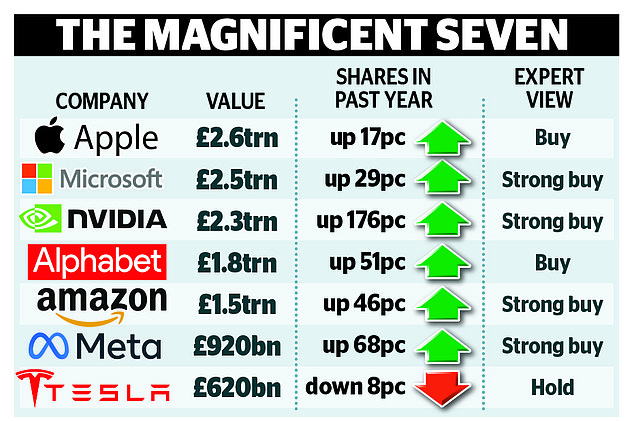

The Magnificent Seven tech stocks – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – have risen to heady heights thanks to excitement over the AI (artificial intelligence) revolution.

The question for investors as they report their latest results in the next few days is whether they can continue at such a clip.

The combined growth in their shares was 107pc last year. That has given investors, including many private shareholders in the UK, a big dollop of the feel-good factor as they have seen their savings and pensions shoot up in value.

But if something looks too good to be true, it often is – even in the 21st century dream factory that is Silicon Valley.

So which of the tech titans are most likely to continue to be superheroes and which look destined to disappoint?

Optimistic analysts expect a 30pc jump in the combined profits of the Mag 7 when they reveal their second quarter profits. That is lower than the 51pc leap in the first three months of their financial year. Even so, it is still well above the 9.9pc predicted for the S&P index – the leading shares barometer in the US – as a whole.

But some members of the Mag 7 are distinctly more magnificent than others.

It has become painfully clear that at least one – Tesla, the world’s largest electric car company – is falling behind.

Its results yesterday revealed lacklustre sales.

Elon Musk, Tesla’s unfailingly controversial boss, is promising exciting innovations, including autonomous ‘robotaxis’, but these will not arrive until October.

The results from Alphabet, owner of the Google search engine, underlined its might, but also revealed some weakness. The group is cashing in on the apparently insatiable demand for cloud computing (the provision of remote computer storage for companies). Yet advertising revenues from its YouTube division were lower than estimates.

So what are the investing experts’ verdicts, as we await the results next week from the other five?

Anyone who is thinking of investing now – or indeed taking profits from shares in the Mag 7 – should be aware that analysts still rate these stocks a ‘buy’, with the exception of Tesla.

This is a reasoned assessment. Investors who are thinking long-term should take a bet on the AI revolution.

Before buying, however, check to see whether the funds you hold already give you this exposure. Global equity funds hold large chunks of Mag 7 shares. F&C and Scottish Mortgage Investment Trust, for example, are major shareholders. Investors can buy these funds as well as the individual shares through online trading platforms such as AJ Bell, Hargreaves Lansdown and Interactive Investor.

At the same time, it makes sense to be realistic about the near-term threats to the Mag 7’s apparently invincible sway. Last week’s global IT meltdown affecting 8.5 million Microsoft computers was a reminder that tech firms are fallible.

FOMO (fear of missing out) helped propel the share prices of these US tech titans – investors wanting a piece of the boom unfolding before their eyes – and seldom has fear been so richly rewarded.

Lately, however, a different fear has emerged: that the Mag Seven may not be the guarantors of ever-increasing wealth.

There is apprehension about the impact of a Trump presidency on these companies’ Chinese operations. Trump has raised the prospect of ‘phenomenal’ tariffs on Chinese imports.

He has also said that Taiwan should pay the US for its defences against a Chinese invasion. The Taiwan Semiconductor Manufacturing Company (TSMC) makes the world’s finest chips, including those bearing the Nvidia brand.

