A WOMAN has revealed that she has made just under £1,500 on Vinted thanks to five simple tips.

Robyn Mort, a savvy side hustler from the UK, explained that people always make the same common mistake which is the reason why their items aren’t selling.

4

A Vinted seller has shared her top tips to making cash quick on the online marketplace appCredit: tiktok/@budgetingrobyn

4

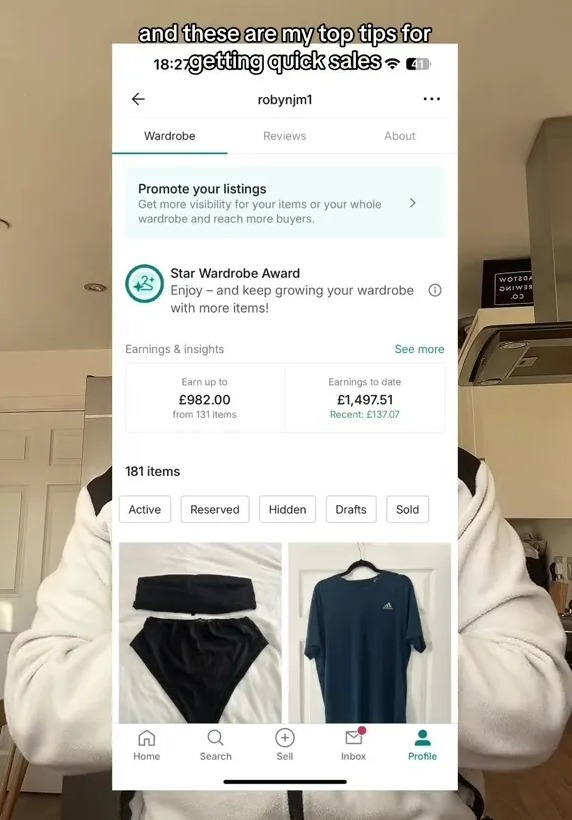

Robyn has made £1,497.51 by flogging her old clothes on VintedCredit: tiktok/@budgetingrobyn

4

She revealed the mistakes people make and the game changing hack she swears by for captionsCredit: tiktok/@budgetingrobyn

4

She also revealed the postage advice that is sure to make your sales soarCredit: AFP

Not only this, but the Vinted fan also shared the savvy hack she swears by for the best captions.

Sharing her advice on social media, Robyn posted her clip with the caption ‘My top tips for smashing it on Vinted! Whether you’re decluttering or looking for great deals, these hacks will help you sell faster!’

Thanks to the online marketplace app, Robyn has made an impressive £1,497.51, as she confessed: “I have made almost £1,500 on Vinted and these are my top tips for getting quick sales and making as much money as you can.”

First things first, Robyn explained that you mustn’t jump the gun and immediately accept low offers, as she stressed: “If you have only just put something up and someone offers you a ridiculous price, do not accept it.

“I know we’re all keen to make a quick sale and get rid of the items, no one wants clutter in the house, but if you’ve put something up for £20 just now, and someone’s offering you £14 or £15, don’t sell it.

“The likelihood is, someone’s gonna pay that price for it. I have so many items where I’ve had low offers constantly throughout the day and by the end of the day someone has just bought it outright for the price that I have it up for.”

Secondly, Robyn shared the common mistakes that people always make, as she added: “Put good pictures up. Don’t put something up that’s not ironed, that’s not washed, it’s got make-up on the collar, don’t bother saying that it’s got marks on it.

“Wash it yourself, get more money for it.

“I’ve seen so many people put photos up of unwashed items, who is buying that?”

In addition to this, Robyn revealed the trick she swears by for the best captions, as she continued: “This is a biggie – use ChatGPT to write your captions.

I’ve made over £333 on Vinted – the exact words to use & the 2 days you should be uploading to sell in under 24 hours

“One of the main ways that Vinted works is it needs you to give it as much information about your item as possible so it can push it to the people who are looking for that item.

“Yes we can write it relatively well – what colour is it, what size is it, what item is it, but ChatGPT will be able to give you a full right up with hashtags that are gonna do well.

New Vinted rules to be aware of

IF you fancy clearing out your wardrobe and getting rid of your old stuff on Vinted, you’ll need to consider the new rules that recently came into play.

If people are selling personal items for less than they paid new (which is generally the case for second-hand sales), there is no impact on tax.

However, since January 1, digital platforms, including eBay, Airbnb, Etsy, Amazon and Vinted, must share seller information with HMRC as part of a crackdown.

You’re unlikely to be affected if you only sell a handful of second-hand items online each year – generally, only business sellers trading for profit might need to pay tax.

A tax-free allowance of £1,000 has been in place since 2017 for business sellers trading for profit – the only time that an individual personal item might be taxable is if it sells for more than £6,000 and there is a profit from the sale.

However, firms now have to pass on your data to HMRC if you sell 30 or more items a year or earn over £1,700.

It is part of a wider tax crackdown to help ensure that those who boost their income via side hustles pay up what they owe.

While your data won’t be shared with HMRC if you earn between £1,000 and £1,700, you’ll still need to pay tax as normal.

“Honestly, it’s such a game changer.”

Not only this, but when it comes to sending out your items, the blonde-haired beauty recommended: “Make sure when you send things, you’re sending them in parcel bags, not ridiculous packaging.

“And in a good condition, I’m talking washed, lint rollered – no one wants dog fur all over it.

What photos you should upload

High-quality and clear images will help your items stand out on Vinted amongst a vast array of items available on the platform

Here are the five essential shots The Sun’s Rose O’Sullivan includes:

- Picture one: A clear shot of the front of the dress, gym set, trousers, etc

- Picture two: The back of the outfit

- Picture three: Photograph sleeve or pant length

- Picture four: Close-up of the stitching, or if any flaws on the item include zoomed-in shots of this too

- Picture five: If they are trousers, take pictures of lining, zips or buckles

“Your reviews matter. When I buy an item on Vinted, I look at the reviews of that seller. If they’re not good I’m not gonna buy from them.”

Finally, if you want to make cash by flogging your unwanted items, Robyn explained: “If you do want quick sales, I know it’s annoying but try and have more postage options on there.

Do you need to pay tax on items sold on Vinted?

QUICK facts on tax from the team at Vinted…

- The only time that an item might be taxable is if it sells for more than £6,000 and there is profit (sells for more than you paid for it). Even then, you can use your capital gains tax-free allowance of £3,000 to offset it.

- Generally, only business sellers trading for profit (buying goods with the purpose of selling for more than they paid for them) might need to pay tax. Business sellers who trade for profit can use a tax-free allowance of £1,000, which has been in place since 2017.

- More information here: vinted.co.uk/no-changes-to-taxes

“I have three shops on mine and there’s always one shop that I dread going to, but I get so many sales because people want that delivery option.

“So if you’re not getting many sales and you’ve literally only got InPost on, then you’re doing yourself a disservice basically.”

‘GREAT ADVICE’

The TikTok clip, which was posted under the username @budgetingrobyn, has clearly left many open-mouthed, as it has quickly racked up 17,900 views.

Social media users were thankful for Robyn’s advice and many flocked to the comments to express this.

One person said: “Great advice.”

Another added: “I didn’t know we could put hashtags!”

Whilst someone else commented: “I’ve made £5,000 from Vinted. Love it.”