to 31, which now includes more than half of top 30 customers. The Arm Total Access agreements were signed with semiconductor companies developing chips for a range of end markets, including AI-enabled smartphones, servers and embedded computing.

STRATEGIES

Arm’s strategy promotes multiple growth drivers. Growth will be driven by royalty revenue. ARM expects the demand for Arm-based compute to continue across all market segments, especially as AI is deployed in virtually all applications, from the most advanced data centers to the smallest edge devices.

All this extra compute requires increased performance with less power consumption, which is driving the need for Arm’s most advanced technology, such as Armv9, into smartphones, servers, smart IoT, and networking devices.

Chips based on Armv9 technology contribute around 20 percent of royalty revenue, up from around 15 percent last quarter.

Arm’s data center customers are reporting substantial performance-per-watt savings compared with legacy architectures and this contributes to why Arm’s energy-efficient technology is being chosen to help run these workloads.

Google recently announced its first custom Armbased Axion product, which provides 50 percent better performance and up to 60 percent better energy-efficiency compared to legacy architectures, and will be used to run AI training and inference. Ten of the world’s largest hyperscalers are deploying Arm-based chips for their data centers, including Amazon Web Services, Microsoft, and Oracle Cloud.

NVIDIA recently announced their Grace Blackwell Superchip that combines NVIDIA’s Blackwell GPU architecture with an Arm-based Grace CPU. This provides significant power savings compared to running a GPU alongside a legacy server chip.

Baburajan Kizhakedath