A WOMAN has revealed that she has made almost £5,000 by selling her old, unwanted items on Vinted.

So if you’ve got a wardrobe full of clothes that you never wear, you’ll need to listen up and take notes.

3

A savvy Vinted seller has revealed her three top tips for making cash on the marketplace appCredit: TikTok/@jjessccaa

3

Fashion fan Jessica revealed that your pictures are key and her £10 trick will earn you cash quickCredit: TikTok/@jjessccaa

3

Not only this, but she also shared her reuploading hack that works wondersCredit: AFP

Jessica, a fashion fan from the UK, swears by her ‘£10 rule’ and a secret trick that will make you cash quickly.

Not only this, but the Vinted pro also stressed the importance of the background on your pictures for those wanting to get rid of their old stuff on the online marketplace app.

Jessica took to social media to share her Vinted tips and tricks, leaving many open-mouthed.

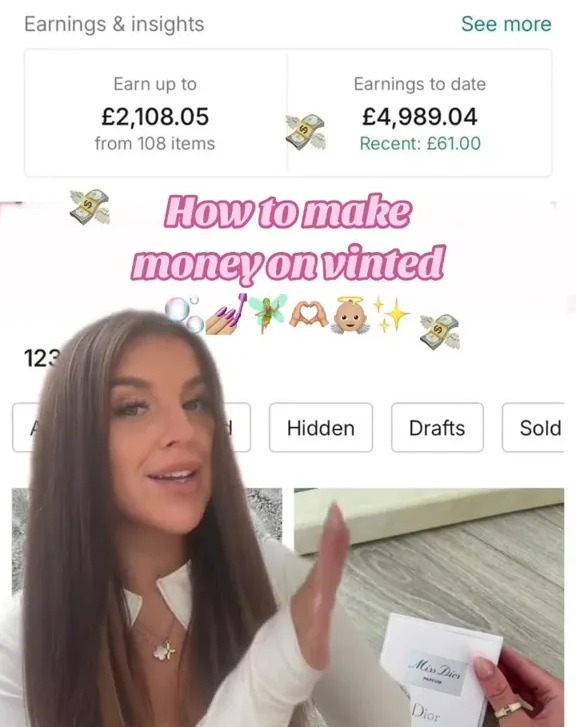

The brunette beauty shared a screenshot of her earnings to date, as she confirmed that she has made £4,989.04.

With 108 items remaining on her Vinted page, she could earn an additional £2,108.05.

Jessica revealed how others can do the same, as she said: “I’ve made about £5k on Vinted so far and if you’re not using Vinted, then what are you doing?”

SNAP IT UP

According to Jessica, taking the right pictures with the right background is key.

What photos you should upload

High-quality and clear images will help your items stand out on Vinted amongst a vast array of items available on the platform.

Here are the five essential shots The Sun’s Rose O’Sullivan recommends:

- Picture one: A clear shot of the front of the dress, gym set, trousers, etc

- Picture two: The back of the outfit

- Picture three: Photograph sleeve or pant length

- Picture four: Close-up of the stitching, or if any flaws on the item include zoomed-in shots of this too

- Picture five: If they are trousers, take pictures of lining, zips or buckles

She advised: “The first tip – you need to have a clean space to get your photos, a plain background.”

Jessica explained that “the more photos the better”, so that you can give buyers a real in-depth look at your items.

PRICING IS KEY

As well as this, the Vinted seller shared her pricing tip, as she continued: “Another tip is do not sell your items for £10 and under – if you bought that for £30/£40 and you’re selling it for £10…that is not what we’re doing.

Why you need to be on Facebook & Instagram if you want to sell quick on Vinted and four other hacks to help you cash in

“People will bid you £5/£8 and you’ll be sat there annoyed and have to say no or just ignore everyone, so don’t do that, just have them up for a higher amount.”

Jessica explained that accepting offers is of course ok if you are happy with the price, but suggested that giving a discount of 10/15% is a good idea.

Not only this, but she also revealed that bundle deals are a great way for shoppers to get discounts that can be controlled by you.

GET REUPLOADING

Finally, Jessica confessed her secret trick that will ensure your items sell in no time at all.

