Source: Shutterstock

It looks like we could be at the start of a new era in communication. We’ve had the print and the electronic eras, and the tectonic plates are now shifting from the digital to the generative AI (GenAI) era.

Within marketing specifically, all kinds of new things will emerge to take advantage of the new technology. New roles, new skills, new brands, new objectives, new tactics, new agencies, new creative forms, new production techniques, new research methods. And new metrics to help us track success.

But it’s always important to think about what’s not new and what’s not changing too. Too much of what’s new in marketing gets built by people with no real understanding of the fundamentals and what’s proven to work. Which is why, whenever thinking about what’s coming, my instinct is to try to connect it to what’s gone before.

So when a colleague at Jellyfish, Jack Smyth, started talking about ‘share of model’ early this year as a way of measuring a brand’s presence within AI data sets, I had a few basic thoughts in quick succession. First, that sounds genuinely new. Second, it feels reassuringly familiar. Third, I wonder if, as with share of voice and share of search, it relates to share of market. (And fourth, ‘why the hell didn’t I think of that?’.)

With most apparently new ideas, they’re never 100% new but are always combinations and evolutions of previous ideas. In fact, for new ideas to gain traction, they usually need to be both original and also familiar. The novelty helps them get attention and the familiarity helps make them easy to adopt.

For full disclosure, Jellyfish is exploring share of model as a marketing metric. It is also building a platform to help monitor it, and working with a number of brands to make it work in practice as a brand management tool.

But before looking at what share of model is and what it could become, here’s a brief look at its ‘share of’ forebears, the giants whose shoulders it’s standing on.

Generative AI isn’t marketing’s future, it’s part of its present

Share of market: The ‘share of’ metric to rule them all

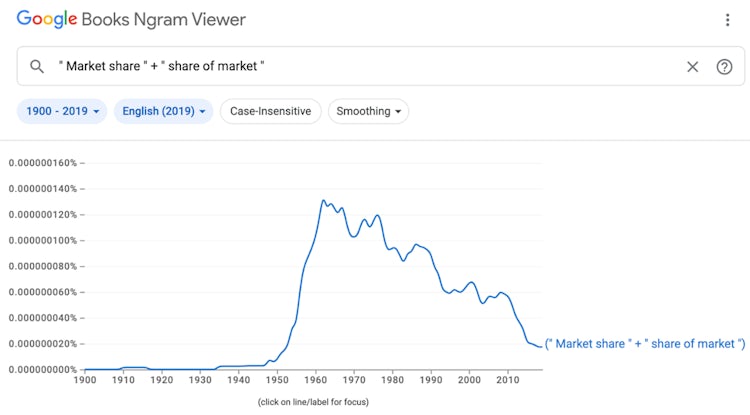

Share of market (or market share) is the Patient Zero of all the ‘share of’ metrics. It really caught on from the 1950s onwards with the explosion of mass production and mass consumerism, as global markets grew, competition intensified and assessing a company’s market position relative to competitors became a priority.

Businesses had previously relied on anecdotal evidence and intuition to gauge their market positions, but from the 50s companies began collecting data more systematically and on a bigger scale, conducting surveys, tracking sales and using more sophisticated statistical methods. The simultaneous rise of early computers enabled all this.

Source: Google NGram showing the rise in mentions in publications of ‘share of market’ and ‘market share’ from the 50s

Source: Google NGram showing the rise in mentions in publications of ‘share of market’ and ‘market share’ from the 50s

Market share had its big moment around 1974-75 when the Harvard Business Review published an article about the positive correlation between market share and ROI, saying that businesses with higher market share tend to have higher profit margins, with economies of scale, market power and quality of management amongst the major factors driving this.

While market share growth remains a primary goal for most brands, over the last 20 years the spotlight (at least in marketing) feels like it’s shifted somewhat to metrics that are more in marketing’s increasingly narrow control, are easier to monitor and move more quickly. Today’s marketers are addicted to the instant gratification of metrics that see bigger, faster shifts. Market share is perhaps more suited to stable and mature categories, and a little hard to keep track of in dynamic and emerging categories, which may mean it’s become less of a North Star for some, however wrong that might be.

Share of voice: The ‘share of’ metric for the mass media age

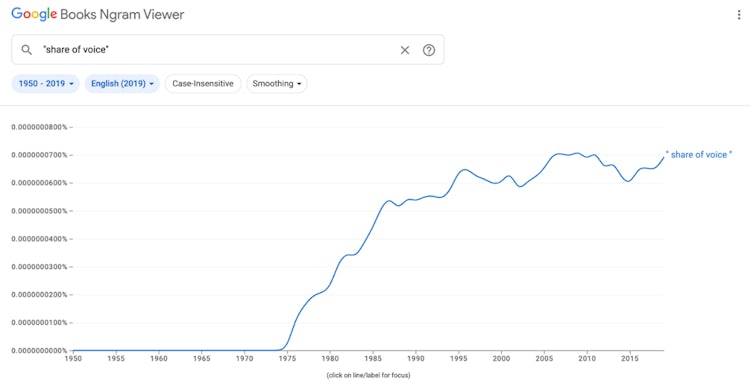

Marketing’s next big ‘share of’ metric, share of voice (SOV), is essentially the concept of market share applied to media spend, and was especially useful in the pre-digital mass media. Les Binet, adam&eveDDB’s head of effectiveness, directed me to the fact that Unilever had pioneered the use of SOV as far back as the 1960s, although the company kept quiet about this at the time.

