What’s the Best Pet Insurance in Texas?

According to our research, Lemonade is the overall best pet insurance company in Texas. Our top seven picks, which were chosen based on factors that matter most to Texas pet owners, include the following providers:

How We Ranked Texas Pet Insurance Providers

The MarketWatch Guides team ranked pet insurance providers in Texas based on availability and the factors that most affect policyholders in the Lone Star State. Our review included an analysis of the average age of pets in Texas, state veterinary costs, average monthly premium prices for cats and dogs, and the most reported pet accidents in the state.

When rating companies, we also considered costs and affordability, coverage options, discounts and benefits, and customer service. In addition, we weighed responses to our nationwide survey of 1,000 pet owners with pet insurance, focusing specifically on the 72 Texas residents who completed the questionnaire.

Our in-depth rating system helps us compare and review each of our picks for the best pet insurance companies in Texas. To learn more, read our full pet insurance methodology for our process of reviewing and scoring providers.

How We Gather Our Cost Data

Dog cost data was determined by averaging quotes from our top-rated providers for a 3-month-old mixed-breed puppy, a 1-year-old medium mixed-breed dog, a 2-year-old golden retriever, a 5-year-old medium, mixed-breed dog and an 8-year-old small-mixed-breed dog.

We determined cost data for cats by averaging sample quotes for a 3-month-old kitten, a 1-year-old shorthair cat, a 2-year-old Siamese cat, a 5-year-old mixed-breed cat and an 8-year-old domestic shorthair cat.

The Best Texas Pet Insurance Companies in Detail

Texas Pet Insurance Costs

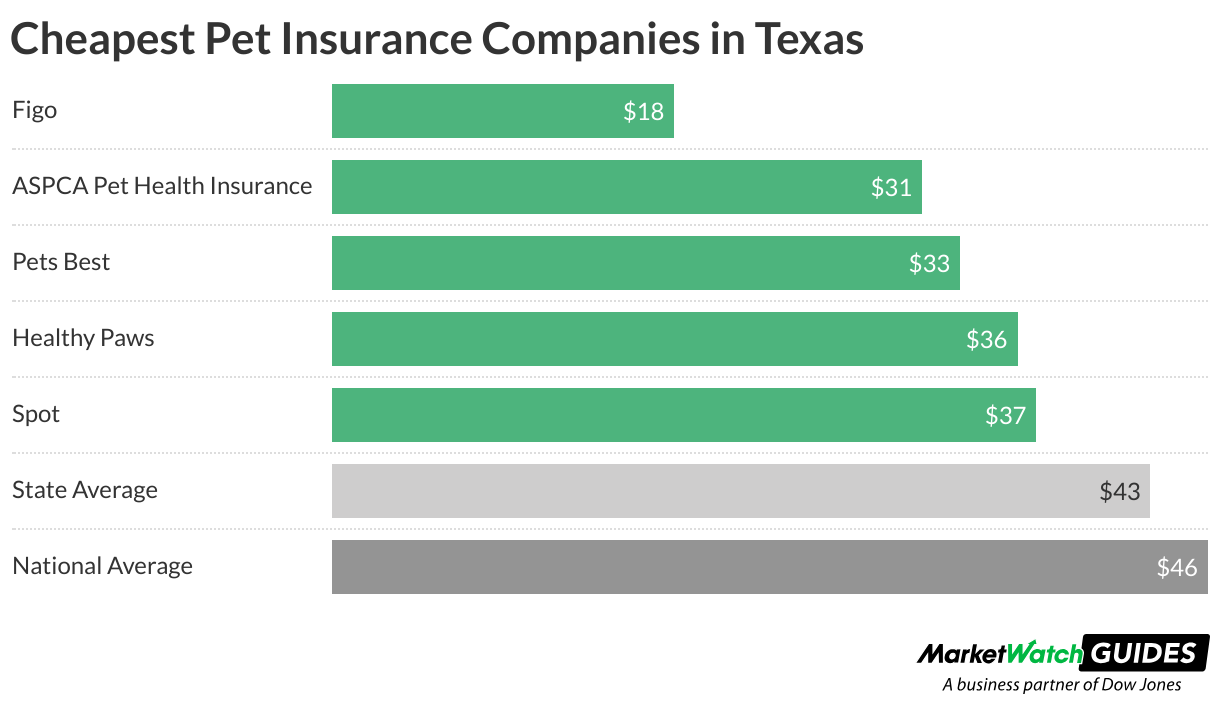

The average monthly cost to insure a pet in Texas is $43 per month. This is 7% less than the national average of $46, which our team calculated based on 17,330 quotes we collected from providers nationwide. When broken down by species, the average cost of pet insurance in Texas is $56 per month for dogs and $30 for cats.

