Editor’s Note: Eric Fry, here. Using his Money Calendar tool, my InvestorPlace colleague Tom Gentile has identified a major shift coming in the AI sector… a pattern he’s calling the Final Phase of the AI boom.

Tom is holding a special event on Tuesday, July 9, at 8 p.m. Eastern time to further discuss this major AI shift. You can reserve your spot by clicking here.

Today, Tom will tell us more about his Money Calendar tool… and what exactly he sees coming.

Take it away, Tom…

Hello, Reader.

It’s the most important question to answer as a trader…

What’s your edge?

An edge is a statistical advantage that helps you achieve consistent profitability.

If you have an edge, you’ve got a method, strategy, or insight that increases the likelihood of making profitable trades.

If you don’t, you shouldn’t be putting a single dollar at risk as a trader.

You’re relying on chance and hoping your trades work out.

And that’s a fast track to the poorhouse. You may get lucky and bag some wins. But over time, you’ll almost certainly get wiped out.

My edge as a trader comes from the software tools I’ve created (with the help of actual NASA rocket scientists) to uncover hidden patterns in the market.

For example, I’ve created a tool that helps me pinpoint the right time to buy and sell Bitcoin, Ethereum, and a group of smaller cryptos.

Using it, I’ve given my subscribers the chance to double their money (or more) on 114 separate occasions.

But the tool I want to tell you about today is the simplest and most powerful.

I call it the Money Calendar because it spots certain “windows” of time each month when stocks tend to rally or fall.

In a moment, I’ll show you how accurate it’s been. But the Money Calendar has more than one purpose…

It’s also alerted me to a major shift that’s coming the most popular stocks in the market right now – AI stocks.

So let’s take a quick look at how it works… Then I’ll show you what it sees coming and why everyone with any money in the market should be pay attention.

Following Seasonal Patterns

The Money Calendar is one of the first tools I developed to spot hidden patterns in the stock market.

You see, when I was learning how to trade, I noticed how a handful of stocks followed seasonal patterns.

Certain patterns would occur year after year, with astonishing regularity.

So, I created a software tool to help me spot them – every day the market was open.

The Money Calendar uses 10 years of historic data to pinpoint windows in time – usually 35 days or less – when a stock is likely to move up or down.

What I’m looking for is a pattern that repeats over the same windows 90% of the time (9 out of the last 10 years).

The Money Calendar isn’t perfect – no trading edge is.

But in the past few years, I’ve used it to give my subscribers the chance to double their money 182 times.

Here’s an example, using Elon Musk’s carmaker Tesla Inc. (TSLA).

What you’re looking at is a specific profit window – May 12 through June 20 – when Tesla tends to rally.

The green and red bars show the percentage returns each year during this window.

As you can see, Tesla has rallied between these two dates 9 of the past 10 years.

Does that give you an edge?

Absolutely.

Using the Monday Calendar, you could have placed a trade this year that delivered a 60% profit over 40 days.

The average annual return for the S&P 500 over the past 20 years is about 10%. So, that’s about five times what you’d earn investing in a fund that tracks the S&P 500 in a typical year.

The Money Calendar delivers dozens, even hundreds, of these patterns every day the markets are open.

And it doesn’t just give you an edge when it comes to trading individual stocks. It also tips you off about big shifts in the overall market.

Spotting Market Shifts

You’re probably familiar with the saying, “Sell in May and go away.”

Brokers and Wall Street investors used to sell their positions before heading to the Hamptons for the summer. And markets would turn bearish.

