Summer brings plenty of things to enjoy, from holiday celebrations to tremendous deals on eligible Amazon products during Prime Day.

This year, Amazon Prime Day falls on July 16th and 17th, but Amazon is also offering early deals all this week. As a former financial planner turned credit card expert, I’ve heard of every way to boost credit card rewards and savings. If you’re going to shop during Prime Day, follow these seven tips for how to maximize Prime Day rewards and savings.

This story is a part of Prime Day, CNET’s guide to the shopping event and how to find the best deals.

More CNET Prime Day

7 tips to maximize rewards and savings on Amazon Prime Day 2024

1. Shop early deals

The bulk of the Amazon Prime Day deals take place on July 16th and 17th, but Amazon is slowly trickling out early deals regularly. Check them out to see if the item you’ve been looking for is on sale now; just don’t blow your budget before the main event.

2. Use the right credit card

Even if you have a rewards credit card, you may not be using the best credit card for Amazon Prime Day deals. To maximize your rewards, you’ll want to pay for your purchases with cards that offer bonuses on Amazon purchases, online shopping and similar spending categories. A few I’d recommend include:

- Prime Visa*. Unlimited 5% back on Amazon purchases with a Prime membership. For those without a Prime membership, the Amazon Visa* earns 3% cash back for Amazon.com purchases.

- Amazon Business Prime American Express Card*. Business owners with a Prime membership can earn an unlimited 5% back on U.S. Amazon purchases (on the first $120,000 in purchases each calendar year, then 1%). If you don’t have a Prime membership, you’ll earn 3% back with the Amazon Business Card*.

- Bank of America® Customized Cash Rewards credit card*. Earn 3% cash back in the category of your choice, including online shopping, on the first $2,500 you spend in combined choice category/grocery store/wholesale club quarterly purchases, then 1%. Plus, get up to 75% more cashback if you qualify for Preferred Rewards.

- U.S. Bank Altitude® Reserve Visa Infinite® Card*. Receive 3x points on eligible mobile wallet purchases using Apple Pay, Google Pay and Samsung Pay.

- U.S. Bank Shopper Cash Rewards® Visa Signature® Card*. Get 6% cash back on the two retailers you choose, including Amazon.com, on the first $1,500 you spend each quarter.

- Wells Fargo Active Cash® Card. Earns an unlimited 2% cash reward on purchases and offers a 0% intro APR for 15 months on qualifying purchases and balance transfers (then 20.24%, 25.24%, or 29.99% variable).

3. Choose no-rush shipping

During Prime Day, Amazon Prime cardholders can earn an extra 2% rewards (for a total of 7%) when they select no-rush shipping. This offer is available exclusively to you if you have an eligible Prime membership and use your Amazon Prime card at checkout. The extra 2% applies automatically to products shipped by Amazon using the “No-Rush Shipping” option.

4. Earn a welcome bonus

When you open a new credit card, you may have the opportunity to earn a welcome bonus. These one-time bonuses are a quick way to earn a lot of cash back, miles or points when you meet the minimum spending requirement before the deadline.

These requirements vary by card, but a common welcome bonus may require you to spend $4,000 within the first three months after opening your account. However, one notable outlier is the Prime Visa. To earn its $200 Amazon gift card welcome bonus, all you need to do is be approved for the card.

Want an extra $200 to put toward Prime Day shopping?

Consider applying for the Prime Visa

You can get an instant $200 Amazon gift card to shop Prime Day when you’re approved for the Prime Visa. Here’s how.

For other cards, you can use your Prime Day purchases to get you closer to earning the welcome bonus. Plus, you’ll earn rewards on every dollar you spend at Amazon and other retailers that are in addition to the welcome bonus.

Just don’t overspend to earn a welcome bonus. The risk of credit card debt and high-interest fees is never worth it.

5. Check for additional perks based on spending

Whether you have a new card or an old one, many offer additional perks when you reach certain spending thresholds each year. Using it for your Prime Day spending can help you get closer to obtaining these perks.

The benefits vary by card, but they may include one or more of the following:

- Elite status upgrades

- Companion certificates

- Free hotel nights

- Airport lounge access

- Reimburse annual fee

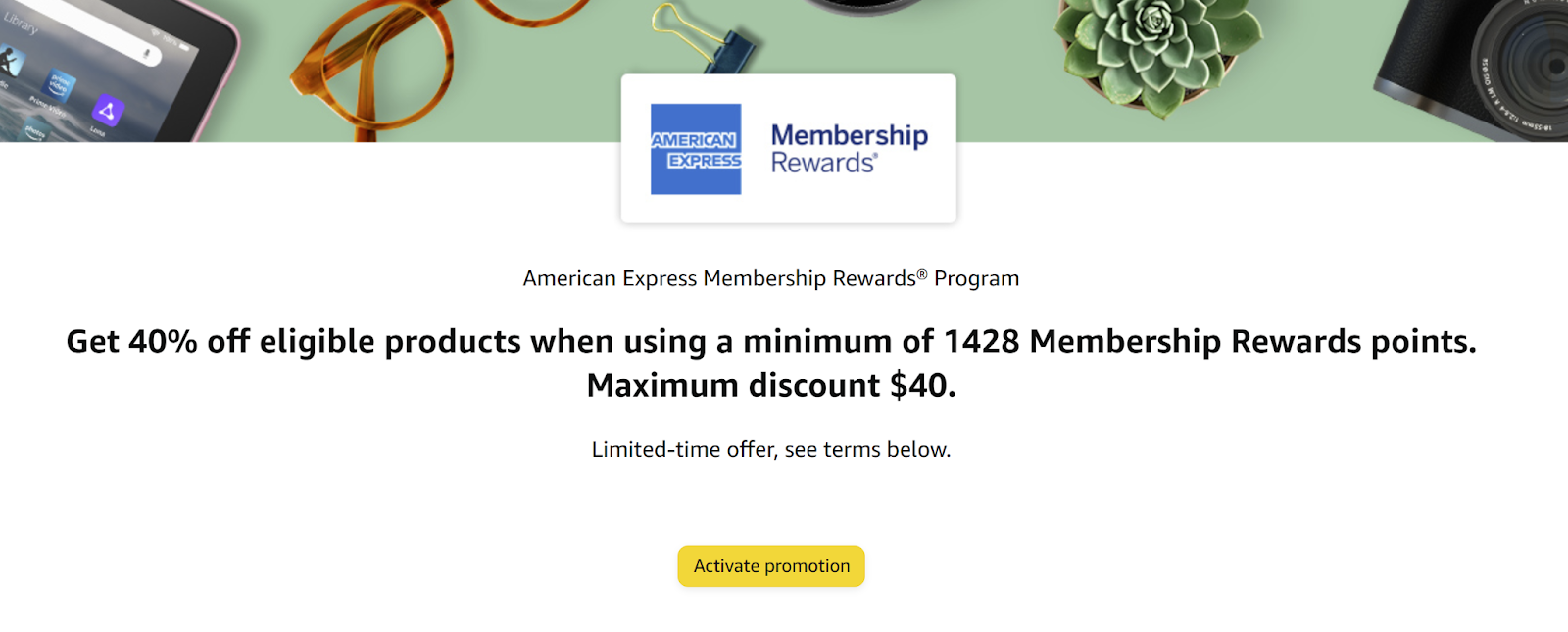

6. Get up to 50% off when redeeming Amex points

Normally, redeeming American Express Membership Rewards points for Amazon purchases does not offer good value for your points. By the numbers, 10,000 Amex points are worth just $70 at Amazon compared to $100 when booking flights through American Express Travel or potentially even more if you transfer them to a hotel or airline loyalty program.

Fortunately, you don’t have to redeem Amex points to pay for the whole purchase. Instead, you’ll get the discount by using at least the minimum number of points. In the past, this was as few as 1 Membership Rewards points, and then using an American Express credit card to pay the rest.

For this promotion, visit this Amazon link to see how much you can save and how many points you need to redeem to unlock the discount. My discount is a savings of up to 40% (maximum $40 discount) when redeeming at least 1,428 points.

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

7. Check online shopping portals

Before shopping at any store online, it pays to go through a shopping portal first. Shopping portals share a portion of the revenue they earn for referring customers who make purchases at those sites. It’s challenging to figure out which shopping portals Amazon participates in on your own.

Visit CashBackMonitor.com first to see the current rewards at thousands of popular sites, including Amazon, Target and Walmart. When I looked on July 10, you could earn as much as 7% from TopCashBack, up to 20% at RetailMeNot and up to 6% at Mr Rebates on eligible Amazon purchases.

Before clicking “Buy Now” during Amazon Prime Day, make sure that you’re not overpaying for an item. Avoid spending more than you can afford or buying something you don’t really want. Here are a few spending traps to watch out for.

View price history

While Prime Day offers some amazing deals, not all of them are as good as they seem.

I recommend using a browser plug-in like Keepa to view the price history of items you’re considering buying. The item may be marked down from an elevated price that ends up being about the same as its normal price you can find any other day of the year.

Overspending

It’s easy to get caught up in the chase for great deals and spend more than you expected. Overspending can not only bust your budget, but it can also lead to debt that takes months, or even years, to pay off.

Credit cards have some of the highest interest rates of any financing option. Earning rewards is great, but if you’re carrying a balance, the interest charges will quickly overwhelm the benefits.

Buying unnecessary items

Finding deals is awesome when it’s something you need or that’s been on your wish list for a while. When you buy unnecessary items just for the sake of “winning” the deal, you’ve wasted money on something you don’t necessarily want or need.

This can lead to a cluttered house with items collecting cobwebs that’ll get donated the next time you clean your home. Before you checkout, make sure you feel good about all the items in your cart.

Recommended Articles

Shop Small This Prime Day: How to Spot Small Business Deals on Amazon

Shop Small This Prime Day: How to Spot Small Business Deals on Amazon

Amazon Prime Day Can Save You Money. Here’s How I Avoid Overspending

Amazon Prime Day Can Save You Money. Here’s How I Avoid Overspending

4 Things to Know Before You Shop With Points on Prime Day

4 Things to Know Before You Shop With Points on Prime Day

*All information about the Prime Visa, Amazon Visa, Amazon Business Card, Amazon Business Prime American Express Card, Bank of America Customized Cash Rewards credit card, the U.S. Bank Altitude® Reserve Visa Infinite® Card and the U.S. Bank Shopper Cash Rewards® Visa Signature® Card has been collected independently by CNET and has not been reviewed by the issuer.

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.