Watch Insight’s episode The Boomer Economy, which explores how baby boomers are spending, and what will happen once all that wealth is handed down on

Angus is a city planner but at 64 years of age, he’s still paying off his mortgage and has virtually no superannuation.For many baby boomers, owning a home outright enables housing security in retirement.

But for him, that security seems out of reach.

“I’m not wealthy.. I’m dependent on my own business for income because there’s nobody else who will give me a job,” Angus told Insight.

“At this stage, best projections are I’m going to have to work till 75 to pay off the mortgage and other debt.”

‘One illness away from homelessness’

With retirement looming and less than $3,000 in his superannuation, Angus is unsure how he will support himself.“I have no security in my future … I’m one illness away from homelessness.”There’s a stereotype of cashed-up boomers retiring with a bountiful super balance and portfolio of investment properties.

But Angus says this image doesn’t apply to people like him.

So, how did Angus get to this point?“Two very expensive divorces,” he said.“At one stage, with my first marriage, we had an investment property and a share portfolio.

“I lost both the investment property, the house and the share portfolio … and came out with negative net worth.”

Selling investment properties ‘at a loss’

Divorce isn’t the only potential detractor after a lifetime of work.When 10 years ago, Craig Doyle, now 61, was advised to convert the funds into “Supposed to be easy, perceived as secure,” Craig told Insight. In total, Craig’s portfolio contained five properties, with a net worth of around $3 million.

However, his financial position was far from secure.

Craig Doyle and his wife have delayed their retirement due to losing money on their investment portfolio. Source: Supplied

In fact, each property was creating more debt than profit due to mortgage costs, interest rate rises, rental freezes, land taxes, upkeep costs and a stagnant apartment market.“We were losing $15,000 a quarter funding our investment properties over the last nearly three years,” Craig said.He made the tough decision to sell off his properties — his retirement fund — one by one.

“We sold most of our properties at a loss,” he said.

Not all boomers are wealthy

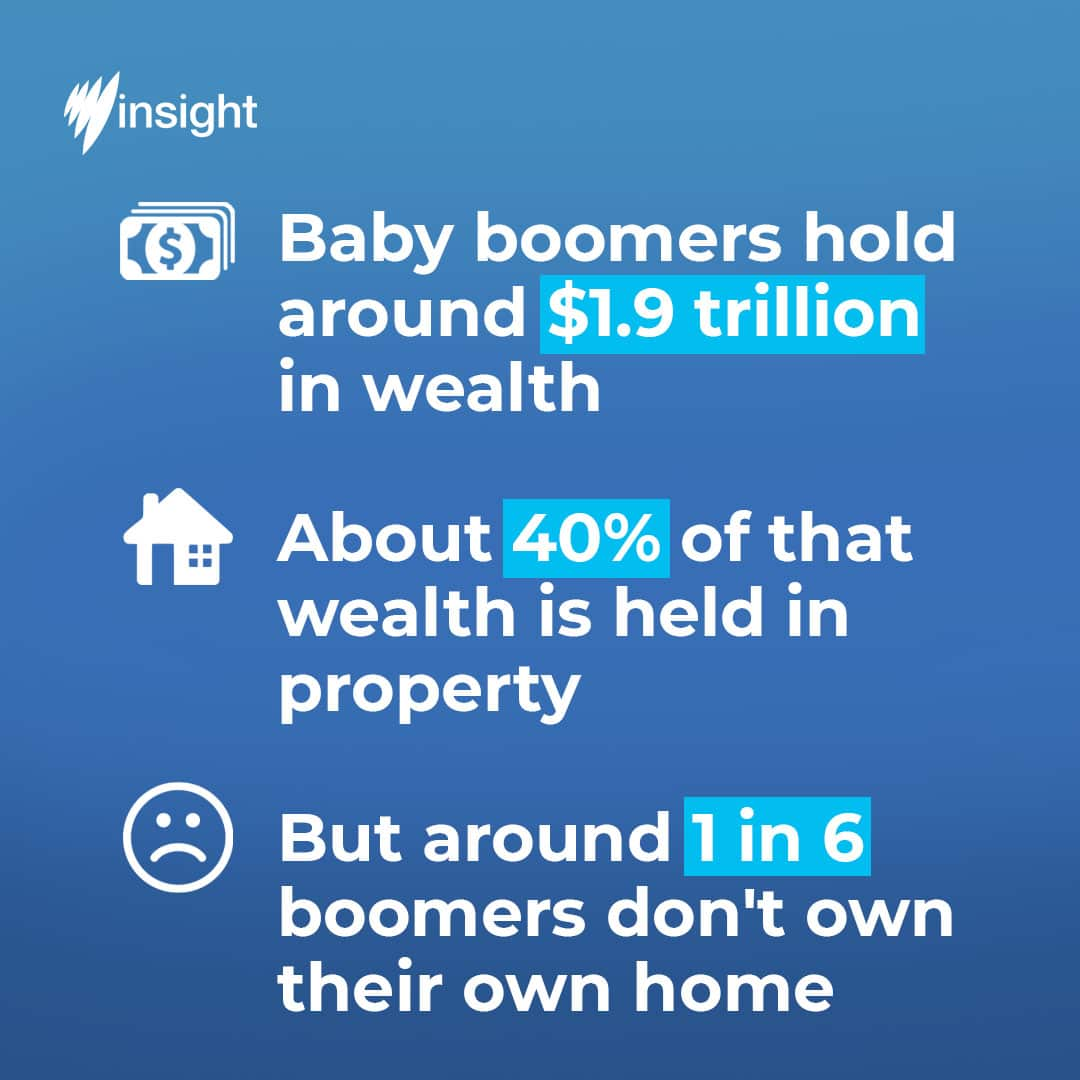

Associate professor Myra Hamilton at the University of Sydney researches Australia’s ageing population and issues impacting the baby boomer generation.“The idea of the wealthy generation is not the reality for some baby boomers,” Myra told Insight.

“About one in six baby boomers don’t own their own home.”

While much of the baby boomer generation’s wealth is tied up in property, around one in six boomers don’t own their own home.

Myra says women aged 55 and over are one of the fastest growing groups of people facing homelessness, partly due to barriers in the workforce.“There is a burgeoning number of people in their 50s and 60s in receipt of [the] JobSeeker allowance.

“So this issue of homogenising the generation, actually really conceals the group of baby boomers who aren’t represented in this idea of the wealthy boomer.”

Source: SBS

Economist Evan Luca says that, while there is a generational wealth disparity, boomers have seen a considerable amount of favourable policy in their lifetime.Superannuation, capital gains tax and have all contributed to boomers holding an estimated $1.9 trillion in wealth.“To put that into consideration, that is a tick shy of the entire wealth of the Australian ASX 200. So that’s all the big four banks, Telstra, Woolworths — take your pick — it’s about $2.1 trillion, and boomers are worth $1.9 trillion,” Evan told Insight

And about 40 per cent of that wealth is held in property, he said.

Dying without debt

While the ‘Bank of Mum and Dad’ is a frequent enabler of boomers’ children entering an otherwise unaffordable property market, Angus says he doesn’t even have enough money to support himself.“I wish was something I was able to do,” Angus said.Unable to retire any time soon, he has had to rely on his children for financial support at times.“I feel as though the best outcome now is leaving my children without debt,” he said.“I don’t want to burden my kids with that.”And for more stories head to , hosted by Kumi Taguchi. From sex and relationships to health, wealth, and grief Insightful offers deeper dives into the lives and first-person stories of former guests from the acclaimed TV show, Insight.Follow Insightful on the , , , or wherever you get your podcasts.

Originally Appeared Here