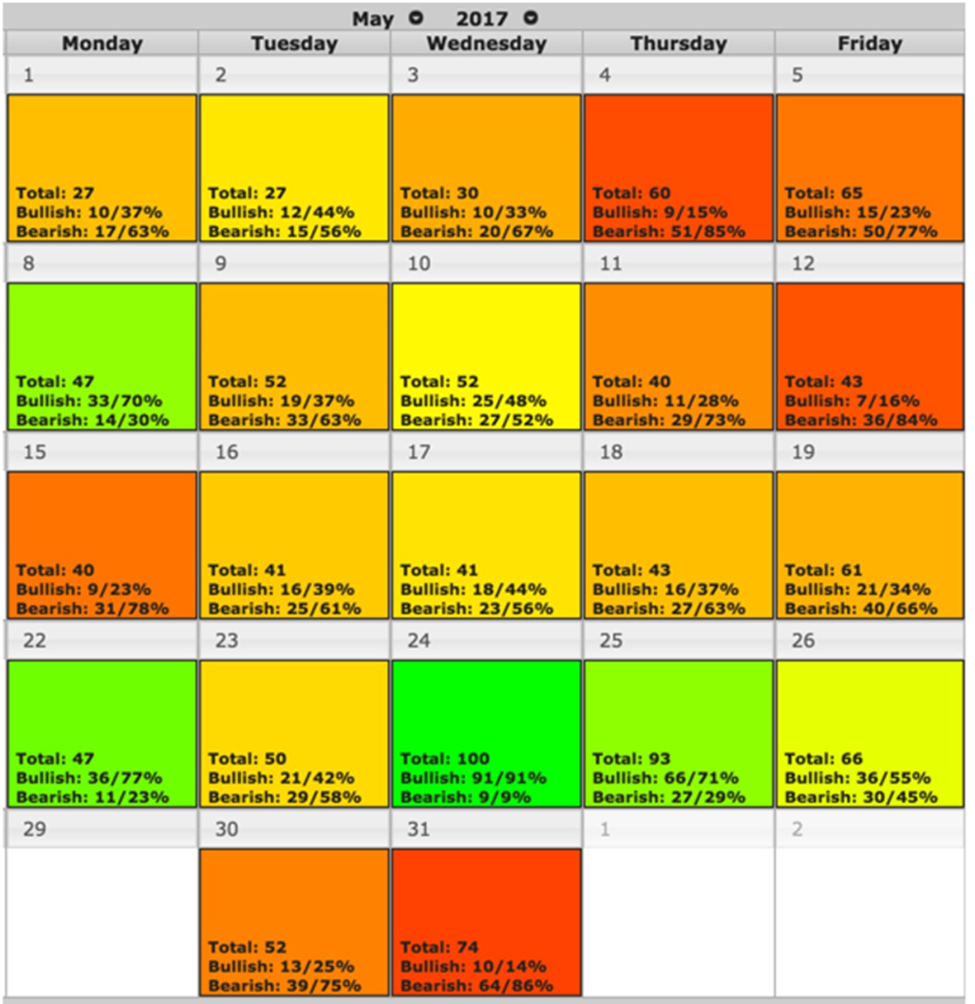

And as recently as seven years ago, this pattern was held. Look at the Money Calendar from May 2017…

The total number shows how many recurring patterns the Money Calendar picked up.

As you can see, it was a bearish month. Lots of orange and even a few red days – meaning more bearish than bullish patterns.

But times change. And so do markets.

And with the Money Calendar, I can see shifts like this ahead of time.

This year, we saw lots of headlines about selling in May from major financial media outlets.

For example…

- ‘Sell in May and Go Away’ Is a Catchy Adage, But Probably Not a Good Idea (CNBC, April 30)

- Should You Sell in May and Go Away? Maybe… (TheStreet.com, May 2)

- Sell in May and Go Away? (Forbes, May 12)

You’ll notice they don’t say whether it’s a good idea to sell in May or not. They use the word “probably” and are phrased as questions.

But with the Money Calendar, it was clear…

Every day was green for May 2024, meaning more bullish than bearish patterns.

For me, there was no question heading into May 2024 about what I should do. I was looking to trade bullishly, not bearishly.

And it paid off. The S&P 500 climbed 4.8% in May. That’s nearly 8x May’s long-term average return of 0.56%.

And that’s not the only shift the Money Calendar has predicted.

How the Money Calendar Foresaw the Rise of AI

In early 2019, the Money Calendar flagged a small group of stocks forming bullish patterns – fast.

Turns out, these stocks were involved with artificial intelligence (AI) – either through software or building advanced chips.

Anyone who listened to the recommendations I made based on the Money Calendar’s results at the time had the chance book gains of:

- Almost 250% on a bullish trade on Meta Platforms (META)…

- 326% on a bullish trade on Microsoft (MSFT)…

- And more than 3,150% on a bullish trade on Nvidia (NVDA).

And I urge you to listen to me now.

Because the pattern I’m seeing is showing something else entirely.

I’m calling it the Final Phase of the AI boom.

Right now, the patterns I track show the biggest AI names are headed for a crash… just like the highest-flying internet stocks did more than two decades ago.

And if you don’t know how to play the last phase of this AI boom, you could end up losing ALL your profits in the blink of an eye.

It will happen so fast you won’t be able to sell until it’s too late.

And you may spend years – even decades – trying to catch up.

Luckily, there’s a way to capture the gains… and avoid the devastating losses.

As I mentioned, I’ve dedicated my life to spotting hidden patterns in the stock market. I use them to predict future events with a high degree of certainty.

And one of my systems is designed to tell me precisely when the Final Phase will hit.

I’m revealing everything you need to know about how it works and how you can use it to navigate this Final Phase on Tuesday, July 9, at 8 p.m.

I’ll tell you more about what’s coming… how to protect your money over the long term… and how to use my proprietary tool to profit over the short term.

This briefing is free to attend. So, make sure you don’t miss it by signing up here.

Good trading,

Tom Gentile