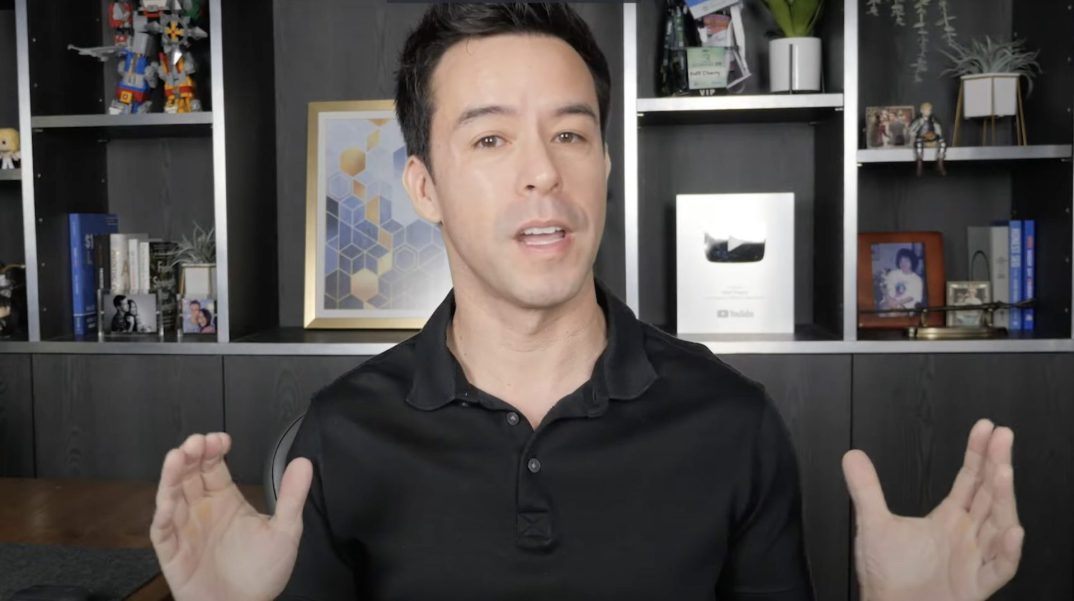

Traditional angel investing often conjures images of Silicon Valley tech startups and million-dollar checks. However, a powerful alternative has emerged that leverages SEO expertise to generate substantial wealth: SEO angel investing. This approach has proven more lucrative than running an SEO agency or pursuing affiliate marketing, while demanding significantly less time and effort. After watching Matt Diggity’s detailed explanation of SEO angel investing, here’s what you need to know.

Matt Diggity’s personal journey into SEO angel investing has yielded remarkable results. Since 2019, one investment in Surfer SEO saw the company grow from $1 million to $13 million in annual revenue. Another venture with Bloom, Thailand’s leading cannabis product company, secured top rankings for crucial keywords. Pre Condo, a Toronto real estate agency investment, led to a successful acquisition by I Rise Realty.

The Power of SEO Angel Investing

SEO angel investing differs fundamentally from traditional angel investing in several key ways:

- Leverage SEO expertise instead of just capital

- Focus on businesses with existing traction

- Target companies with proven product-market fit

- Exchange knowledge and resources for equity

The model works exceptionally well because it allows business owners to focus on their core competencies while you handle the marketing. A dentist can concentrate on dentistry, a lawyer on legal work, while you drive organic traffic and growth.

Smart Equity and Value Creation

The concept of smart equity sets SEO angel investing apart. By contributing expertise, networks, and resources, investors can acquire shares at significant discounts or even no cost. This approach creates a joint venture scenario, where both parties benefit from their respective strengths.

“Growth by acquisition has allowed me to reach numbers in life I could never even dream about.” – James Dooley

The value multiplication effect makes this model particularly attractive. When businesses within your investment portfolio collaborate, the benefits compound. A simple $1,000 transaction between two portfolio companies can generate $4,000 in actual value, assuming a standard three-times valuation multiplier.

Building Your Investment Strategy

Success in SEO angel investing requires a systematic approach:

- Develop a strong personal brand to attract quality deals

- Create visible channels for deal flow

- Focus on vetting founders more than business models

- Evaluate product-market fit and scalability

- Assess competitive advantages and market gaps

A crucial aspect of deal sourcing comes from building a strong personal brand. This doesn’t require complex strategies – simply helping others and sharing knowledge consistently can establish expertise and attract opportunities.

Risk Management and Due Diligence

While the potential rewards are significant, SEO angel investing carries risks. Not every investment succeeds, particularly with pre-product-market fit businesses. Smart investors follow these guidelines:

- Invest only what you can afford to lose

- Focus on businesses with proven traction

- Thoroughly vet founder backgrounds and capabilities

- Look for “numbers founders” who understand metrics

- Evaluate market size and growth potential

The most successful investments often come from founders who have skin in the game, previous experience, and a mathematical understanding of their business model.

Maximizing Investment Success

Active involvement remains crucial after making an investment. Successful SEO angel investors:

- Deliver on promised expertise and support

- Provide strategic guidance when requested

- Facilitate valuable network connections

- Monitor and support growth initiatives

This engagement not only improves investment outcomes but also enhances your reputation in the investment community, leading to better future opportunities.

Frequently Asked Questions

Q: How much capital is needed to start SEO angel investing?

Unlike traditional angel investing, SEO angel investing can start with minimal capital. The primary investment often comes in the form of expertise, knowledge, and resources rather than money. Some successful investments require no upfront capital at all.

Q: What types of businesses are best suited for SEO angel investing?

The ideal candidates are established businesses with proven product-market fit, existing revenue streams, and clear growth potential through SEO. This includes SaaS companies, e-commerce stores, professional service firms, and local businesses with strong online potential.

Q: How long does it typically take to see returns on SEO angel investments?

Return timelines vary significantly based on the business and market conditions. Some investments may show results within months through improved organic traffic and sales, while others might take years to reach an exit event. The key is maintaining a diversified portfolio approach.

Q: What skills are most valuable for successful SEO angel investing?

Beyond SEO expertise, successful investors need strong due diligence abilities, network building skills, and business acumen. Understanding market dynamics, valuation methods, and founder assessment are crucial components for making sound investment decisions.