To calculate these averages, we gathered quotes from 22 pet insurance providers using 10 different sample pet profiles. Sample pet profiles include mixed-breed and purebred dogs and cats, ranging from 3 months to 8 years old.

However, your actual costs will vary based on factors such as your pet’s breed, age, location and more. Learn more about the average costs of pet insurance for Texas dogs and cats with top pet insurance providers below.

If you’re a Texas pet owner looking for coverage on a budget, we found Figo is the most affordable pet insurance provider in the state. However, several providers offer plans at rates below the national average. See the table below for the cheapest pet insurance providers compared to national and state average costs.

Our research has found that the cheapest plan available may not necessarily offer the best option for your pet’s needs. It’s best practice to consider costs in relation to coverage, reimbursement rates, annual limits and the deductible when choosing a pet insurance policy.

Average Cost of Dog Insurance in Texas

Based on our research, the average cost to insure a dog in Texas is $56.

According to the North American Pet Health Insurance Association (NAPHIA) 2023 State of the Industry Report, almost 80% of the 5.7 million insured pets nationwide are dogs. The cost to insure dogs in the Lone Star State can vary based on breed since some breeds are more susceptible to certain conditions that can increase insurance costs. For example, we found the average cost to insure a French bulldog in Texas is $88, while the cost to insure a Chihuahua is $29.

Your location also plays a role in pet insurance costs. If you live in a large city in Texas, such as Houston, San Antonio or Dallas, the cost of vet care is often higher than care in rural areas due to higher supply and operating costs. Learn more about the cost to insure a dog in 10 different cities in Texas in the table below.

| City | Average Dog Insurance Cost | Cost With Wellness Coverage |

| Houston | $39 | $51 |

| San Antonio | $31 | $47 |

| Dallas | $43 | $56 |

| Austin | $43 | $56 |

| Fort Worth | $31 | $46 |

| El Paso | $32 | $48 |

| Arlington | $33 | $46 |

| Corpus Christi | $31 | $45 |

| Plano | $41 | $56 |

| Lubbock | $32 | $47 |

Waiting Periods for Pet Insurance Providers in Texas

As you shop for pet insurance, you’ll come across what’s known as a waiting period with each plan. This is the amount of time you’ll need to wait after purchasing your pet’s policy for coverage to begin. Companies use waiting periods to prevent claims from being filed for pre-existing conditions or accidents that happened before a policy was purchased, which a pet insurer will not cover.

Each provider has set waiting periods for accidents, illnesses and orthopedic conditions, but the exact time may vary. A lower waiting period means you can use your pet’s policy sooner in the event of an accident or illness, which may seem more desirable to pet owners.

See the table below for the waiting periods set by our top provider picks in Texas.

What Isn’t Covered by Texas Pet Insurance Companies?

As is common practice in the pet insurance industry, companies in Texas have exclusions regarding what a policy will and will not cover. Most policies exclude coverage for pre-existing conditions, cosmetic procedures, grooming, vaccinations and more. However, some providers — including Lemonade, ASPCA Pet Health Insurance and Embrace — offer add-on coverage for wellness services, vet fees, alternative therapies and more.

Why Get Pet Insurance in Texas?

Based on our research, pet insurance in Texas is worth considering, as it can help cover vet bills if your pet experiences an unexpected health issue or emergency. We spoke with James Oldeshulte, a doctor of veterinary medicine (DVM) and medical director at Veterinary Emergency Group in Austin, Texas, on state-specific hazards pet owners in the Lone Star State should look out for.

Snakebites: Texas is home to several venomous snakes, including rattlesnakes and copperheads, which can pose serious bleeding disorders, pain and swelling.

Porcupines: Porcupine quills can cause painful injuries if pets come into contact with these animals. If not removed, the quills can migrate and cause life-threatening internal injuries.

