“I still remember it took about three months to get those first 1,000 subscribers. But then it took off and by the time it was a year, we touched 1 lakh subscribers. And during Covid, when everyone was locked up, traffic really picked up.”

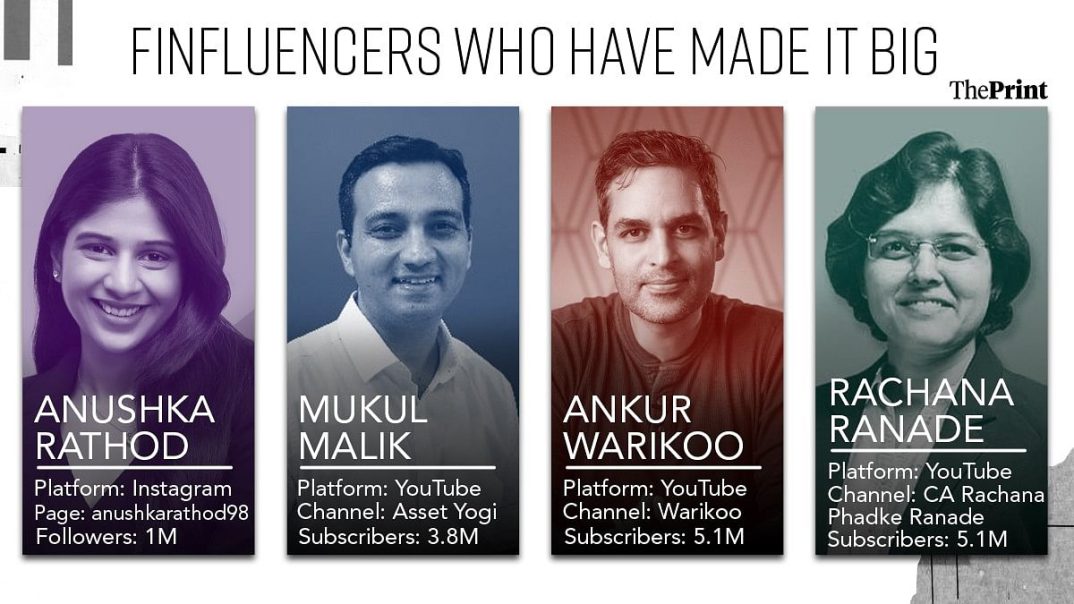

Today, Malik has 3.85 million YouTube subscribers, and counting.

He is one of a growing tribe of ‘finfluencers’ who are influencing investment decisions by dishing out financial advice on social media through short videos on everything from stock market investing and mutual funds to personal finance and taxes.

And they’re also making money themselves while they’re about it.

Financial influencers have become popular in the past five years largely because of the stock market boom that has pushed millions of Indians onto the investment bandwagon, often for the first time. But the big reason people have ditched traditional financial advisers and bankers in favour of social media was the Covid lockdown. During the pandemic, people were locked in their homes and had a lot of time to invest in the markets.

Suddenly, not just financially savvy investors but many people who had been wary about the market also jumped in.

“During Covid, influencers became more expensive than celebrities because influencers command trust and authenticity. And then the stock market world opened up for a whole lot of people, even those who were wary of stocks,” said Shashank Bhardwaj, an expert in influencer marketing.

Adding, “These influencers started talking about how to become rich and how to make more money, something people got curious about. And this was not done in a jargon-heavy language, but in a simple and easy-to-understand language.”

Also Read: How do you spot a fake ‘finfluencer’? Red flags include penny stocks, get-rich-quick schemes

Huge following

Industry experts say top financial influencers on average have about 2 million subscribers but the number can sometimes even cross a staggering 5 million.

What makes these financial influencers so popular? The answer is simple: they teach people how to become rich. And they do it in a very relatable manner.

Many investors, especially younger first-time investors, have been flocking to financial influencers in recent years because they connect with people through their chatty style, casual dressing and easy language. Their short and pithy videos explain complex financial concepts engagingly and creatively to make it easy and accessible for new investors who are looking to make their millions but don’t have the financial knowledge.

Since their subscribers are generally between 18-40 and are a mix of both big-city and small-town people, they dress casually in T-shirts or tops and use Hinglish, or a mix of Hindi and English, to explain complicated financial issues to their followers.

Their videos also grab eyeballs because of their catchy titles such as ‘How to Invest’, ‘What are SIPs’, ‘Withdrawal of PPF’ and ‘ Basics of the Stock Market’. And their graphics are more engaging because they are stripped off any jargon.

