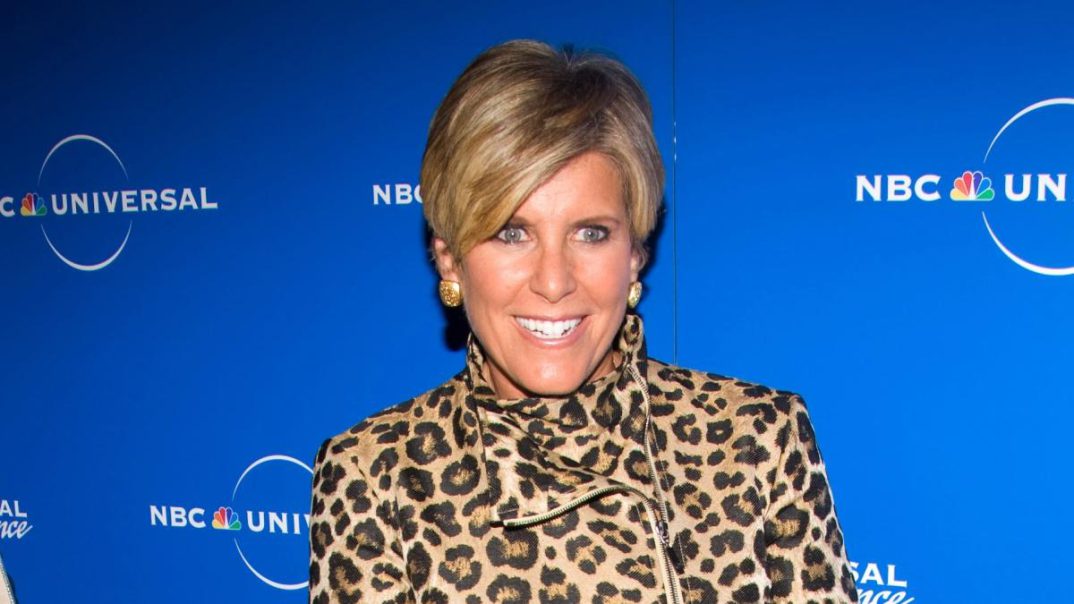

Charles Sykes/Shutterstock / Charles Sykes/Shutterstock

Though saving for retirement may seem a daunting task, with the right guidance from a seasoned financial advisor and expert like Suze Orman, it can also be an exciting journey toward a fulfilling future.

For You: 10 Steps To Prepare For Retirement

Discover More: 5 Subtly Genius Moves All Wealthy People Make With Their Money

Because retirement planning can be quite complex, you may need to seek more specific retirement advice for your situation. It’s important to remember that saving and investing can mean different things to different people, but most financial planners will agree on at least a baseline starting point.

Orman has been a guiding light for many when it comes to managing money, especially around retirement income sources. Here are some of her most valuable pieces of financial advice for you to better get a handle on successfully setting up your golden years.

Trending Now: Suze Orman’s Secret to a Wealthy Retirement–Have You Made This Money Move?

Start Saving Early and Consistently

One of Orman’s key messages is the importance of starting your retirement savings as early as possible. The power of compound interest means the earlier you start saving, the more your money will grow over time, essentially making it free money earned in your free time.

Orman advised making retirement savings a regular habit, treating it like a non-negotiable monthly bill. She wrote, “Someone who starts saving 15% of their income by age 25 and keeps at it will be in good shape decades from now.”

Trending Now: 3 Things Retirees Should Sell To Build Their Retirement Savings

Know Your Retirement Needs

Orman also stressed the importance of understanding how much you’ll need to live comfortably in retirement. This means calculating your retirement expenses, which will vary for everyone. You should consider factors like healthcare costs, housing and lifestyle desires.

Planning with a clear goal in mind helps you create a more effective and tax-advantaged savings strategy. One main strategy Orman advised is as follows:

Maximize Retirement Account Contributions

Orman recommended making the most of retirement accounts like 401(k)s and IRAs. She suggested contributing enough to get any employer match, as this is essentially free money. For those closer to retirement, taking advantage of catch-up contributions allowed for individuals over 50 can be a smart move.

Orman said, “I recommend the Roth option. If your plan doesn’t have a Roth option, your strategy should be to contribute just enough to the traditional 401(k) to qualify for the maximum matching contribution. Then do more retirement saving in a Roth IRA.”

Diversify Your Investments

Diversification is vital for minimizing risk and maximizing returns over the long term. Orman suggested a mix of stocks, bonds, and other investment vehicles. She also emphasized the need to review and adjust your investment portfolio regularly, especially as you get closer to retirement.

For example, on trying to switch up how you earn dividends, Orman said on her podcast, “There’s approximately $6 trillion in those kinds of investments. And I have absolutely no doubt that when interest rates really do start to come down and the people in those investments are no longer happy with the interest rate that they are getting, that money will flow where it will flow into growth stocks that pay a dividend yield.”

Pay Off High-Interest Debt

Before retirement, Orman recommended paying off high-interest debt, such as credit card balances. This debt can be a significant drain on your resources, and entering retirement debt-free can provide financial and emotional relief.

Orman advised not to let debt linger and to pay as much as you can every month, because if you just pay the minimum it will eat into your finances for years to come.

Consider Delaying Social Security

Delaying Social Security benefits can result in larger monthly payments later on. Orman often suggests waiting until full retirement age or even later, if possible, to maximize these benefits. However, this strategy should be tailored to individual financial situations and health considerations.

Orman wrote, “I was concerned when I recently read that just 10% of people are committed to waiting until age 70 to start claiming their Social Security benefit. As I have explained many times, when you wait to claim Social Security, you are promised a bigger payout. A much bigger payout.”

Final Take To GO

The bottom line is that Orman’s advice centers around early and consistent preparation, which while it can feel like a part-time job, will set you up for full-time comfort in retirement.

Orman promotes a mindset of financial independence, which involves living within your means and making informed financial decisions. This mindset is key to a successful and stress-free retirement.

The financial world is constantly changing, and so are personal circumstances such as job loss or medical expenses. Orman encourages staying informed about financial matters and being flexible with your retirement plan in the long run. This includes being open to adjusting your savings rate, investment choices and retirement age as needed.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Suze Orman’s Retirement Tips — 6 Pieces of Money Advice You Shouldn’t Ignore