Ogden • At around noon on a sunny spring afternoon, the halls and lobby of the bright industrial office building in west Ogden teem with people in Lycra cycling clothes, walking their carbon-framed bikes among visitors and office employees in workplace attire, some daring to mount the cycles and ride them over the smooth concrete floor.

It’s lunch time at ENVE, the Utah bicycle manufacturer with a cult-like following among avid cyclists.

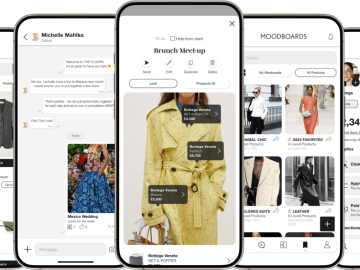

Many of ENVE’s employees are also the company’s target client: Cycling enthusiasts, including some retired professionals, who obsess over their gear and seize any free moment to log some miles.

The “lunch ride” is part of ENVE’s daily rhythm. The rest of the day, a wall tucked away past the lobby is full of bikes employees have ridden to work or will ride again at lunch tomorrow.

ENVE was founded in Ogden in 2007 and has maintained its headquarters in northern Utah ever since. But the brand is back in local hands after eight years under the Amer Sports umbrella. Amer, the Finnish sports conglomerate that also owns such brands as Arc’Teryx, Salomon and Atomic, sold ENVE to Utah private investment firm PV3 in April.

(Trent Nelson | The Salt Lake Tribune) Employee bikes at ENVE’s Ogden facility on Tuesday, May 28, 2024.

Private capital buyouts can sometimes foretell doom for businesses facing financial hardship — and ENVE did face some hardship, said Mike Stimola, the company’s general manager. The bike industry as a whole is still climbing out of a COVID-induced valley.

But ENVE has bounced back. Stimola, who joined the company in January, said this is a new chapter for the niche cycling brand — one that brings it back to its local roots while, ideally, giving it room to grow.

The new owners, Stimola said, “plan on owning this forever. … They’re passionate about ENVE, they’re passionate about Utah. The goal is to keep [ENVE] in Utah.”

PV3 Principal Mark Hancock is an avid cyclist himself and a personal fan of the brand, he told The Tribune. He has owned three ENVE bikes — two road, one gravel — and knows several people who have worked for the company, including his son, who worked there as a high school student.

ENVE is a “world-class” brand at the “center of excellence for research, design and engineering,” Hancock said. His firm’s objective is to keep it that way.

“I know in the years to come, we’re going to hear more and more about ENVE,” Hancock said. “It’s already recognized all over the world. It should be recognized here in our hometown.”

Under one roof

Almost all of ENVE’s operations, from engineering to manufacturing to sales and marketing, happen in one 80,000-square-foot Ogden building. The company manufactures some components overseas and has a distribution center in France for European orders — but this Ogden factory houses most of ENVE’s business.

The work that requires a desk and a computer — sales, human resources, engineering, marketing — happens upstairs. Downstairs, however, is where the magic happens.

ENVE moved into this building in 2016 and retrofitted every inch to meet the brand’s specific needs, said Neil Shirley, ENVE’s marketing director and a former racer on ENVE’s cycling team.

Unlike some manufacturers nearby, ENVE is not concerned with mass production. Instead, it is obsessed with precision.

“We make a very niche product — it’s very technical, very precise,” Stimola said. “We’re highly focused on one little niche. That’s all [ENVE] does, and it beats the daylights out of it every day.”

(Trent Nelson | The Salt Lake Tribune) Neil Shirley looks at limited edition carbon fiber bike frames in the paint shop at ENVE’s Ogden facility on Tuesday, May 28, 2024.

What he means is: Most of what happens in the factory is wheel rim production. ENVE started making custom carbon frames three years ago, and builds other components, such as seat posts and handlebars; but wheels are the company’s bread and butter. To build a wheel, from scratch and raw carbon, is precise work.

Oscar Gorritti would know. He has shaped close to 100,000 rims, by his estimate, in his 19 years at ENVE.

“And I’m as committed as I was the first day,” he said.

Gorritti spends 10 hours a day, four days a week (an employee perk, Stimola said, that gives factory employees three-day weekends) in the “layup room,” the first and most fundamental stop on the journey from raw carbon fiber to carbon rim.

The carbon fiber is delivered in massive rolls directly to a walk-in freezer — so the resin (the carbon sheets come pre-glued) doesn’t melt or set.

ENVE rims are made from mostly unidirectional carbon fiber, which means all of the fibers run in the same direction. It’s a common material among cycling manufacturers because it’s strong and durable. But carbon’s true strength is determined by how it is layered and the angles in which it is assembled, Shirley said. It is up to the people in this room, plus a team of engineers upstairs, to know how to mold these carbon sheets so that they are strong, stiff and lightweight.

“It’s meticulous and highly-skilled work,” Shirley said.

Shirley said it takes around six months of training just to become “adept” on the assembly line. Most of the employees in the layup room — around 70%, by Shirley’s estimation — have been around for at least 10 years.

The sheets are laser-cut into individual pieces. Each is given a serial number, so workers down the assembly line know exactly what it’s for and where it goes. Once the carbon is shaped and assembled into a rim, the technician responsible for it signs it with their name. It’s a point of pride for ENVE employees, Shirley said — and a personal touch for cyclists.

(Trent Nelson | The Salt Lake Tribune) Longtime ENVE employee Oscar Gorritti assembles a carbon fiber rim at the company’s Ogden facility on Tuesday, May 28, 2024.

Once the rims are assembled, they cook “like a pizza” in an industrial oven — 20-to-30 minutes at between 400 and 450 degrees Fahrenheit, Shirley said. The heat and pressure cure and harden the carbon.