The rise of ‘finfluencers’

According to a report by statistics portal Statista, the global influencer market more than trebled from 2019 to $21.1 billion in 2023. The report pegged India’s influencer marketing industry at over Rs 12 billion in 2022 and predicted it would grow to Rs 28 billion by 2026.

It also projected the market would grow at a compound annual growth rate of 25 percent over the next five years.

Already, nearly 55 million urban Indians were direct consumers of content by various influencers as of 2022.

So, what’s driving this surge in the popularity of online financial influencers?

The boom in India’s stock markets. Look at the numbers. The stock market has skyrocketed more than 225 percent in the past few years from below 26,000 in March 2020 to 85,000 points in September 2024. The registered National Stock Exchange (NSE) investor base nearly tripled from March 2020 to 9.2 crore as of March 31, 2024.

This meant that 20 percent of Indian households are now channelling their household savings into financial markets.

In August, the total number of registered investors in the country crossed the 10-crore mark, according to a National Stock Exchange (NSE) report. The report noted that the journey from 9 crore to 10 crore registered investors took just five months.

“It took over 25 years to have a crore investors, but the subsequent milestones have been crossed much sooner, with new investors predominantly in the 20-30 age bracket,” said the report.

And the number of demat accounts with both depositories rose to 1,514 lakh in 2023-24 from 1,145 lakh in 2022-23.

“Nothing sells like success. So if we look at the market, Nifty and Sensex post-Covid have picked up. Nifty tripled since March 2020. The SME market has also gone up 79 times. Everyone likes to see the market going up. And hence many more people are getting attracted to this world of finfluencers,” said Ajay Bodke, an independent expert on financial markets.

India’s stock market boom took off when people were stuck at home during the Covid lockdown. “When Covid hit and the entire economy shut down, people had ample time at their disposal. A retail boom started in 2020 because interest rates had plummeted. People preferred to spend their money rather than keeping it in FDs,” said Bodke.

“Finfluencers use social media to make tall claims about returns and today in the market, in the pendulum that swings between greed and fear, we are seeing that there is no fear at all. It is just greed raised to infinity,” he added.

Bodke said the exuberance in the market stemmed from three ideas: There is no other alternative to equities; FOMO or fear of missing out on a good deal to get into the stock market; and buy the dips, which means an investor buys an asset when its price dips in the hope of getting a good deal.

Apart from the market boom, another reason for the growing popularity of financial influencers is India’s low financial literacy.

According to the National Centre for Financial Education, India’s financial literacy is just 27 percent compared to a global average of around 60 percent. As a result, many investors turn to financial influencers, some of whom are chartered accountants or have management degrees or are just amateurs dabbling in the market, for advice.

Financial influencers have also grown as data has become cheaper, smartphones have reached every corner of the country and digital currency has grown.

Also Read: Brokerages & hedge funds make a killing as India’s inexperienced youth flocks to the equity market

Success stories

Malik, a Delhi-based influencer, did his MBA in finance in 2008 and then started working in the corporate world. But he always wanted to try his hand at entrepreneurship. He then quit his job in 2013 and started blogging about financial and real estate subjects such as carpet area, building byelaws and greenfield vs brownfield projects.

“I wanted to educate people about the right investment strategies. But back then, I did not know that this will grow into what it is today. That time nobody really was talking about finance in the video format though textual content was there. And videos can touch more lives. That was the whole idea,” he said.

Today, Malik makes an average of four or five videos a month with views ranging from anywhere between 200,000 to a million a month.

While Malik dabbles in stocks and real estate, another YouTuber, Ankur Warikoo, focuses on money matters and personal finance.

Warikoo’s YouTube channel has 5.06 million subscribers and he clocks in 10-12 videos per month, with an average views of over 500,000 per video.

The 44-year-old has come a long way since he decided to strike out on his own as an entrepreneur in 2009 after a string of professional failures. He started his entrepreneurial journey with secondshaadi.com and gaadi.com in 2009 and started Groupon India in 2011.

In 2012, Delhi-based Warikoo started creating content online on LinkedIn and Quora to attract the best talent for his startup without any middlemen. “In 2015, LinkedIn launched its video feature. And I started doing video content every Wednesday by the property name Warikoo Wednesday, which was well received. They used to be two-to-four-minute videos and I was talking about my achievements, and challenges as a startup founder,” he said.

In 2017, he started his YouTube channel. And for the first three or four years, he was mostly repurposing his LinkedIn content. By 2020, he had 7,000 followers on YouTube, 14-15,000 on Instagram and 600-700,000 LinkedIn followers.