Green algae: Certain types of blue-green algae found in stagnant water can produce toxins that are harmful or lethal to dogs.

Heat stroke: The hot Texas climate can quickly lead to heat exhaustion and heat stroke in pets, especially short-faced dogs that cannot cool as efficiently.

Hot asphalt: Walking on hot pavement can burn pets’ paw pads, causing pain and injury.

Sago Palm: This ornamental plant is a common toxin that [can] cause liver failure in Texas dogs. All parts of the plant are toxic to dogs.

Top Pet Diagnoses in Texas

We spoke with Amber Batteiger, the public relations and communications manager for Embrace, to learn about the top pet-related diagnoses in Texas according to the company’s database. The list includes:

1. Allergic dermatitis (allergies)

2. Osteoarthritis

3. Diarrhea

4. Vomiting

5. Skin mass

6. Otitis Externa (ear infection)

7. Anxiety

8. Lameness

9. Seizure

10. Urinary tract infection

How Much Can Pet Insurance Save Texas Pet Owners?

Dog and cat owners in Texas can offset out-of-pocket costs for high veterinary bills or routine care services by opting for a pet insurance policy. However, your savings may vary depending on your pet’s breed, age, health history and more — and it doesn’t always pay off

Our research team found that some of the most popular dog breeds in Texas include the French bulldog, Chihuahua and Yorkshire terrier. To show you how much you could save by purchasing pet insurance, we’ve included examples of common treatments in Texas, associated costs and potential savings for these three breeds.

Charlie the Chihuahua had a heatstroke

Teddy the Yorkshire Terrier was bitten by a snake

Flynn the Frenchie needs preventative puppy care

Charlie, the 11-year-old Chihuahua

Charlie had a heatstroke due to high temperatures in Texas. The tables below show the treatment cost breakdown with and without pet insurance for one year of coverage.

Cost Without Pet Insurance

| Treatment | Cost |

|---|---|

| ER exam | $150 |

| Blood test | $140 |

| Oxygen therapy | $400 |

| Fluid therapy | $300 |

| Hospitalization | $2,050 |

| Gastric protectants | $100 |

| Pain medication x6 | $360 |

| Total | $3,500 |

Source: CareCredit

Cost With Pet Insurance

| Pet Insurance | Cost |

|---|---|

| Avg. cost of annual pet insurance | $612 |

| $250 deductible | $250 |

| 20% of $3,500 (co-insurance) | $700 |

| Total | $1,562 |

Teddy, the 6-year-old Yorkshire Terrier

Teddy has a snakebite. The tables below show the treatment cost breakdown with and without pet insurance.

Cost Without Pet Insurance

| Treatment | Cost |

|---|---|

| ER Exam | $150 |

| Pain medication x6 | $360 |

| IV fluid therapy | $300 |

| Wound treatment | $250 |

| 48 hour hospitalization | $2,050 |

| total | $3,110 |

Source: CareCredit

Cost With Pet Insurance

| Pet Insurance | Cost |

|---|---|

| Avg. cost of annual pet insurance | $612 |

| $250 deductible | $250 |

| 20% of $2,888 (co-insurance) | $578 |

| Total | $1,440 |

Flynn, the 8-week-old French Bulldog

Flynn had an ear infection and needs preventative puppy care. The tables below show the treatment cost breakdown with and without pet insurance.

Cost Without Pet Insurance

| Treatment | Cost |

|---|---|

| Office Visit x3 | $204 |

| Vaccines/Shots | $215 |

| Neuter package (under 6 months) | $419 |

| Ear infection treatment | $149 |

| Total | $987 |

Costs collected for Houston, Texas

Source: Banfield Pet Hospital

Cost With Pet Insurance

| Pet Insurance | Cost |

|---|---|

| Avg. cost of annual pet insurance | $612 |

| $250 deductible | $250 |

| 20% of $987 (co-insurance) | $197 |

| Total | $1,059 |

If you feel pet insurance is worth the cost but are looking for ways to save money on a policy, Texas pet owners can lower premiums by choosing a lower reimbursement rate, higher deductible and taking advantage of qualifying discounts their chosen pet provider offers.

