Unsurprisingly, companies looking to generate value from personal data have been racing to acquire AI start-ups.

Image: Shutterstock

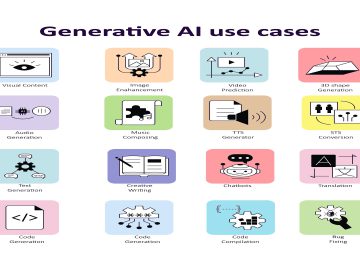

The latest advances in artificial intelligence offer companies unprecedented opportunities to become more customer centric. As University of Virginia Darden School of Business Professor Rajkumar Venkatesan expounds in his recent book, The AI Marketing Canvas: A Five-Stage Road Map to Implementing Artificial Intelligence in Marketing, AI can help companies create and deliver superior customer value through personalized products and services.

Amazon, for example, strives to be the most customer-centric company on the planet by creating the best online shopping experience. Based on the vast trove of personal data it collects, Amazon leverages AI and machine learning to improve the matching of products with consumers and deliver recommendations tailored to their unique needs and preferences.

Unsurprisingly, companies looking to generate value from personal data have been racing to acquire AI start-ups. “Acquisitions,” says Venkatesan, “can be an effective growth strategy, because they allow firms to obtain AI capabilities faster than developing them in-house.”

Since 2010, AI acquisitions have been growing at a compound annual growth rate of 44%, with tech giants like Facebook, Amazon, Microsoft, Google, and Apple leading the way, according to a report from CB Insights.

Growing Privacy Concerns Spur Regulations

To deliver personalized experiences and tailored recommendations that increase customer satisfaction and loyalty, customer-centric AI technologies rely on vast amounts of customer data, which raises concerns about privacy and the ethical use of personal information.

Policymakers respond to such concerns with new laws and regulations. For example, in 2016, the European Union enacted the General Data Protection Regulation (GDPR), a law mandating that firms manage customer data according to a set of principles and safeguards, including obtaining consent from customers before using their data.

GDPR has achieved the intended outcome of strengthening individual rights. However, as Venkatesan points out, it has also had unintended negative consequences.

Research shows that under privacy regulations, firms are directing resources away from AI initiatives. There’s evidence that GDPR negatively affects technology venture investments, hurting European start-ups. For example, between May 2018 and April 2019, the overall venture funding for EU tech firms decreased by $14.1 million per month per member state, according to a paper published in Marketing Science.

This decline could be driven by concerns that under privacy laws, AI algorithms would have less accurate predictions about customer needs and result in lower returns from AI investments.

Those developments prompted Venkatesan and his collaborators from Texas Tech University and the University of Manitoba to investigate the changes in returns from AI-related acquisitions for firms exposed to GDPR. Using a uniquely compiled dataset of 432 AI acquisitions made by 312 US and European firms, Venkatesan specifically looked at how privacy regulations affected deal size and systematic risk of firms making AI investments. He presented his findings in the working paper, “Influence of Privacy Regulation on Customer-Centric AI Acquisitions: Case of GDPR.”

Also read: How AI could potentially manipulate consumers

Privacy Regulations Boost Consumer Trust

Venkatesan’s study found that, on average, deal size is lower and systematic firm risk is higher for firms exposed to GDPR that make AI acquisitions after the rollout of GDPR.

Contrary to conventional wisdom, Venkatesan’s research also showed that, for firms making investments in AI capabilities around customer centricity, deal size is higher and the firm risk is lower in the presence of GDPR. The customer-centric focus of the AI technology being acquired seems to alleviate the negative impact of GDPR on deal valuation and weaken the impact of GDPR on the systematic risk that investors perceive to originate from the AI acquisition.

Venkatesan also discovered that trust is a critical mechanism that enables increased returns on customer-centric AI investments. Through a lab experiment, Venkatesan and his collaborators demonstrated that privacy regulations increase consumer trust — and the willingness to share personal information — with brands that comply with those regulations.

By showing why the decrease in AI investments following the rollout of GDPR may be myopic, Venkatesan’s research can help not only firms investing in AI technologies, but also the innovative AI start-ups that are being acquired.

Regulators may also find Venkatesan’s research relevant. It could help them convey to the venture capital industry the increased financial benefits of privacy regulations for AI acquisitions that prioritize customer experience and protect customers’ personal information.

Privacy Management Matters

Privacy management is becoming a cornerstone of customer-centricity, which relies on extensive use of AI and data, notes Venkatesan. His latest research offers evidence that privacy regulations can benefit not only consumers but also companies deploying innovative AI solutions. By enforcing strict rules on how companies manage personal data, privacy laws like GDPR increase consumer trust in brands by reducing the perceived privacy risks associated with sharing their personal information.

According to Venkatesan, trust is a critical aspect of AI adoption and usage. “AI has a trust deficit with the general public,” says Venkatesan. “The government has a role to play in building that trust by enacting policies that give consumers rights to their data and recourse against its misuse.”

Darden Professor Rajkumar Venkatesan co-authored “Influence of Privacy Regulation on Customer-Centric AI Acquisitions: Case of GDPR” with S. Arunachalam of Texas Tech University’s Rawls College of Business and Kiran Pedada of the University of Manitoba’s Asper School of Business.

]]>

[This article has been reproduced with permission from University Of Virginia’s Darden School Of Business. This piece originally appeared on Darden Ideas to Action.]