“That is when I started with active content creation with a small team. And in 2020 March, Covid hit. So I was at the right place at the right time and things fell in place,” he said.

Though YouTube remains the preferred platform, new age influencers are also tapping Instagram for short videos.

Surat-based Anushka Rathod, who has a million subscribers on Instagram, is one of the earliest female finance creators in the short-video space.

After the pandemic derailed Rathod’s Master’s plans, she decided to turn it into an opportunity to make videos in a shorter format.

“I started my YouTube journey when I noticed my friends getting their first jobs as engineers, architects and designers. They were really excited about making money for the first time, but many of them had no idea how to manage it. When I suggested they ‘just Google it’, they found the information boring and hard to understand. That’s when I realised I could help,” Rathod told ThePrint.

“I decided to create short, funny videos to make personal finance more engaging and accessible for everyone. My aim was to take the confusion out of finance and make it enjoyable,” she added.

Today, she creates 16 to 25 videos each month, mostly in Hindi, on various topics from taxes and credit card usage to tips on savings and investments. In one of her most popular reels, ‘Simplest Trick to Save Money’, done in partnership with Flipkartgrocery, Rathod talks about grocery shopping via Flipkart and promotes it on her social media page.

But her biggest success is her ‘Mehnat ki Kamai’ series where she gives smart shopping tips to help save your hard-earned money.

In one episode, for example, a young lady refuelling her car asks for petrol worth Rs 2,000. Rathod then tells her how to refuel by not paying a single rupee.

How? “Smart people don’t use UPI or cash to pay for petrol. Instead, they use special fuel credit cards,” Rathod says. She goes on to explain how special fuel credit cards give you a 12th month of fuel free if you accumulate enough points by using the card to buy Rs 2,000 worth of petrol each month. This video got her 23.4 million hits.

Like many financial influencers, chartered accountant Twinkle Jain also moved to the world of ‘finfluencers’ during the pandemic in 2021.

With over 500,000 followers on social media, she says she “tries to make complex financial concepts like budgeting, saving and investing accessible to a broad audience”.

She posts around 12 to 15 videos per month which includes a mix of short reels and informative posts. “As a chartered accountant, I bring professional expertise and credibility to my financial advice. My audience knows that the information I provide is both accurate and practical, which is crucial in a field where trust is key,” Jain said.

She chooses topics based on a mix of current trends, common questions from her audience and her own experience with money.

Business models

Financial influencers are a part of a wider breed of social media influencers across the world.

WebX Integrated Communications founder Shashank Bhardwaj, who has been in the digital marketing business for over a decade, says the genesis of the influencer market was in “mommy bloggers” and people posting DIY tips on topics such as their experiences at a particular restaurant, how to use makeup or recipes. These influencers, he says, were mostly newly married young women or new mothers talking about baby care.

Earlier, these influencers worked on a barter system.

“Give us the product and we will promote it. Give us some freebies and we will promote the place, hotel, etc. But then with Covid, things started changing. Then came the concept of money exchange and exploring brand partnerships,” he said.

Most videos are free for subscribers. However, influencers have many business models to make money. The most immediate form is Google advertisements where, according to industry experts, a ‘finfluencer’ can get a minimum $3-$5 per 1,000 views.

And for those clocking a million views per video, monthly earnings could be in lakhs.

But this is not the only way a ‘finfluencer’ can make money.

As a channel grows, more brands want collaborations. Influencers promote the brand and the partnering brand pays them. But for that, consistency is the key.

“A large part of YouTube or any other content creation is about consistency and doing it for far too long when other people drop out so you realize you are winning not because you are the best but because you stuck it out,” said Warikoo.

As the market started skyrocketing, stock brokers also started collaborating with these ‘finfluencers’ and endorsing them. “The channel had to grow and we had to also make money; so we started taking promotions slowly. But we had to draw a line at what to promote and what not to. We were trying to regulate ourselves. And did not want to promote the products that I did not try or use first,” said Malik.

However, there’s another side to the world of financial influencers. Critics say some of them hand out dodgy advice and can mislead their followers. With the market booming, the unchecked explosion in the number of influencers had brought a host of problems.

Influencers with little to no knowledge of a subject are grabbing eyeballs with click-bait thumbnails such as “How to make Rs 100 crore by investing in stock market?” and “Rs 1 lakh to Rs 1 crore in days”.

Bhardwaj says that not all ‘finfluencers’ have the authority to speak on the subject. All they do is go through tonnes of material by journalists and academics on YouTube and rehash it in simple language.