How To Pick a Texas Pet Insurance Plan

Our team recommends that Texas pet owners consider several factors when choosing a pet insurance plan. Your pet’s lifestyle, state-specific risks and breed can help inform your choice and help you pick the best plan to suit your pet’s needs.

Consider Your Pet’s Lifestyle

If you have a pet accompanying you on outdoor adventures in Texas, you run a higher risk of encountering snakes, porcupines and bodies of water with algae blooms. Considering the lifestyle you lead with your pet can help you determine the type of coverage that best suits its needs.

“[Practice] environmental awareness. Be aware of your surroundings and avoid areas known for snake or porcupine activity. Check local advisories for algae blooms in water bodies,” said James Oldeshutle, DVM and medical director at Veterinary Emergency Group in Austin, Texas

Weigh Texas-Specific Pet Health Risks

Texas is known for its scorching summers, venomous snakes and the Sago Palm, an ornamental plant that can cause liver failure in dogs. Comprehensive accident and illness plans can cover vet bills related to complications from heat stroke, snake bites, or the ingestion of toxic plants or other foreign bodies.

Understand Breed Risks

As mentioned, some of the most popular breeds in the Lone Star State include French bulldogs, Chihuahuas and Yorkshire terriers. French bulldogs in particular are susceptible to respiratory conditions that could become exacerbated by the summer heat in Texas. Other breeds, such as boxers, are more prone to conditions such as hip dysplasia. A provider with a shorter waiting period for orthopedic conditions, such as Spot, could offer a better choice over a company with longer waiting periods for these conditions, such as Healthy Paws.

If your pet is susceptible to certain conditions due to its breed, it’s worth considering a comprehensive plan that covers accidents and illnesses for total peace of mind.

“It’s important to make sure pets are protected from the Texas heat. Dogs use panting as a means to cool themselves, and breeds with short noses like bulldogs, boxers and pugs are especially susceptible as they cannot efficiently cool themselves through their shortened airway,” said Dr. Kaitlin Agel, DVM and area medical director at Modern Animal’s Texas Clinics. Signs of heat stroke in pets are excessive panting and drooling, restlessness, gastrointestinal upset, bright red tongue and gums, and weakness or disorientation. Heatstroke requires emergency intervention so take your pet to a veterinarian if you are concerned.“

How Pet Insurance Works

Texas pet owners with pet health insurance can visit any veterinarian they choose and then submit a claim with their pet’s insurance company for reimbursement. While few providers allow vet-direct payments under specific circumstances, this is not common practice.

When you file a claim, your insurance company determines which services are eligible for reimbursement to calculate how much you’ll get back. The company will also review your pet’s medical records to ensure the claim doesn’t involve a pre-existing condition, which pet insurance providers exclude from coverage.

Insurance companies calculate reimbursements based on your deductible, reimbursement rate and annual limit. Learn more about each of these below.

- Deductible: A pet insurance deductible is the amount you pay before your plan covers any approved vet expenses. Pet insurance companies typically offer deductible amounts ranging from $100 to $1,000. A lower deductible will decrease your out-of-pocket costs but raise monthly payments. In comparison, a higher deductible lowers monthly payments but increases out-of-pocket expenses when you file a claim.

- Annual limit: An annual policy limit is the maximum amount your pet insurance provider will pay for bills associated with approved claims. You can often customize this limit, with some providers offering unlimited annual coverage in exchange for higher monthly payments. Choosing the highest limit within budget can help protect Texas pet owners from paying out-of-pocket for pricey vet bills.

- Reimbursement rate: Once you’ve met your pet’s deductible, the plan’s reimbursement rate is the percentage of a total claim the insurance provider will pay. Our research found that popular providers typically offer rates of 70%, 80% or 90%, with some offering a full 100%. Your chosen rate will ultimately affect your monthly premium, so we suggest choosing the highest rate that suits your pet’s needs and your budget.

Available Plan Types

Pet owners in the Lone Star State have choices regarding pet insurance plans. The three basic plan types offered by most providers include:

- Accident and illness plans: These full-coverage plans reimburse you for accidents such as broken bones and illnesses such as cancer, hip dysplasia or allergies.

- Accident-only plans: These plans are designed for emergencies and provide limited coverage for accidents. Unlike accident and illness plans, they do not cover illnesses and are usually cheaper due to their limited coverage.

