Earlier this year, Super Micro Computer, Inc. (SMCI) was on top of the world. The company’s server solutions were in high demand, thanks to the artificial intelligence boom. Investors were hungry for stocks that were riding the wave, and SMCI fit the bill.

The company’s high-performance, liquid-cooled servers are tailor-made to handle the workloads of NVIDIA Corporation’s (NVDA) powerful GPUs. This helped put Super Micro far ahead of the competition.

As a result, the stock surged 332% to a record high of $1,229 by March. It was also one of the top-performing stocks in the beginning of 2024.

InvestorPlace – Stock Market News, Stock Advice & Trading Tips

However, the stock took a tumble over the past few months after the company was hit with wave-after-wave of bad news, including nasty allegations by an unscrupulous short seller and a Department of Justice investigation.

So, in today’s Market 360, we’ll discuss the allegations and subsequent investigation SMCI is facing, and the catalyst that could help the stock bounce back. I’ll also share if SMCI is a good buy right now… and where to learn more about another AI stock that’s poised to soar following Elon Musk’s big event next week.

What Happened to Super Micro?

On August 26, a notorious short-seller, Hindenberg Research, released a report claiming that Super Micro committed accounting violations based on the story of a disgruntled former employee. Super Micro dropped 8% but was able to regain some of its losses.

Two days later, Super Micro announced that it was delaying the filing of its annual 10-K report, which caused the stock to fall by 20%.

Then, on September 24, The Wall Street Journal reported that the Department of Justice (DOJ) issued a probe into Super Micro to investigate its accounting practices in light of Hindenberg’s report.

What this all comes down to is that a disgruntled, former employee made claims about accounting violations and filed a whistleblower lawsuit against Super Micro Computer. And Hindenberg Research, being the unscrupulous short seller that it is, latched on to these claims and further muddied the waters with its report. All of which have hit SMCI shares.

In my opinion, short sellers are scum. Short-selling firms like Hindenberg issue this kind of report for one simple purpose: to cause a stock to tumble. They make money off a stock going down. Then they take that money and run, and never have any subsequent follow-up reports.

Keep in mind that this report was issued back in August when trading volume is usually light and no one is around. So, a stock is more likely to fall, and Hindenberg found the perfect opportunity with Super Micro.

Story continues

Personally, I don’t think these allegations have any proof, but we’ll see what the DOJ determines, of course. It is unfortunate, though, that Super Micro Computer has been the victim of all this slander and volatility.

In the meantime, Super Micro is backed by superior forecasted sales and earnings growth. But some investors are wondering whether they should buy SMCI on the dip – especially since there is a potential catalyst…

I’m talking about Super Micro’s 10-for-1 stock split, which took effect on Tuesday, October 1.

So, let’s discuss what exactly a stock split is… and why it may be tempting to buy SMCI right now.

What’s a Stock Split?

A stock split is when a company decides to divide shares of its stocks into smaller units. From a fundamental perspective, it doesn’t change anything about the company or its value.

It merely changes the number of shares you own.

Let’s say you owned 10 shares of Super Micro before the split. After Tuesday’s split, you should now hold 100 shares. Every share of Super Micro you owned pre-split has been divided into 10 individual shares.

But the fact is the value of the shares remains the same. A split doesn’t affect you in terms of gains or losses. So, why do this in the first place?

When a stock split is announced, the intention is to make it more affordable and attractive to individual investors. An average investor may not have the funds to invest in a stock that’s trading above $1,000. In fact, buying a few shares may cause an overallocation of their portfolio.

Again, nothing has fundamentally changed about the stock itself. But perception is everything, as they say. So, a lower share price will make the stock seem more affordable and accessible to everyday investors.

I should also add that a split can attract more investors. So, you’ll often see a post-split rally.