“Some 90 percent of these finfluencers were repurposing the content available online. Take five paras and break it into five statements; that is what the readers were also attracted to. That is how they started getting more followers. But this puts a question on the credibility,” he said.

SEBI crackdown

It is hardly surprising that the market regular has come down heavily on some ‘finfluencers’. In the past year, the Securities and Exchange Board of India (SEBI) has actively started regulating ‘finfluencers’ and cracking down on those who violate norms.

The market regulator began monitoring the growth of ‘finfluencers’ after many investors filed complaints about being duped by online financial advisers.

In one of the first crackdowns, SEBI barred P.R. Sundar, a ‘finfluencer’ with over a million YouTube subscribers, from the securities market in May last year for allegedly carrying out investment advisory activities without registering with SEBI. Sundar was running a website through which he offered various packages for providing advisory services.

Sundar and his associates settled with SEBI to end the proceedings without any determination of guilt. They also agreed to pay SEBI over Rs 6 crore in settlement and disgorgement fees.

In an effort to safeguard investors, SEBI has tweaked its norms and made it mandatory for ‘finfluencers’ giving advice on picking stocks or intraday strategies to register with the market regulator.

However, educational videos explaining the concepts of stock markets, taxation or various investment instruments are allowed.

Experts say they aren’t surprised at the market regulator’s crackdown. “People were promoting anything left, right and centre and then everyone started questioning including the media. That’s when SEBI also started tracking them down,” said Malik.

Bhardwaj from WebX Integrated Communications said the market regulator had to crack down as people were blindly following online financial influencers. “These people then started telling people where to invest, including cryptocurrency. People started blindly following them and opening accounts.”

He added, “As their following, popularity, and engagement grew, many influencers began promoting a wide range of financial products without conducting proper due diligence. Eventually, people started losing significant amounts of money, particularly in cryptocurrency.”

“Initially SEBI overlooked it since ASCI (Advertising Standards Council of India) had introduced a set of guidelines for influencer advertising. But as losses mounted, SEBI stepped in and began regulating the ‘finfluencing’ space. They said that if you are going to talk about investment, you have to get registered with SEBI and obtain a license.”

In another prominent case a year ago, SEBI barred financial influencer Mohammad Nasiruddin Ansari, known as ‘Baap of Chart’, from the securities market for providing stock recommendations on social media in the garb of educational training.

The regulator also ordered Ansari to pay back Rs 17.2 crore, which he had allegedly made by luring clients through misleading videos asking people to deal in securities.

The crackdown on Ansari, who had more than 4.3 lakh subscribers and garnered over 7 crore views, wasn’t based on just a few videos. SEBI held him accountable for several videos between January 1 2021 and July 2023 after it found that he collected money from people and lured clients into investing in the market through his educational courses.

In April 2024, the regulator also cracked down on another financial influencer, Ravindra Balu Bharti, who was offering “guaranteed returns up to 1,000 percent”.

It also ordered Bharti to pay more than Rs 12 crore that he earned “unlawfully”.

Bharti operates two YouTube channels: Bharti Share Market Marathi with over a million subscribers; and Bharti Share Market Hindi with 822,000 subscribers.

“Guaranteed returns up to 1,000 percent is a clear case of abuse of investors’ confidence in the securities market,” said the SEBI order.

Since then, SEBI has often come out with new guidelines for financial influencers to protect unsuspecting investors. Its latest guidelines issued on 27 June 2024 distinguished between regulated and unregulated financial influencers and barred regulated entities from dealing with unregulated ones. “Entities regulated by SEBI and their agents are prohibited from associating, directly or indirectly, with any individual or entity that offers financial advice or makes performance claims without SEBI’s permission. This includes any form of monetary transactions, client referrals, or IT system interactions,” the market watchdog said.

As of last month, SEBI had removed more than 15,000 ‘content sites’ by unregulated financial influencers as part of its efforts to protect investors. Experts say regulation is necessary though it’s impossible to stop people from coming to social media.

Malik sees no harm in educational videos and younger, inexperienced influencers if they can explain concepts easily. “Of course, people should check the background of a person explaining. You cannot stop anybody from coming on social media, whether it’s an 80-year-old or a 20-year-old. How to draw a line,” he told ThePrint.

“But giving advice on stocks is a tricky part. Then the regulator has to do its job.”

(Edited by Sugita Katyal)

Also Read: Millionaire influencer BitBoy’s fall has lessons — ‘perfect example of why crypto needs regulation’