-

I made $143.73 over the course of three Uber “shifts” that totaled roughly 10 hours of active driving.

-

I completed 10 trips, put 305 miles on my economical Uber rental and spent $38.80 on one tank of gas.

-

Subtract the gas cost from $143.73, and I earned $104.93, or $10.49 an hour.

-

Only $3 of my earnings were tips, which I found surprising — because I’m nice!

If you’re wondering, the minimum wage in Maryland handily beats my earnings at $15.00 per hour.

Uber wasn’t a lucrative side hustle for me, but it was an interesting experiment. Here are four things to keep in mind if you’re thinking about trying Uber. And if you want to watch all the ups and downs of this side hustle stress test, here’s a video of my experience.

Give yourself the flexibility to roam

During each of my three Uber “shifts,” I had the idea that I’d do rides relatively close to where I live. But the reality of living in a less populated area is that short, local trips can be few and far between. I found that to be the case even on a Friday evening in my suburban town, located roughly 50 minutes north of Baltimore.

I learned that to earn higher fares, you need to be open to where the Uber trip takes you. I left a lot of money on the table by skipping trips that would end too far from my home base. Uber works by matching riders with nearby drivers. As a driver, you have just a few seconds to accept a ride request when it comes in. I often took too long to decide when considering distance.

Toward the end of that Friday, I caved and accepted a 30-mile trip with a fare of $30.42. But when it was over, it was after 9 p.m. and I was a long way from home.

If I had put in 8-hour shifts and left myself to the mercy of the Uber Driver app, I’d have done better. But if I’m going to be driving all over creation for hours, is Uber a side hustle, or is it a main hustle?

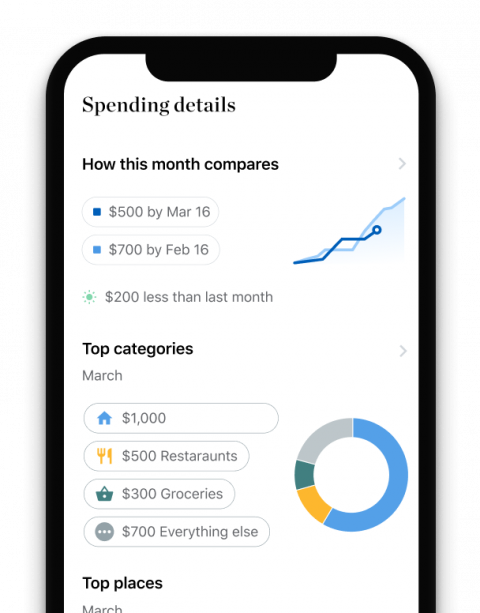

Track all the money you make

See the ins and outs of your cash, cards, and bank accounts at a glance.

Your car is a taxi cab and your primary tool

All that driving means you need a car that’s up to the task — something affordable, reliable and efficient. My personal vehicle is a gas-guzzler so I used Uber’s car rental service to rent a more appropriate vehicle and make this test more realistic.

But what I realized is a lot of people rent their Uber rides on the regular. If you go this route, you must rent from one of Uber’s approved rental company partners. The rental office I used, a local Hertz that partners with Uber, was packed, and I found the experience to be super hectic. It took three hours to get my car, and the one they gave me was a downgrade from what I reserved in advance.

Because of my experience, I don’t recommend renting if you can avoid it. Uber rentals cost $260 or more per week, so the recurring cost will eat heavily into earnings.

Finding your own affordable used car would likely cost less in the long run, even in cases where you get a car loan with bad credit. For example, let’s say you finance a $20,000 used car for 60 months with a high 19% interest rate. The $518 monthly payment costs less than the $260 a week rate for a rental car.

You will need to factor in insurance (which can include rideshare insurance), maintenance and repairs when comparing costs. You can turn to the Nerds for resources on how to build credit and finance a vehicle you can afford.

Keep tabs on all your money

NerdWallet tracks all of your income streams and spending accounts — all in one place.

Consider a “slush fund” for car costs

I had the pleasure of meeting and riding home with a true Uber pro after I returned my rental car. His name is Greg Hiteshew, and Uber is his post-retirement hustle. He drives most days, says he earns between $1,000 and $1,500 in a typical week and is disciplined about saving money for car costs.

Hiteshew says he sets aside $40 at the end of every day and has done so for years without fail. He says it’s a daily habit that ensures he has enough to cover maintenance and repairs for his current car, and helps him save for the next car.

Consider putting your daily $40 (or whatever you can swing) in a high-yield savings account for the added bonus of interest on top.

Embrace the human side of rideshare

While we chatted on my ride home, Hiteshew opened up about how driving for Uber helped him cope with the loss of his wife. She passed away from cancer 12 years ago, and in the years after, he found himself in a pretty dark and lonely rut. Then one day a friend had a suggestion for a side hustle that would change his life.

“He said, ‘I want you to Uber,’” says Hiteshew, talking about meeting with his friend. The friend hoped it would give him something to keep his mind occupied. Hiteshew thought about it and decided to give it a try a week later.

“It worked,” he says. “Turns out I love it. I really enjoy doing it. I’ve met a lot of nice, nice people.”

I get what he’s talking about. I’ve been working from home for years, and trying Uber put me back into the world. I interacted with different people, visited parts of my area I hadn’t been to and realized how critical a service like Uber is for those who may not be able to afford a car. It reminded me how important it is to communicate with others, strangers even.

Turns out that part of the experience was more valuable than the money. And if I drive for Uber again, I think I learned enough to do better than $10.49 an hour.

Get more financial clarity with NerdWallet

Monitor your credit, track your spending and see all of your finances together in a single place.