If you’ve ever found yourself counting your last pennies before payday, you’re not alone. Research shows that more than one in three American workers are living paycheck to paycheck. And have little to no money left for savings after covering their monthly expenses. They’re known as the “working poor”. Yet experts suggest we should be saving around 20% of our salary every month.

With the rising cost of living, that’s easier said than done. But while it’s challenging, it is possible to put some cash away every month. If you think creatively. Someone recently asked “What’s a tip that has saved you the most time or money?” And people didn’t disappoint.

They spilled their secrets, and some are pure genius. Bored Panda has collected the best answers, to help you through these trying times. Don’t forget to upvote yours and please do share your own creative money saving hacks in the comments.

Looking at price per Kg/500ml instead of just buying the cheapest. Also adding the items up in your head before you purchase them.

Image credits: PipeDazzling6860

Store brands are sometimes just as good as name brands.

Image credits: Mamaofthreecrazies

Get a library card. I’ve read or listened to over 600 books in 6 years. I’ve taken courses, got help with tax prep, researched my ancestry, checked out movies, magazines, and CDs, helped a friend attain citizenship, and had my resume reviewed and tweaked – all absolutely free. Most people don’t know everything that libraries offer and are sadly underutilized.

Image credits: Extremely_unlikeable

An obvious way to save money is to budget. Instead of just hoping for the best. There are a few strategies you can use when it comes to budgeting. One of them is known as the 50-30-20 rule. Basically, you allocate 50% of your salary toward things you need. 30% goes to things you want. And the remaining 20% is for your savings or investments.

Then take it a step further by using your some of the tips and tricks on this list when buying the things you need. For example, ordering your groceries online and picking them up. Or not going to the grocery store hungry.

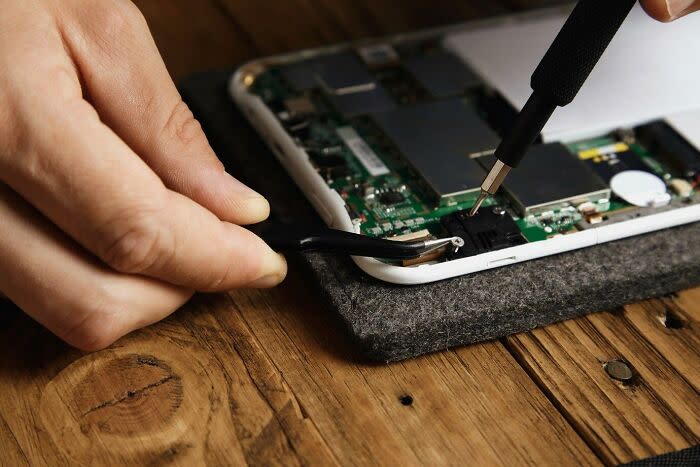

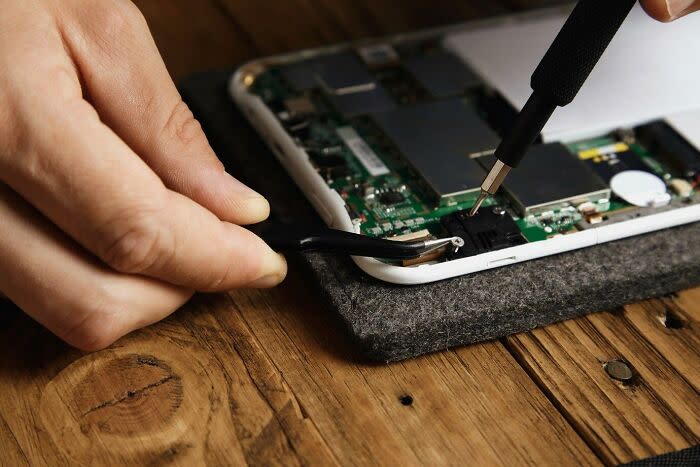

Buy good tools. C**ppy tools don’t last. You wind up paying more over the long term than if you just bought good tools in the first place.

Also good tools make jobs go faster.

Image credits: BoredBSEE

Replacing shopping as a hobby with actual hobbies.

Image credits: snarkymlarky

Never start smoking.

I look at how much cigarettes cost and I am so glad I didn’t keep up the habit after trying smoking in high school to fit in with my friends. I didn’t like how it made my breath and fingers stink so I only went through two packs, decided it was not for me then never smoked again.

Image credits: CMelody

If the 50-30-20 is too rigid, you could try the 80-20 trick. This is when you put 20% of your salary into savings, and spend the rest on whatever you need or want. Either way, financial experts advise that you always try to set aside 20% for a rainy day.

It might seem impossible to save a fifth of your salary every month. But you’ll be surprised what you can achieve when you get creative. There are some clever ways to free up your spending money, and use it towards savings. As many of the netizens featured here have revealed.

My father telling me to never go to the grocery store hungry. When I first moved out i used to get high and go grocery shopping and spend tons of money on random snacks.

Once I realized the old man was on to something I’d always go grocery shopping shortly after having a meal and spent dramatically less.

Image credits: D-BO_816

Knowing how to sew.

Image credits: JustJJeal

Shop second hand first! Very good for the environment and your pocketbook.

Are there subscriptions you could do without? Are you wasting money on takeaways? Do you have bad habits (like smoking) that are depleting your bank account? Have you considered making gifts instead of buying them? Scroll through this list and find the tips that work for you. Then implement and stick to them.

