- The Central Bank of Kenya (CBK) licenced an additional 27 digital credit providers (DCPs) to operate in September 2024

- In June 2024, CBK approved the operation licence of seven DCPs after subsequent licensing in January and in 2023 following an application from 730 companies

- However, speaking to TUKO.co.ke, cyber and information security consultant Allan Lwala warned Kenyans to be careful since most loan apps are prone to attacks

TUKO.co.ke journalist Wycliffe Musalia has over five years of experience in financial, business, and technology reporting and offers deep insights into Kenyan and global economic trends.

Digital Credit Providers (DCPs) allowed to operate in Kenya have increased in number to 85.

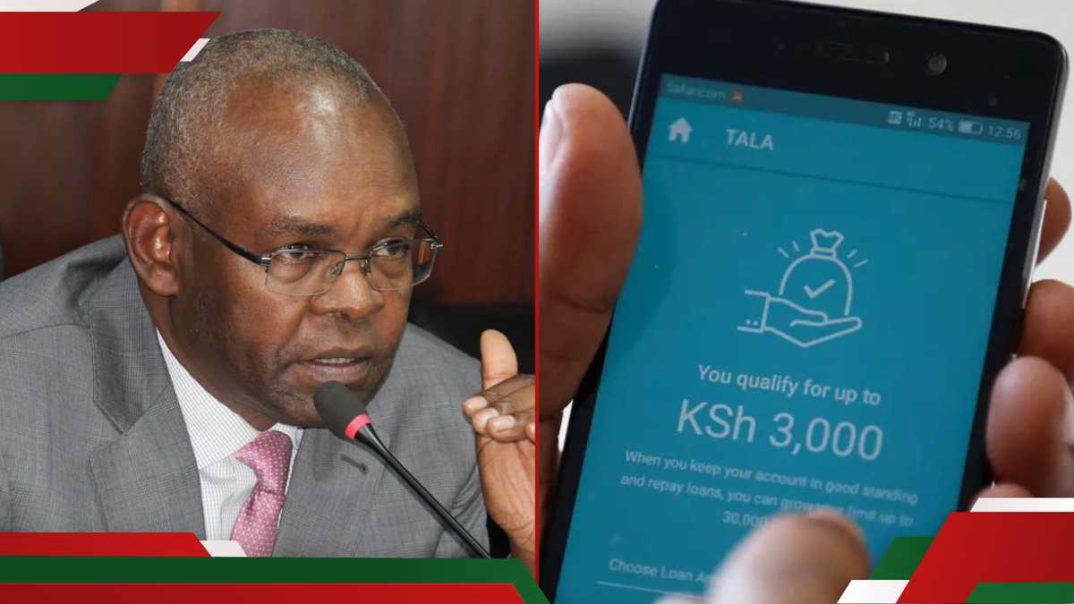

Central Bank of Kenya (CBK) governor Kamau Thugge speaking at a past meeting. Photo: Parliament of Kenya.

Source: Facebook

The Central Bank of Kenya (CBK) approved an additional 20 DCPs in September 2024 after licensing seven more in June 2024.

Read also

David Ndii defends KSh 104b SHIF IT tender: “Value for money”

Why CBK is regulating mobile loan apps

CBK said the 27 additional mobile loan providers are among the 730 lenders who applied for licensing in 2023 and have yet to receive approval.

“The Central Bank of Kenya (CBK) announces the licensing of an additional 27 Digital Credit Providers (DCPs). This brings the number of licensed DCPs to 85 following the last licensing of seven DCPs as announced in June 2024,” CBK explained in a press statement on Tuesday, October 1.

As the number of DCPs licensed to operate grows, Kenyans have been urged to be vigilant about loan apps.

Speaking exclusively to TUKO.co.ke, cyber and information security consultant Allan Lwala warned Kenyans to be careful since most loan apps are prone to attacks.

“Most digital loan apps are developed independently with no oversight or regulation. This means that there might be vulnerabilities in the code that attackers can exploit. These can lead to access to their systems and client information. Bad actors can then use this information however they please.

Read also

Central Bank of Kenya licenses 27 additional digital loan providers

“Your personal information is like a secret; once it is shared, it is no longer a secret,” Lwala explained.

CBK said the newly licensed DCPs submitted all the required documents, urging the remaining applicants to submit the pending documentation to enable completion of the review of their applications.

Which new mobile apps received CBK licence?

Below is the list of newly licensed loan apps:

| 1. Bytech Credit Limited | 14. Pesaglow Capital Limited |

| 2. Dreamlife Technology Limited | 15. Pesakuu Credit Limited |

| 3. Ellegant Credit Limited | 16. Phoenix Capital Limited |

| 4. Fahari Point Capital Limited | 17. Premier Credit Limited |

| 5. Fincorp Credit Limited | 18. Puphik Credit Limited |

| 6. Hela Capital Limited | 19. Radi Credit Limited |

| 7. Inspire Credit Limited | 20. Simplepay Capital Limited |

| 8. Lenana Innovative Solutions Limited | 21. Siti Mobility Technologies Limited |

| 9. LockBx Limited | 22. Sure Cred Capital Limited |

| 10. MCF 2 Kenya Limited | 23. Tanir Credit & Accounting Services Limited |

| 11. Momentum Credit Limited | 24. Tip-Point Capital Limited |

| 12. ODI Credit Limited | 25. Treasure Store Limited |

| 13. Opal Quick Limited |

Read also

Kenya Power issues update on experienced token message delay

How many mobile loan apps are in Kenya?

CBK shared the full list of the 85 licensed digital lenders here.

The CBK recently published the banking supervision report, which provides a holistic picture of the country’s financial sector.

CBK stated that it continuously engages with licensed DCPs and licence applicants to ensure adherence to the relevant laws.

Proofreading by Asher Omondi, current affairs journalist and copy editor at TUKO.co.ke.

Source: TUKO.co.ke