KARACHI:

The external economy of Pakistan, which is a net oil importer, is gaining momentum with a 20% drop in global crude prices since hitting the recent peak, as the lower cost helps slash the import bill, build foreign currency reserves and improve the foreign debt repayment capacity.

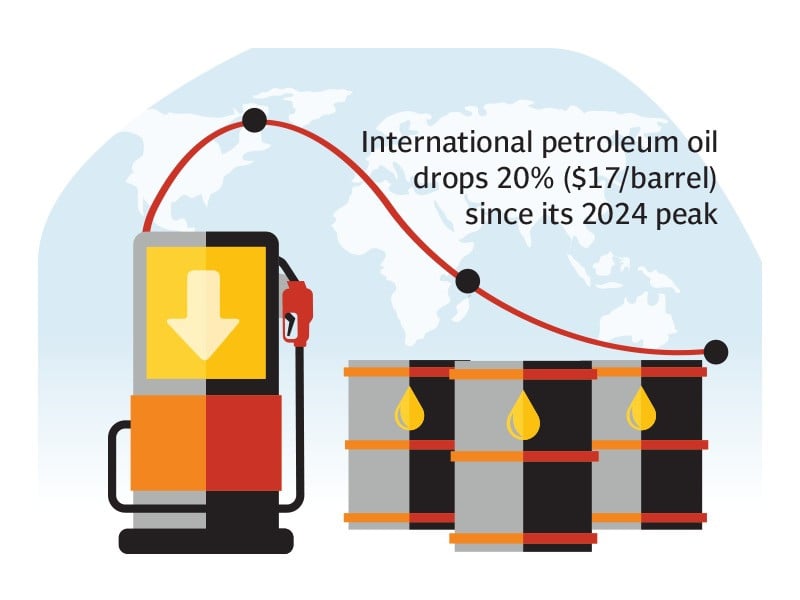

In a comprehensive report titled “Oil price downturn – a familiar safety net,” JS Global research house reported that the international crude oil prices had cumulatively dropped 20% (or $17 per barrel) to a 15-month low at $72.9 since hitting the peak at $91.17 in April 2024.

The low oil prices, however, may prompt the government to increase the petroleum development levy by Rs10 per litre on the sale of petrol and diesel. With the increase, the levy will reach Rs70 per litre, aimed at meeting the collection target of Rs1.28 trillion in the current fiscal year.

A prolonged slump in the global oil market, which is not the case at present, will impact the inflow of workers’ remittances as a large number of expatriate Pakistanis live in the oil-rich Middle Eastern countries.

JS Global Head of Research Amreen Soorani said in the report that a $5-per-barrel drop in oil prices would reduce Pakistan’s annual import bill by $900 million and slash the annual inflation rate by 35 basis points. On the other side, it provides room for an increase in petroleum levy to support the fiscal balance.

The crude oil has declined by 20% since reaching its peak in early 2024 due to increased supply, higher inventories and weaker demand. This benefits Pakistan, which is a net importer, as oil plays a pivotal role in two most critical economic indicators.

One, petroleum imports account for 30% of total imports and 55% of total export proceeds, meaning that it is a significant driver behind narrowing the trade deficit. Second, oil prices directly impact the transport segment in the inflation basket and any decrease in rates slows down the pace of inflation.

Soorani pointed out that Pakistan’s current account deficit had been relatively controlled on the back of a reduction in the trade deficit to 11-month low in August 2024 and 4% year-on-year contraction in the first two months of FY25.

“The decline is largely contributed by prioritising essential imports and reduced demand in the current macroeconomic landscape,” she said.

Trade data for July 2024 indicates that crude oil and petroleum products were purchased at an average of $83 per barrel, where global prices decreased by 12% ($10 per barrel) from those levels.

“Decrease in the realised oil import prices will positively impact the import bill, potentially reducing our CAD (current account deficit) estimate for FY25 by $800 million (0.2% of gross domestic product – GDP),” the analyst said.

“A drop of $5 per barrel reduces the annual import bill by $900 million (0.25% of GDP), which is almost 10% of our existing SBP (State Bank of Pakistan) foreign exchange reserves of $9.4 billion.”

Lower imports and increase in reserves are welcome at a time when the available foreign exchange reserves provide import cover for less than two months and “the country is burdened with $22 billion of debt obligations for FY25 – dependent on rollover commitments of $12 billion and new lending of $10 billion,” Soorani commented.

There could be a potential counterbalancing effect of lower oil prices on workers’ remittances. Since 55% of Pakistan’s remittances originate from the Middle East – a region heavily reliant on oil income, any prolonged decline in crude prices could negatively impact the economies of these countries and hence weaken the remittance flows.

“However, historical data suggests a weaker correlation between oil prices and remittances, reducing the possibility of any notable impact,” she said.

The government may seize the opportunity provided by the low international oil prices to increase the petroleum development levy by Rs10 per litre (4% of the present petroleum product prices) to the upper limit of Rs70 per litre, helping offset the shortfall in levy collection due to sluggish oil sales, she added.

The softening oil prices have begun to contribute to the benchmark Consumer Price Index (CPI)-based inflation reading, with a 5% reduction in petroleum product prices in the country in the last six months.

The disinflationary trend, which has brought the CPI back to single digit after three years, is one of the major reliefs, resulting in initiation of a monetary easing cycle after four years.

“We expect the FY25 average CPI to clock in at 9%; lower oil prices may lead to a slight revision in our estimate as the transportation segment comprises only 6% of the CPI basket.”

Any second-round impact may remain limited as witnessed in the historical trend, Soorani added.