Palantir Technologies (PLTR 3.92%) has been one of the hottest stocks on the market in 2024, logging amazing gains of 319% as of this writing. The company’s artificial intelligence (AI) software platform has been in terrific demand from customers and governments looking to integrate generative AI into their data analysis.

Palantir’s revenue growth accelerated in recent quarters, and its sizable revenue pipeline suggests that it could maintain that momentum in 2025 as well. However, there is one problem with Palantir stock right now — its valuation. The stock trades at a whopping 67 times sales and 372 times trailing earnings.

This makes it clear that Palantir is no value stock. More importantly, the AI software specialist will have to continue exceeding Wall Street’s expectations quarter after quarter to maintain its red-hot stock market rally. Palantir’s valuation is now so expensive that the stock’s median 12-month price target of $38, as per 20 analysts, points toward a 48% downside from current levels.

The good news for investors looking to capitalize on the booming generative AI software market is that there is a much cheaper alternative to Palantir that they can consider buying right away.

C3.ai taps into the fast-growing enterprise AI software market

C3.ai (AI 3.16%) stock’s returns this year are nowhere near Palantir’s, but that’s good news for investors as it can be bought at a much cheaper valuation. But more importantly, C3.ai’s growth in the second quarter of fiscal 2025 (which ended on Oct. 31) shows that it can match Palantir’s financial growth.

C3.ai released its latest quarterly results on Dec. 9. The company’s revenue increased an impressive 29% year over year to $94.3 million, which was well above the consensus estimate of $91 million. Additionally, C3.ai’s bottom-line loss shrank to $0.06 per share from $0.13 per share in the year-ago period. Analysts were expecting a bigger loss of $0.16 per share.

The important thing worth noting here is that C3.ai’s growth has been improving at an impressive pace in recent quarters. For example, the company reported a 17% year-over-year increase in revenue in the year-ago quarter, while its top line was up 21% year over year in the first quarter of fiscal 2025. This acceleration in C3.ai’s growth can be attributed to an increase in the number of customer agreements that the company is signing.

More specifically, C3.ai struck 58 customer agreements last quarter, which was almost in line with the 62 agreements it struck in the same period last year. However, C3.ai managed to win more business from existing customers. As pointed out by CEO Tom Siebel on the latest earnings conference call, the company has entered new and expanded agreements with ExxonMobil, Coke, Dow, Holcim, Shell, Duke Energy, Boston Scientific, Rolls-Royce, Cameco, Mars, ESAB, and Flex and Worley, among others.

C3.ai’s AI software offerings are gaining traction among federal customers as well. The company has entered into new and expanded agreements with the U.S. Department of Defense, U.S. Air Force, U.S. Navy, U.S. Army, U.S. Marine Corps, the Defense Logistics Agency, and the Chief Digital Artificial Intelligence Office, among others.

C3.ai was also engaged in 36 pilot projects last quarter. So there is a good chance that it could win more contracts going forward and keep growing at a healthy pace. The company has also raised its fiscal 2025 guidance and now expects to end the year with $388 million in revenue at the midpoint, up from the earlier midpoint of $382.5 million.

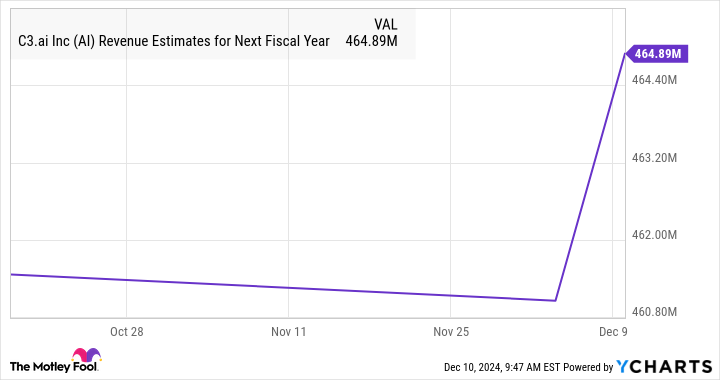

The updated revenue guidance means that the company is on track to finish the current fiscal year with revenue growth of 25%, though that figure can move higher if it can convert more of its pilots into actual customers. For comparison, C3.ai’s top line increased by 16% in the previous fiscal year. More importantly, analysts have significantly raised their revenue expectations from the company for next year as well.

AI Revenue Estimates for Next Fiscal Year data by YCharts

The valuation makes C3.ai stock a solid buy

We have already seen how expensive Palantir stock is right now at 67 times sales. C3.ai, for comparison, is trading at a much lower price-to-sales ratio of 15. Another thing worth noting is that Palantir’s revenue in the previous quarter increased by 30% year over year. So C3.ai isn’t lagging far behind in its pace of growth.

Moreover, C3.ai’s full-year revenue growth forecast is in line with the growth that Palantir is expected to deliver in 2024. Of course, Palantir is a much bigger company, but investors will have to pay a significantly richer valuation if they want to buy it. So investors who missed out on Palantir’s remarkable surge this year can still consider buying C3.ai.

The stock could deliver healthy gains — assuming C3.ai generates $465 million in revenue next fiscal year (as we saw in the chart earlier) and the market decides to reward it with a higher sales multiple thanks to its improving growth profile and the premium that its fellow AI software specialist is commanding.

Assuming C3.ai is trading at even 20 times sales at the end of the next fiscal year, its market cap could hit $9.3 billion based on the revenue estimate discussed above. That would be a 94% jump from current levels. Even a sales multiple of 15 would translate to a $7 billion market cap, which would be a 46% increase from current levels.

Investors looking to add an AI stock to their portfolios that’s significantly cheaper than Palantir but is matching its growth can definitely take a closer look at C3.ai as it seems poised for a solid 2025.