Source: Google NGram showing the rise in mentions in publications of ‘share of voice’ from the 50s

Source: Google NGram showing the rise in mentions in publications of ‘share of voice’ from the 50s

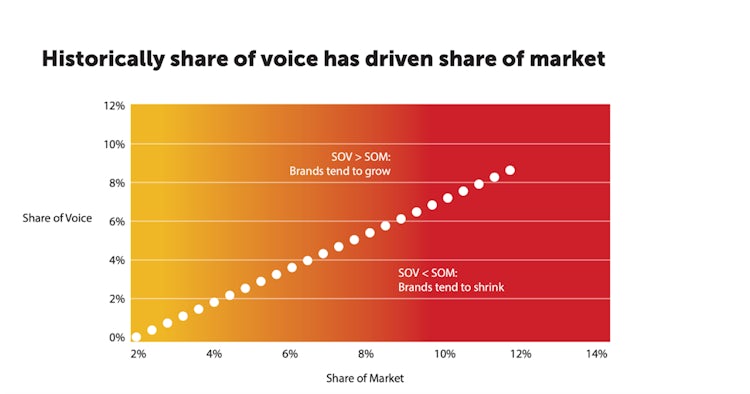

James Peckham at Nielsen brought all this out into the open in the early 70s, and then John Philip Jones made it famous with a big, multimarket study in the late 80s and early 90s. The key insight in all this work was that brands investing more in media than their market share implied were much more likely to grow their market share over the longer term.

Binet and Peter Field built on Jones’s findings, featuring it in 2007’s ‘Marketing in the era of accountability’ and later work. Binet told me he first explored using SOV for Volkswagen as early as 1993 and coined the term ‘excess share of voice’ or ESOV then, ESOV being the difference between a brand’s share of voice and its share of market. This concept was known to Unilever as ‘dynamic difference’, although Binet wasn’t aware of that work at the time. Binet and Field’s work established SOV as a core planning principle, especially useful for budget setting.

Source: Binet and Field, Media in focus: Marketing Effectiveness in the Digital Era, IPA

Source: Binet and Field, Media in focus: Marketing Effectiveness in the Digital Era, IPA

But SOVs pre-digital roots are now showing and it’s getting harder to calculate due to a lack of comprehensive and reliable data on brands’ digital media spend relative to competitors. Some even think the link between SOV and market share has now broken. It seems unlikely that the fundamental principle no longer holds true, but it does point to the need to think about effective share of voice, not just share of voice, when planning media.

Share of search: The ‘share of’ metric for the digital age

Share of search measures the proportion of online searches for a brand compared to the total searches in its category. It was popularised by Binet and James Hankins from around 2020, although people in the performance marketing and SEO worlds claim they’d been using a version of it for some time as part of their toolkit, they just hadn’t been shouting about it. Google and Kantar have shown that share of search is a proxy for a brand’s mental availability, and Binet and Hankins’ work with the IPA showed that in many categories it’s a leading indicator of market share.

Based on freely available Google Trends search data, it’s relatively easy and inexpensive to measure compared to traditional market research methods, and because various platforms and tools exist to monitor it, it has become standard for many brands to track.

All of which feels like a natural progression to the new kid on the block.

Share of model: The ‘share of’ metric for the GenAI age?

As with the earlier ‘share of’ metrics, the development of each being intrinsically linked to the emergent or dominant marketing technology of the day, share of model has arrived hand in hand with a new era in marketing and a newly available data source.

What the AI large language models (LLMs) ‘know’ in relation to brands is essentially the sum total of everything in their datasets about a brand, its touchpoints, its communications and, increasingly, the new content each model can find on what consumers think, feel and do in relation to it. All in one place, and all for free, or at least without the need for costly surveys and panels.

Marketing Week’s Mark Ritson noted the power of synthetic data for market research last year, after the publication in October 2022 of academic research suggesting LLMs could generate perceptual maps and brand attributes closely resembling human-generated data.

Plainly, any vast repository of data on a brand that’s essentially free will be interesting to marketers, and so the race has been on to find robust, stable, replicable ways of organising what LLMs know about brands that can be of use to marketers.

Enter share of model – defined here as the number of mentions of a brand by one or multiple LLMs, as a proportion of total mentions of brands in the same category. It essentially gives a picture of a brand’s overall ‘visibility’ to AI models and so to marketers. Tracking a brand’s mention rate as it shifts over time in relation to key competitors can make this practical and actionable.

But it’s not just about visibility, it can also be about brand positioning. At its simplest, brand positioning is about improving positive brand associations, reducing negative associations and distinguishing a brand on key associations where there’s an opportunity for relative differentiation.

Share of model could also help here. LLMs can generate clusters of positive and negative associations with brands and categories, and so we can use them to compare a brand with its competitors on those associations and track them over time. So the models can be a great source of brand positioning insight, as an input to help identify positive brand associations to build, negative associations to reduce and relative differences to further distinguish a brand, and as an output to track progress towards an ideal positioning.

So what next for share of model?

It’s too early to say if share of model will prove to have the universal utility that has been the key to the success of its ‘share of’ predecessors, and there’s a lot of work to do if it’s to become anywhere near as widely known and used.

Firstly, as with SOV, ESOV and share of search, establishing if there’s a relationship with share of market feels important. Do improvements in share of model reflect or even predict market share gains? Can changes in the communications approach impact share of model and share of specific brand associations? Can the insight generated help us produce new, more relevant creative content? How do we ensure creative gets the attention of its human audience in order to influence brand growth directly? How do we ensure content reaches its new ‘audience’ – the models – in order to influence it indirectly? All are questions we’re exploring at Jellyfish.

No doubt some brands and marketers will use this as a reason to open the floodgates to huge quantities of poor AI content of all kinds to try and ‘game’ the models, as in the early days of search engine marketing. Any new metric is likely to lead to some unintended consequences. Let’s do everything we can to avoid that.

Let’s hope people use this to help create better, longer-lasting, strategic communications with a higher goal – to drive share of market – not just to get a short-term boost for their share-of-model measure.