She concluded: “Another tip is if your items have been on your page for a while, I would take some new photos and get them uploaded again.”

Why I hate Vinted, a real-life view

Fabulous Associate Editor Sarah Barns opens up on why she hates Vinted:

It’s the king of second-hand fashion but I hate Vinted.

There I said it. Yes, it stops items going into landfill. Yes, it helps create additional side-hustle income for many.

And yes, you can get things at bargain prices. But it is just not my (shopping) bag.

From personal experience, I’ve bought ‘cheap’ bundles of children’s clothes only for them to arrive dirty and misshapen.

Plus, with postage and buyer protection they didn’t feel like such a great deal. I much prefer going to my local charity shop or supermarket for kids’ stuff.

I’ve also bought more premium high-street items – a dress from Arket and a skirt from Cos – only to find they didn’t fit properly and the colours were faded.

I attempted a bout of selling stuff but gave up after my £110 Veja trainers got lost in the post and I spent two hours on the phone to Royal Mail.

A major gripe with it is that it still encourages you to spend, spend, spend. I’m not sure I needed the items I did purchase, I just didn’t want to miss out.

Also, the reselling of fast-fashion items – a £5 Shein top on Vinted for £17.50 – makes me feel a bit queasy.

Clothes shopping has become a daily hobby for a lot of people when really it should be something that’s done once or twice a year as a necessity.

But the 18 million Vinted app users clearly disagree with me.

Jessica advised sellers to reupload pictures that are “10 times better” as the previously uploaded snaps, as she claimed that doing so will sell your items much faster and in some cases, “within the next few days of you reuploading them.”

The TikTok clip, which was posted under the username @jjessccaa, has clearly left many open-mouthed, as it has quickly racked up 66,800 views in just five days.

NEW RULES TO NOTE

But if you want to flog your old items on Vinted, you’ll need to consider the new rules that came into play this year.

If people are selling personal items for less than they paid new (which is generally the case for second-hand sales), there is no impact on tax.

Do you need to pay tax on items sold on Vinted?

QUICK facts on tax from the team at Vinted…

- The only time that an item might be taxable is if it sells for more than £6,000 and there is profit (sells for more than you paid for it). Even then, you can use your capital gains tax-free allowance of £3,000 to offset it.

- Generally, only business sellers trading for profit (buying goods with the purpose of selling for more than they paid for them) might need to pay tax. Business sellers who trade for profit can use a tax-free allowance of £1,000, which has been in place since 2017.

- More information here: vinted.co.uk/no-changes-to-taxes

However, since January 1, digital platforms, including eBay, Airbnb, Etsy, Amazon and Vinted, must share seller information with HMRC as part of a crackdown.

You’re unlikely to be affected if you only sell a handful of second-hand items online each year – generally, only business sellers trading for profit might need to pay tax.

A tax-free allowance of £1,000 has been in place since 2017 for business sellers trading for profit – the only time that an individual personal item might be taxable is if it sells for more than £6,000 and there is a profit from the sale.

However, firms now have to pass on your data to HMRC if you sell 30 or more items a year or earn over £1,700.

Read more on the Irish Sun

It is part of a wider tax crackdown to help ensure that those who boost their income via side hustles pay up what they owe.

While your data won’t be shared with HMRC if you earn between £1,000 and £1,700, you’ll still need to pay tax as normal.

Win an £8k trip of a lifetime to the Maldives

FABULOUS is the home of high-street fashion – we even launched our own range earlier this month.

And now our Fabulous High Street Fashion Awards are back – giving you the chance to voice your opinion on all your favourite brands.

Do you love a shopping spree at M&S or are you more of an F&F woman?

Do you lust after celebrity partnerships or are you all about the perfect pair of shoes?

Have your say and you could win a dream holiday – we’ve teamed up with Ifuru Island Maldives to create an amazing prize.

You could win 7 nights for two adults in a Sunset Sky Suite at Ifuru Island Maldives on an Exclusively Yours Premium All-Inclusive package, plus return economy flights from London to Maldives and return domestic transfers for two adults.

For your chance to win this dream getaway, vote and enter HERE by July 28, 2024. T&Cs apply*