SINGAPORE – Against the backdrop of rising costs, the path to financial freedom can be daunting.

This is especially so for young millennials and Gen Zs who are trying to achieve financial stability while paying off big-ticket items such as housing and weddings, and caring for ageing parents.

In 2024, the youngest millennial will be 28 years old and the oldest Gen Z will be 27 years old, according to the Pew Research Centre.

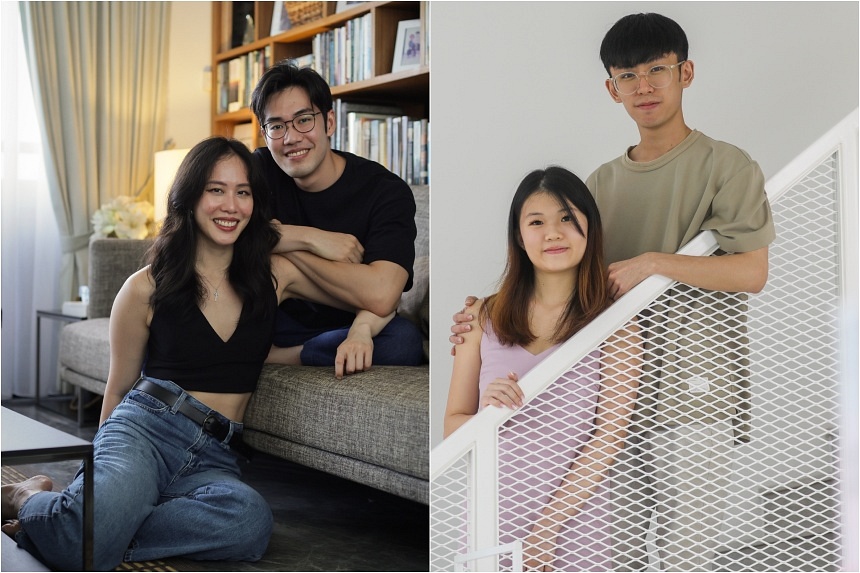

Mr Kermond Koh, 23, and Ms Winnie Yong, 22, are no strangers to some of these generational challenges.

The Gen Z couple have plans to get married and buy a home together but right now, their focus is helping their parents retire.

To achieve that, they aim to make $1 million by 2027 with a distributorship business they started in August 2022.

Ms Sara Wee, 31, and Mr Aaron Wee, 28 – who run the TikTok account @theweeblings0 with nearly 37,000 followers – are on a similar mission to hit the million-dollar mark in earnings and investment portfolio value by the end of 2026. They currently have multiple streams of income, including paid partnerships on social media.

Both pairs have unabashedly made their journeys to $1 million public on social media, listing every bit of their progress – business earnings and investment returns – for all to scrutinise, undeterred by potential scammers, kidnappers or saboteurs.

Their financial transparency and openness online reflects a broader quest for authenticity among the young, notes social media consultant Aaron Khoo. He was head of video at new media company SGAG and a co-founder of the now-defunct home-grown YouTube channel Tree Potatoes, which has more than 375,000 subscribers.

“Relatability and authenticity are the pillars of a strong social media personality. Part of that authenticity is sharing your story, your vulnerabilities and your ups and downs of life. Essentially, in order to be an authentic personality on social media, you shouldn’t be afraid to bare it all,” he says.

Dr George Wong, senior lecturer of sociology at Singapore Management University (SMU), does not see the act of chronicling wealth accumulation journeys online as either positive or negative, but rather, he questions the motivation – why young people see the need to do it.

“From a more cynical and critical point of view, this could be interpreted as a form of conspicuous display of financial literacy as cultural capital, by which the chronicling of their knowledge and experiences is seen as a way to ‘flex’,” he says. A slang term, “flex” means to showcase or boast.

“Yet, one could also see this as an exercise for validation. If there is something to be concerned about, it would be whether it is healthy to over-emphasise the seekingof external validation from social media on things like money matters, given that everyone’s journey is unique and often quite personal.”

Many of these young millionaire aspirants sharing their journeys online are proponents of the financial independence, retire early (Fire) movement, which became popular after a book titled Your Money Or Your Life, authored by Americans Vicki Robin and Joseph Dominguez, was published in 1992.