Against this more nervous background, some leading fund managers have a new obsession – the UK stock market. It could be Cool Britannia all over again as unloved UK companies step into the limelight. Check your holdings to see whether in the fan mania over the Mag 7, you have forgotten to back Britain.

Here is a stock-by-stock verdict of the experts on the Magnificent Seven (and the consensus among analysts as to whether the shares are a strong buy, buy, hold, sell or strong sell).

TESLA: HOLD

Tesla’s battery-powered pick-up truck, the Cybertruck. The company’s shares have tumbled

The electric car maker – run by Elon Musk – last night revealed that profits had tumbled to £1.15bn in the three months to the end of June, a steep drop of 45pc from the year before.

This disappointing performance has prompted experts to tell investors to ‘stay on the sidelines’ when it comes to buying Tesla shares.

Revenues rose to £19.8bn, which is a lot of money by any reckoning. But the figure was up by just 2pc, which fell well below what the market was expecting.

The downbeat numbers come as Musk grapples with dwindling demand. He is also locked in a battle with Chinese car makers offering cheaper vehicles, forcing him to push down his own prices.

Tesla now admits it expects to see ‘notably lower’ growth in 2024. It is already trying to cut costs. Draconian measures include laying off more than 10pc of its employees earlier this year.

They have not, however, extended to Musk’s own rewards. He was awarded a package worth up to $56bn earlier this year – admittedly much of it in Tesla shares, which went down as much as 7pc in after-hours trading on Tuesday night having already fallen 8pc over the past year.

Even so, his outsized pay has not impressed some investors, who are becoming increasingly sceptical.

Mamta Valechha, analyst at Quilter Cheviot, said the market ‘remains cautious’ and urged investors to ‘stay on the sidelines’ when it comes to Tesla.

She cited poor car sales as the key factor.

Josh Gilbert, a market analyst at eToro, said investors were looking for some ‘Musk magic’ on Tuesday night but were left disappointed.

‘He was subdued and offered little insight as to what’s next for investors, and that will put shares under pressure,’ Gilbert said.

ALPHABET: BUY

Tech giant Alphabet – which owns Google and Youtube – said revenues surged to £65.7bn in the three months to the end of June

Google owner Alphabet found itself in a much more comfortable position last night.

The tech giant – which also owns Youtube – said revenues surged to £65.7bn in the three months to the end of June, up 14pc from the year before.

It came as Alphabet posted bumper growth at its advertising arm, calming concerns that chatbots from rival companies such as OpenAI’s ChatGPT were hitting the Google search engine.

Profits were also up 22pc to £18.3bn.

Like its big tech rivals, Alphabet is racing to roll out AI offerings as investors pour billions into the technology.

But in a win for shareholders, Alphabet’s chief executive Sundar Pichai said the results were proof that the company’s punts were paying off.

Shares fluctuated in after-hours trading but are up 50pc in the past year.

This gives it a valuation of around £1.75trillion – making it the world’s fourth most valuable listed company behind Apple, Microsoft and Nvidia.

City analysts are confident Alphabet is one to buy, with Dan Coatsworth, analyst at AJ Bell, noting the company’s ‘major advantage’ thanks to its’ financial strength to try lots of new things’.

But he added: ‘Anyone investing in Alphabet needs to have confidence that it can move with the times, constantly think up new ways to make money, and maintain its dominant position in search and advertising.

‘Its success rate to date would suggest the company has the right skills to stay on top, but investors must appreciate there could be bumps along the way.’

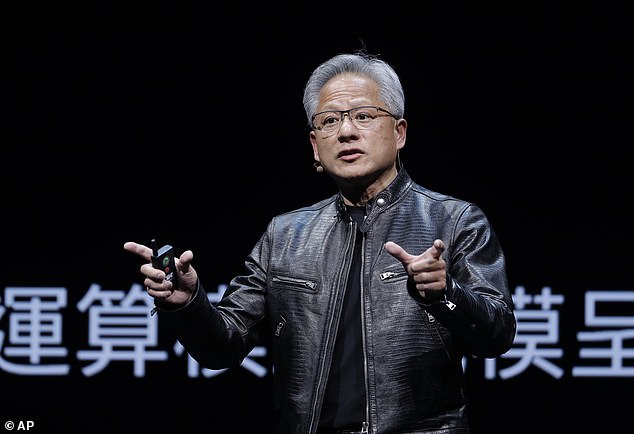

NVIDIA: STRONG BUY

The meteoric rise of microchip designer Nvidia has been fuelled in recent years by the insatiable appetite among investors for artificial intelligence (AI)