- Pet wellness plans: Wellness plans are not technically insurance since they provide reimbursements for routine services, which a standard pet insurance plan will not cover. Generally, wellness plans do not cover the total cost of routine care. Instead, companies will assign amounts for specific wellness services or an overall lump sum to use toward the services or treatments of your choice.

Texas Pet Laws

Texas enacted three new pet laws in 2023. As of Sept. 1, it is a criminal offense for someone in Texas to have a pet if they have been convicted of animal cruelty within the past five years. Additionally, dog breeders with five or more breeding females require a license (reduced from 11 breeding females). Finally, trap neuter return (TNR) efforts to keep the feral cat population stable cannot be prosecuted as abandonment. Additional laws by location include:

Austin Pet Laws

- Pet owners must keep dogs on a leash and under control in all areas not designated as off-leash.

- It is illegal to sell a puppy or kitten that is not spayed or neutered, vaccinated and microchipped.

- A fence must confine all off-leash dogs.

Houston Pet Laws

- A pet running at large within city limits is considered a nuisance.

- All dogs and cats older than 3 months must be licensed and have a current rabies vaccination.

- Owners must keep pets under restraint while in public spaces.

Dallas Pet Laws

- Failing to vaccinate and microchip a pet can result in a civil citation and fine.

- Pets older than 6 months must be spayed or neutered.

- It is a criminal offense to allow an unsecured dog to make an unprovoked bite.

San Antonio Pet Laws

- All dogs, cats and ferrets older than 16 weeks must be licensed and vaccinated against rabies.

- A city residence is allowed to have a maximum of eight cats or five dogs, or a total of eight pets.

- All outdoor cats must be spayed or neutered.

Is Pet Insurance Worth It in Texas?

Whether pet insurance is worth it to you as a Texas pet owner is a personal choice. To better understand what pet owners like you think about pet insurance, we ran a nationwide pet insurance survey consisting of 1,000 participants in April 2024. Out of the respondents who live in Texas, almost 85% felt that based on their experience, pet insurance was worth it. When asked why, one participant noted: “Veterinarian costs for emergency procedures are crazy expensive. I wouldn’t have been able to cover [the bill] any other way.”

Oldeshulte, quoted earlier, said this when asked whether pet insurance is a worthwhile investment for Texas pet owners:

“Yes, pet insurance is a must! The diverse range of hazards and potential for significant medical expenses make pet insurance valuable for every pet. Investing in pet insurance can provide peace of mind and help pet parents afford high-quality veterinary care when their pets need it most. Most emergency veterinarians have pet insurance on their pets — we understand firsthand the benefit of having coverage, and we see it help families every day and every night.”

We received data from Batteiger, quoted earlier, centered around common claims submitted by Embrace policyholders in Texas. The provider’s database includes the following statistics for the Lone Star State:

- The average cost of claims in the state is $421, based on data from 2024.

- Texas has the third-highest number of insured pets in the country.

- Texas has the fourth-highest number of total claims in all U.S. states.

- The highest individual claim paid out in 2024 for a dog was over $20,000.

- The highest individual claim paid out in 2024 for a cat was over $11,500.

Frequently Asked Questions About Texas Pet Insurance

Does pet insurance cover exotic pets in Texas?

Many pet insurance companies only cover dogs and cats, not exotic animals such as small mammals, birds and reptiles. If you have an exotic pet, ensure it is covered when researching pet insurance providers. Based on our research, Nationwide and ASPCA Pet Health Insurance are the only providers to offer some exotic pet coverage, covering birds and horses, respectively.

Can you use pet insurance at any vet in Texas?

Generally, you can use pet insurance plans at any veterinary clinic in Texas. However, where you live impacts policy availability, so ensure a pet insurance company operates in your area before purchasing coverage.

What is the average cost of pet insurance in Texas?

According to quotes gathered by our team from 22 providers using 10 different sample pet profiles, the average monthly cost of a pet insurance policy in Texas is $43. This breaks down to an average of $56 for dogs and $30 for cats.

Our Methodology: How We Rated Pet Insurance Providers

Additional Pet Insurance Resources

Use the resources below to learn more about pet insurance and pet care in Texas.