Next, Shirley said, rims take a spin in the “finishing robot” — a machine that cleans and polishes the rims, removing any extra resin and texture. It’s one of the only automated steps in the process, Shirley said. Nearly everything else happens by hand.

The rims’ final stop is at a workstation in the quality control department, where each will be closely inspected, weighed and measured. If a rim passes the test, it will join hundreds of other rims on the wall of racks until a cyclist or a bike shop places an order. ENVE will assemble the rims into full wheels for domestic clients; their European distribution center will finish building out the wheels for overseas orders, using the same process and technology.

Down the hall is a large, garage-like space that does not require safety equipment but Shirley called the “heart of the place.” It’s the first stop on a tour of the facility and one of the first, and most essential, in ENVE products’ lives. ENVE works directly with its sponsored athletes to come up with new designs and technologies — and it’s here, in this garage-like space, those ideas are born and evaluated. (There is also a test lab upstairs, where components are put through the wringer.)

It is, perhaps, nontraditional for a company to keep its manufacturing facility under the same roof as its professional offices, and keep most of it in the United States, Shirley said. Domestic bike manufacturers are the underdogs of the industry; less than 1% of bikes sold around the world are made in the United States, according to industry analysts. Most are made in China and Taiwan, where labor is cheaper and companies can mass-produce.

But ENVE is in the business of speed, and keeping its operations together allows for efficiency it could not otherwise achieve. ENVE employees and athletes can conceive of a new idea together, build it and test it in the prototype room in a matter of days. If any part of that process happened overseas, Shirley said, it would take months.

“There’s nothing [that happens] here that can’t happen elsewhere,” he said. “But it’s really helpful to be under one roof. It allows for flexibility, and for us to make quick changes.”

Its niche focus has also helped ENVE stay afloat through a turbulent four years.

The bike ‘bubble’

The bike industry as a whole is riding against some major headwinds in the wake of a pandemic-fueled bike boom, when COVID created a perfect storm of cycling enthusiasm with which the industry could not keep up.

At first, the closures brought about by the pandemic shut down many retailers and interrupted the supply chain for parts and materials. But the pandemic also birthed a massive wave of new or returning cyclists, Stimola said, who took up the sport as a way to get outside and stay active while gyms were closed and social distancing prevailed. Suddenly, everyone was buying bikes.

The bike “bubble,” as Stimola called it, was buoyant and beautiful — but then it popped. Retailers and manufacturers couldn’t keep up with demand in an already-altered supply chain. Wholesale orders for bikes and parts were taking months, at best, to fulfill.

“You could sell more , but it was hard to get it,” Stimola said.

So bike retailers and manufacturers over-ordered. Then all of those orders came in at once, and suddenly, they had a surplus.

ENVE, though, stayed out of that bubble, Stimola said. Its customers aren’t new cyclists; they’re devoted riders who can shell out the extra money for a premium product. ENVE wheels start at around $1,100. A more economic wheel from a major retailer, like REI or Evo, can cost as little as $70.

“It costs a lot of money to make this product,” Stimola said. Customers know that, and are willing to pay the premium, he said.

(Trent Nelson | The Salt Lake Tribune) Photographs of employees at ENVE’s Ogden facility on Tuesday, May 28, 2024.

So ENVE’s sales did not skyrocket during the height of the pandemic. ENVE’s “core customers, core employees and core product” buoyed the company as much as they could, Stimola said.

Still, disruptions in the supply chain and general economic uncertainty took their toll on the small company. It had to offload some excess inventory. It also had to offload some people, Stimola said.

It was “painful,” Stimola said. “We got off-track during COVID.”

Amer Sports went public on the New York Stock Exchange in February, shortly before selling ENVE. In financial disclosures, ENVE’s revenues were too small to report on their own; they are grouped with ski maker Armada, and the two companies collectively accounted for roughly 3% of Amer’s revenue in 2023. Their revenue decreased, too, while revenue for such companies as Solomon and Atomic grew.

But ENVE is “back in growth mode,” Stimola said. Its staff has grown again, from the roughly 110 it was left with after layoffs to around 130.

“The business is in a really good place now,” Stimola said. “And it’s kind of a testament to the fact that the product is amazing, the people are amazing. … You can fix the business. You can’t fix the people. You can’t fix the product.”

Stimola said he feels good about PV3′s ownership, and excited to put the company back in local hands. The new owners are aligned with the company’s goal to, essentially, do “more of the same” and make “incremental progress,” Stimola said.

The new owner agrees.

PV3 won’t have much of a hand in ENVE’s day-to-day operations, Hancock said. It just wants to support the work that’s already happening.

“It’s now a standalone business,” Hancock said. “We’re supporters of theirs. It’s an incredible local team… I’m proud to be able to support them.”

Hancock said he feels lucky to get in when he did. He wasn’t the highest bidder; but he was the most enthusiastic. And he is local.

Hancock said he understands how loyal ENVE’s customers are, because he was one. Its employees, too, are passionate about the brand.

The “little company” in Ogden has a big name, Hancock and Stimola both said in separate interviews. Its name has reached distant corners of the world on race team jerseys and products distributed “everywhere.”

“It’s amazing for a little company,” Stimla said. “It’s a really unique situation to be in … It is really cool. It’s really cool.”

(Trent Nelson | The Salt Lake Tribune) Bikes at ENVE’s Ogden facility on Tuesday, May 28, 2024.

Shannon Sollitt is a Report for America corps member covering business accountability and sustainability for The Salt Lake Tribune. Your donation to match our RFA grant helps keep her writing stories like this one; please consider making a tax-deductible gift of any amount today by clicking here.