Nvidia is one of the stock market success stories of the century. Shares in the pioneering microchip designer have gone from just 10 cents at the turn of the millennium to more than $122 today, valuing Nvidia at over $3trn and making it the third largest quoted company in the world after Apple and Microsoft.

This meteoric rise has been fuelled in recent years by the insatiable appetite among investors for artificial intelligence (AI). The question is: can it continue?

James Anderson, one of the UK’s best-known fund managers, certainly thinks so.

In his previous role running the FTSE 100-listed Scottish Mortgage Investment trust, he was an early investor in Nvidia, along with other tech stocks such as Amazon and Tesla. In his two decades at the helm, Anderson turned Scottish Mortgage into the UK’s largest investment trust, whose recent performance is recovering after a sharp fall.

Despite the phenomenal performance, Anderson reckons Nvidia’s shares have much further to go. According to Anderson, its market leadership in cutting-edge AI chips means it could be worth $50trn within the next decade – more than twice the size of the entire US economy.

‘The potential scale of Nvidia,’ he says, could take its market value to ‘double-digit trillions,’ he says. ‘This isn’t a prediction but a possibility if artificial intelligence works for customers and Nvidia’s lead is intact..’ But even Anderson admits it could be a bumpy ride.

There was a reminder of this last week when shares in Nvidia and other similar stocks tumbled after US presidential candidate Donald Trump warned Taiwan it should pay the US for its defence.

Nearly all of the world’s most advanced chips used in satellites, stealth bombers and,increasingly, AI are made on the island. The US has previously vowed to protect Taiwan if China invades, but Trump’s remarks called its support into question.

Experts warn that, if he wins November’s presidential election, shares in AI firms such as Nvidia could fall further as investors take profits after their strong recent run.

Despite these concerns, the stock is rated a ‘strong buy’ by financial market analysts.

MICROSOFT: STRONG BUY

Microsoft’s share price took only a slight knock after an estimated 8.5million computers were disabled by a global IT meltdown

Microsoft was at the centre of the storm last week after an estimated 8.5million computers were disabled by a global IT meltdown.

The share price, however, took only a slight hit from the episode.

Richard Hunter, an analyst at investment platform Interactive Investor, says Microsoft is still regarded as ‘best in class’ amongst the Magnificent Seven.

The group continues to pump millions into AI, in the belief this will reap untold rewards down the line.

Microsoft has been a major backer of OpenAI, the company behind chat bot ChatGPT, which exploded onto the scene at the end of 2022.

Ahead of the company’s results next week, City experts are backing the stock as one to buy.

Twenty-one analysts have said it is a strong buy, according to market data company Refinitiv.

Shares have climbed by a fifth since the start of 2024 and the group is locked in a three-way tussle with Apple and Nvidia for the mantle of the most valuable company in the world.

Hunter said: ‘Aside from its famed Microsoft and Excel applications, the group is now more focused on both cloud computing and artificial intelligence, both of which either have made, or have the potential to make, significant returns in future for the benefit of company profits and shareholders alike.’ Investors will be watching closely next week for more detail on how the company will cement its position at the top.

AMAZON: STRONG BUY

Expectations for Amazon’s potential for ever-increasing profits and sales have been sky high for several years. But analysts say there are no signs of this waning

It may come as no surprise given its lucrative track record that experts are flagging up Amazon shares as a strong buy.

Expectations for the tech giant’s potential for ever-increasing profits and sales have been sky high for several years. But analysts say there are no signs of this waning.

