The dirty little secret behind artificial intelligence (AI) is that few companies have yet figured out how to integrate it into their products.

This is especially true in the software sector. In fact, some software firms are seeing their growth actually slow. However, there is at least one software company that is successfully using AI – ServiceNow (NOW).

Let’s take a closer look at how NOW is making it happen.

ServiceNow and AI

ServiceNow (NOW) was founded in 2003 as a cloud-based software company to automate IT processes, and IPO’ed in mid-2012. The company makes most of its money from its IT service management platform, but today it also has human resources (HR) and customer service management tools. About 97% of its revenues come from subscription software sales.

The difference between ServiceNow and many other software companies is that it hasn’t slapped an AI feature onto its product in the past year, saying “hey, we’re an AI company.”

That said, the company has been aware of the importance of AI for a number of years, and has been investing accordingly.

In 2015, ServiceNow launched a venture arm, which has since invested in over 45 tech businesses. It acquired Element AI in 2020 for $500 million to bring expertise in applying AI to things like text and language, chat, images, search, and so on.

This long-term investment into AI is beginning to bear fruit. In its latest quarter, the company’s generative AI product – “Now Assist” – became the fastest-growing product in its history. It doubled its net new annual contract value quarter on quarter!

The benefit of its AI offering this that it includes predictive analysis, as well chatbots to handle IT support and HR enquiries. For example, it can predict IT incidents before they occur and identify trends in customer service issues. NOW also has “low-code” development tools, which allow businesses to easily build custom applications without needing to code.

During the recent earnings call, management said it signed 11 deals worth over $1 million each, with two of them worth over $5 million. More importantly, ServiceNow is selling its AI products for 30% more and the deal sizes are three times larger than during previous new product adoption cycles.

In short, generative AI embedded in the company’s Pro Plus tier was a powerful factor in attracting new customers to the platform. After several quarters of ServiceNow seeing this type of traction against the backdrop of hesitation with regard to AI offerings from peers, ServiceNow is clearly emerging as an AI leader.

Management expects to see a 25% increase in average selling prices as new generative AI-based tools drive higher-priced solutions. In addition, RBC Capital analysts believe the company could see organic subscription growth of over 20% next year.

Currently, ServiceNow is selling most of its generative AI products directly. However, it has begun to partner with other companies. An example of this occurred in May when the company announced it had partnered with Microsoft (MSFT), giving its customers access to large language models (LLMs) powered by OpenAI’s ChatGPT.

In 2023, the company partnered with Nvidia (NVDA) to develop enterprise-grade generative AI tools, aimed at transforming business processes with “intelligent workflow automation” to increase capabilities and productivity across a business. It is also working to help Nvidia streamline its own operations.

More Than AI

Its AI offering is still rather small compared to the rest of ServiceNow’s business, so let’s take a look at how the rest of the business is doing.

In the latest quarter, subscription revenue increased 23% year on year to $2.5 billion. In addition, current remaining performance obligations (CRPO) – contract revenue that will be recognised as revenue in the next year – rose 22.5% to $8.8 billion. This was up from the 21% growth the prior quarter and ahead of the 20.5% guidance given by management.

The surprisingly strong quarter encouraged management to raise its full-year subscription revenue guidance to roughly $10.6 billion, indicating expected year-on-year growth of 22%. The operating margin forecast was also increased by 50 basis points to 29.5%. NOW’s non-GAAP operating margin rose to 27% last quarter, nearly 250 basis points ahead of guidance.

Buy ServiceNow Stock

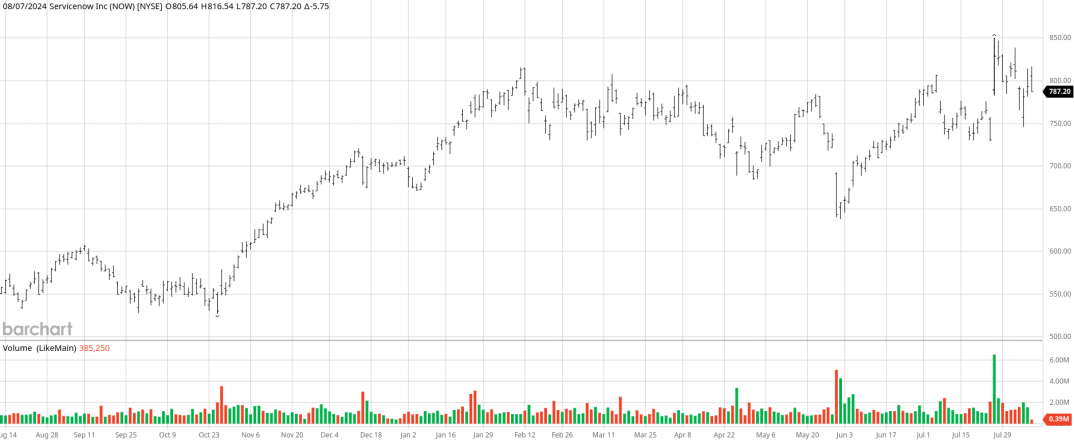

Some investors may question ServiceNow’s valuation, since its share price has increased 42% in the past year. That translates to trading on a forward price/earnings multiple of 58. However, due to its accelerating earnings trajectory, the 2026 PE ratio is a more reasonable 39. But that’s still not cheap.

If we look at price to free cash flow, the 2026 price/free cash flow is roughly 33. For a company with 80% gross margins and revenue growth consistently above 20%, that looks reasonable.

Here’s why I like ServiceNow. To have accelerating growth when everyone else is doing well is no big deal. But to have accelerating growth while your peers are slowing down is impressive.

The other impressive thing is the expansion of the operating margin above expectations. The company appears to have the ability to combine growth, margin expansion, and new product development.

AI threatens to upend many businesses, especially in software. But by investing early into AI, ServiceNow looks to be among the winners in the sector.

Buy NOW stock below $815.

www.barchart.com

On the date of publication, Tony Daltorio did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Originally Appeared Here