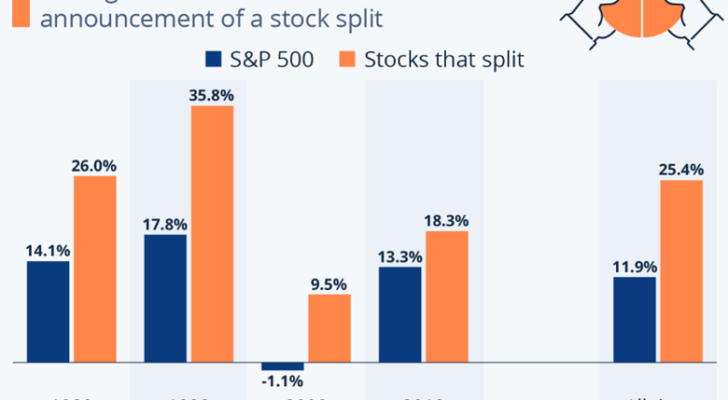

Case in point: According to Bank of America’s Research Investment Committee, stocks that split beat gained 25.4% in the following year after a split, compared to the S&P 500’s 11.9% gain. You can see the returns in the chart below.

Source: Statista

Is SMCI a Buy?

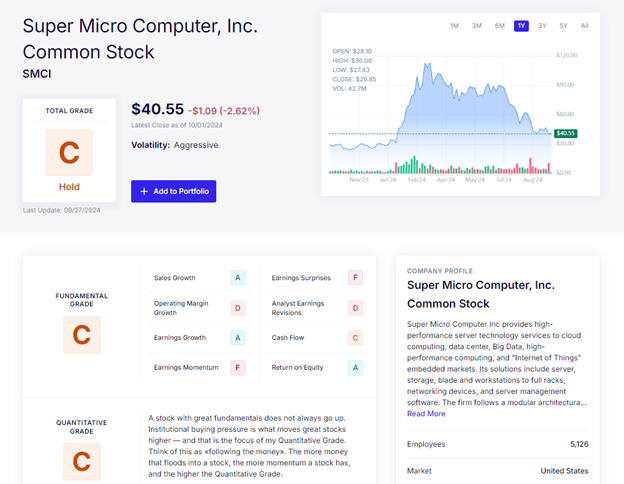

Given SMCI’s stock split and its superior fundamentals, you may be considering buying SMCI. So, let’s take a look at what my Stock Grader (subscription required) has to say.

As you can see, Super Micro gets a Fundamental Grade of C making it a Hold. That’s because the company has seen some margin compression lately, and it has recently failed to beat analysts’ lofty expectations.

What’s more, it has a Quantitative Grade of C. This means the buying pressure from the “smart money,” i.e., institutions like hedge funds, pensions, etc., has been slowing lately.

So, overall, Stock Grader currently gives Super Micro a Total Grade of C, which signals a Hold.

What does this mean for you?

Bottom line: Stock Grader is saying not to buy SMCI… but if you own it, don’t sell it, either.

Super Micro will release its quarterly results on November 6. For the current quarter, earnings are forecast to more than double year-over-year to $7.51 per share, up from $3.43 per share in the same quarter a year ago. And revenue is forecast to surge 212.8% year-over-year to $6.46 billion.

If it can beat analysts’ estimates and provide positive guidance, I expect the stock to bounce back strongly.

A Front Row Seat to the Next Breakthrough In AI…

Now, I’ve been following Super Micro Computer for a while now and recommend it in all my services. The fact of the matter is the company is still a game-changer in the AI Revolution.

But while we wait for the stock to rebound, there’s another AI breakthrough on the horizon…

On October 10, Elon Musk is set to reveal his long-awaited “Robotaxi” to the world.

Now, self-driving cars have been one of Elon’s biggest and boldest promises. So far, it hasn’t been pulled off. But my InvestorPlace colleague, Luke Lango, has found a small, little-known supplier that could play a key role in making it happen.

In other words, this is your chance to get in on the ground floor of what could be Elon Musk’s next big thing.

And that’s why, on Monday, October 7, at 10 a.m. Eastern, Luke is hosting a broadcast to tell you everything you need to know.

You don’t want to miss it.

Click here to sign up and save your seat for Luke’s event now!

Sincerely,

Louis Navellier’s signature

Louis Navellier

Editor, Market 360

The post Should You Buy Super Micro Computer After the Stock Split? appeared first on InvestorPlace.