Apart from its ultra-low UK tax bills, the company is best known as a one-stop online shop for anything from toilet roll to lampshades. But Amazon has another money spinner that is getting everyone excited.

Mamta Valechha, consumer analyst at Quilter Cheviot, says its cloud business – Amazon Web Services (AWS) – will be a key focus for investors when the group announces its quarterly figures next week.

AWS has become a slow but steady profit engine and has been making great strides into generative AI.

That is where you can feed a computer system text, image, audio, video, and code and it will generate new content.

For instance, you can ask generative AI models how to write an entire novel in the style of Ernest Hemingway and it will churn out a draft in minutes.

According to Refinitiv, of the 61 analysts covering Amazon, all but a single dissenter rate it as a ‘buy’ or ‘strong buy’. The solitary objector advises clients to ‘hold’.

Valechha said: ‘Amazon is also taking the opportunity to use its strong growth to reinvest in the business and take advantage of the strong demand and backlog in its cloud division.

‘Given its history of delivery in this sort of area, we are confident Amazon can make a success of AI.’

META: STRONG BUY

Despite a rocky few years, Facebook-owner Meta has managed to win the confidence of the City and Wall Street

Facebook-owner Meta has also managed to win the confidence of the City and Wall Street, despite its well-documented struggles in recent years.

Advertising is a key part of its business meaning the social media giant has suffered as marketing budgets have been squeezed.

The group – which also owns social media sites WhatsApp and Instagram – saw shares tumble over 60pc during the course of 2022. They only started to rally again at the start of last year.

This coincided with Meta boss Mark Zuckerberg laying off over 21,000 staff and axing several experimental projects.

Dan Ives, analyst at Wedbush, said Meta is back in a strong position and the stock is a ‘buy.’ He argues investors can cash in as Meta’s ‘AI story and advertising rebound plays out’.

Zuckerberg, who founded the tech giant in 2004, is trying to re-fettle the ad business with a focus on AI.

He has also been pumping cash into areas such as smart spectacles, where the company doesn’t currently make money.

Meta smart glasses, which cost around £300, allow users to take photos and videos, listen to music, make calls and livestream to Facebook and Instagram.

Ahead of its second quarter figures next week, analysts Hargreaves Lansdown said they would be ‘watching for Zuckerberg’s commentary as much as the numbers themselves’.

The share price is often sensitive to Zuckerberg’s remarks more than the financial results themselves.

In April, shares plunged when he signaled Meta’s costly bet on AI could take years to pay off Hargreaves said: ‘In today’s landscape, throwing cash at AI is the aim of the game. But Meta needs to convince investors there’ll be a decent enough return at the end of the road and there are no guarantees.’

APPLE: BUY

Apple shares are up 17pc in the past year, which makes it one of the weaker performers among the Magnificent Seven. This could make it a relatively cheap buy right now

Apple investors have also endured a bumpy ride in recent months, though it remains the world’s most valuable company with a market value of £2.6trillion.

Not only has the group been grappling with lagging demand for its products, but it has also been facing the prospect of a chip war between the US and China – something that would put it under immense pressure.

Nonetheless, market experts are still backing the stock as one to buy.

Ben Barringer, technology analyst at Quilter Cheviot, said the company was simply going through a ‘transition phase’.

Apple shares are up 17pc in the past year, which makes it one of the weaker performers among the Magnificent Seven. This could make it a relatively cheap buy right now.

And Barringer said the company now has the chance to ‘turn the corner’ later this year with the launch of its latest iPhone, which could send shares flying.

It is expected to launch an ‘AI smartphone’ which could turn out to be a shot in the arm for investors.

Rumours suggest new features on the iPhone 16 could include providing summaries of news stories and photo editing tools.

And the company appeared to flex its muscles in May when it announced the largest share buyback in corporate history.

The company revealed it will spend £88bn buying its own stock back from investors.

That is generally a sign that bosses are confident about their company’s prospects – believing the best investment they can make is in its own shares.

But the group’s exposure to the Chinese market has also made it a ‘hold’ for many investment banks.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.