Time-shares are a waste of time and money.

Public transportation. This was particularly good for me, as my company pays for my orca pass. It was costing me about $600 a month to drive to work and pay for parking (between gas and parking fees) and the commute was about 2 hours long because of traffic. Since then, parking fees have gone up about 40% and gas prices have risen, so it’s probably more. Now I ride the train to work every day and I’m at work in an hour. Doesn’t cost me a dime.

Image credits: SweetCosmicPope

When you want to buy something (and you earn your wage hourly), consider how much the product would cost in hours worked instead of just the cost in amount.

If you’re already living on a tight budget, another option is to increase your income. Either through a side hustle, by working extra hours at your current job, asking for an increase, or applying for a higher paying position elsewhere. Earning extra money doesn’t have to be a painful experience. For inspiration, check out how these people earned quick and easy cash.

In all honestly, looking at my spending nearly on a daily basis. It’s easy to forget about the small purchases, and those add up quick.

The more you have your eyes on it, the more you will be on yourself about spending. Then it almost becomes like game or challenge to see how much you can save once you get some good rhythm going.

Probably not the answer you were looking for, but I hope this helps.

Image credits: ketchupandcheeseonly

Meal prepping has been an absolute game changer for me.

Image credits: HannaZukiXOXO

To save money, drink water. Don’t order a soda with your meal. It adds up fast.

In the event that you cannot put away 20% of your salary, remember that something is better than nothing. Even if it’s $10 or $20 a month, you’ll eventually get into the habit of not touching a portion of your paycheck. And the money will inevitably grow. By the time you’re able to put away more, it’ll hopefully already be second nature.

Don’t get too attracted on cheap/discounted items. It’s fine to purchase but the question is, do you really need it?

Image credits: HY90CR1T3

Cancel Amazon Prime.

If you find yourself needing/wanting to order something on Amazon, as you check out it will say something like “do you want a free/$X trial of Amazon for free overnight shipping.” Accept the offer (if it’s less than shipping of course), finish checking out, and immediately go cancel the sub. Cancelling doesn’t interfere with your free shipping.

As far as I can tell, you can do this any number of times. The first few times the trial is free. Eventually you do have to pay, but it’s still cheaper than keeping an active subscription unless you’re buying stuff on Amazon every week.

If you’re buying stuff from Amazon every week my money saving tip for you is to stop buying stuff from Amazon every week…

Image credits: Solesaver

Using the internet to learn how to do something rather than paying a “professional” to do it for me.

Go through your last 3 months of bank statements and see if anything can be dropped you don’t need like subscriptions you forgot about. It’ll also make you realize what you’re spending on.

Image credits: brokenmessiah

Always make a shopping list before going to the store. It keeps you focused, prevents impulse buys, and saves you from extra trips back.

Buy the cheapest thing if it’s an experiment; the most expensive if you know you’ll use it forever

Image credits: praxistat

Asking myself, “Do I really need this?” before purchases. .

Depending on where you live, getting a window fan. At night, the inside of my house is insanely hot and the outside is very cool. Opening the windows isn’t enough, but a window fan pulls all that cold air in and cools the room within minutes. It has saved me probably thousands in air conditioning costs over the years.

When something breaks. Don’t throw it out. Try to call/email warranty first. A portion of the retail price goes to fund the warranty account.

Image credits: randomshitifind

Grocery pick up. I don’t go in the stores to shop. I order online and pick up when ready. This way I do not grab things not on my list. Plus I save time cause I’m not walking the aisles…..

Image credits: missionwonderwoman

Using reusable shopping bags and containers can save both time and money. Also reducing the need for single-use plastic bags and containers.

Making gifts. People seem to enjoy them more too.

Don’t consider the maximum mortgage that you qualify for as your upper range on price. Not that *I* necessarily would have but I would have been completely house poor if I had and I do know a lot of people do fall into this trap.

With our current house we would have qualified for something about twice the price because of all the equity we built in our first house.

Image credits: Smyley12345

Buy once cry once…meaning, buy the quality item the first time instead of the similar but cheaper quality item over and over and over. Kitchen knives, winter coat, appliances, mattress, work boots are quick examples I can think of.

Keeping my freezer stocked with pre-cut veggies to add to easy meals. Mix peppers, onions, etc. Stir-fry mixes as well to add to pastas or eggs or whatever. That and an air fryer, before that my adhd left me almost setting things on fire because I’d forget they were in the oven.

Image credits: fakeblondeponytail

Learn to maintain and repair your own vehicles. A little intellectual curiosity here goes a long way.

Everyone’s saying meal prepping etc. missing the wealth enemy: **cars**.

The difference between a new and a 5-10 year old car could be $50,000.

As long as you don’t make that mistake (most people think they deserve a fancy car), you don’t have to worry about the smaller things as much.

Image credits: WhenTimeFalls

Using a credit card with a good bonus points program. I use it for autopay on monthly bills and all other expenses. I can use that for gift cards or cash back, it’s free money. If my card is compromised it doesn’t hit my bank account because i never use my debit card for anything.

If you can’t afford two, you can’t afford one.

Image credits: kannasri

Set a strict online spending curfew. For me, it’s midnight. Absolutely no purchases once the clock hits 00. Obvious exceptions are things like bills or textbooks I forgot to get sooner. But anything I don’t need? Nope. Not happening after midnight.

Image credits: an_ineffable_plan